Rolls-Royce’s share price is around a record high, so why am I going to buy more following H1 results?

Rolls-Royce’s (LSE: RR) share price has risen 142% from its 6 August one-year traded low of £4.43. This puts it around a record high.

To some investors, it might appear counterintuitive that I am looking to add to my holdings in the firm at this price. After all, surely it cannot rise much further after such a spectacular increase?

Others may think I am doing exactly the right thing, as the bullish price trend must inevitably continue.

However, I know that a share’s price and value are not the same thing. Its price is simply whatever the market will pay for it at any given moment. But its value is what it is truly worth, based on the business’s underlying fundamentals.

And I think Rolls-Royce shares are still worth a lot more than their price reflects.

H1 results

The catalyst for the latest share price rise was its H1 2025 report released on 31 July.

Revenue jumped 11% year on year to £9.057bn, while operating profit soared 51% to £1.733bn. Revenue is a firm’s total income, while profit is what remains after expenses are subtracted. And it is growth in profits ultimately that powers any company’s share price and dividends over time.

Meanwhile, the operating margin increased 36% to 19.1% and earnings per share leapt 76% to 15.74p. Return on capital (ROC) rose 22% to 16.9%. This measurement focuses only on capital actively invested directly in the business, excluding short-term liabilities. Return on capital employed is based on all capital used across the business, including equity and debt financing.

Over the same period, free cash flow increased 37% to £1.582bn, which itself can be a major engine for profit growth.

Upgraded forecasts

Rolls-Royce increased its 2025 profit guidance to £3.1bn-£3.2bn from £2.7bn-£2.9bn. It did the same for its free cash flow – to £3bn-£3.1bn from £2.7bn-2.9bn.

It also upped its guidance to 2028 to a profit of £3.6bn-£3.9bn. The previous profit guidance of £2.5bn-£2.8bn was for 2027.

The new 2028 operating profit margin forecast is 15%-17%, up from the earlier 2027 guidance of 13%-15%. And 2028’s free cash flow is expected to be £4.2bn-4.5bn against 2027’s target of £2.8bn-3.1bn.

ROC is now forecast at 18%-21% in 2028 compared to the previous 16%-18% for 2027.

Why so conservative?

What is additionally interesting to me here is how conservative these forecasts look. Based on H1’s numbers, the firm is already performing at or close to these projections.

Most notably, for example, ROC is already at 16.9% against 2028’s target of 16%-18%. And operating margin is at 19% compared to 2028’s forecast of 15%-17%.

Does the company think it will not expand much between now and 2028? Not according to its CEO, Tufan Erginbilgic, who said: “We see these targets as a milestone, not a destination.”

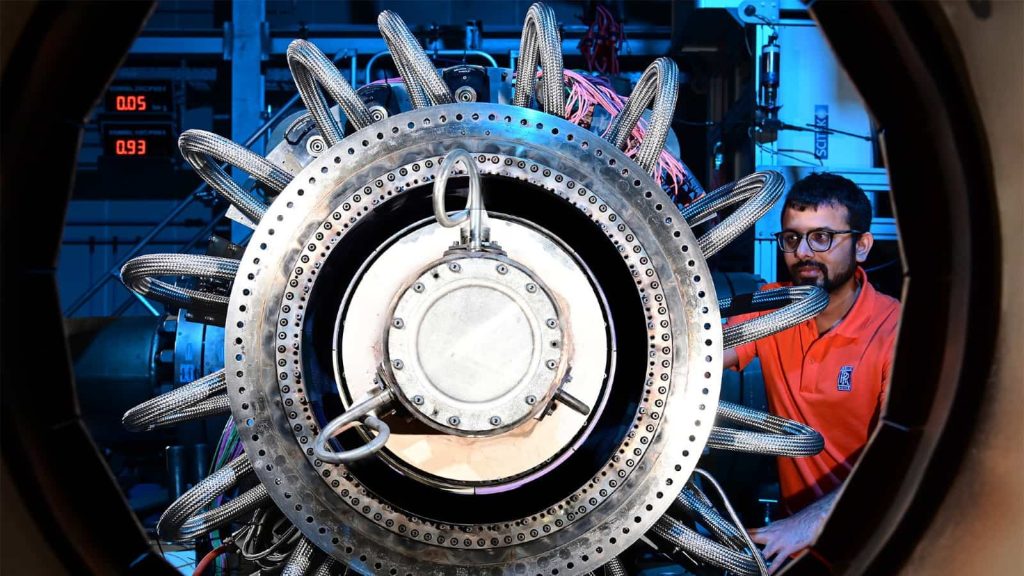

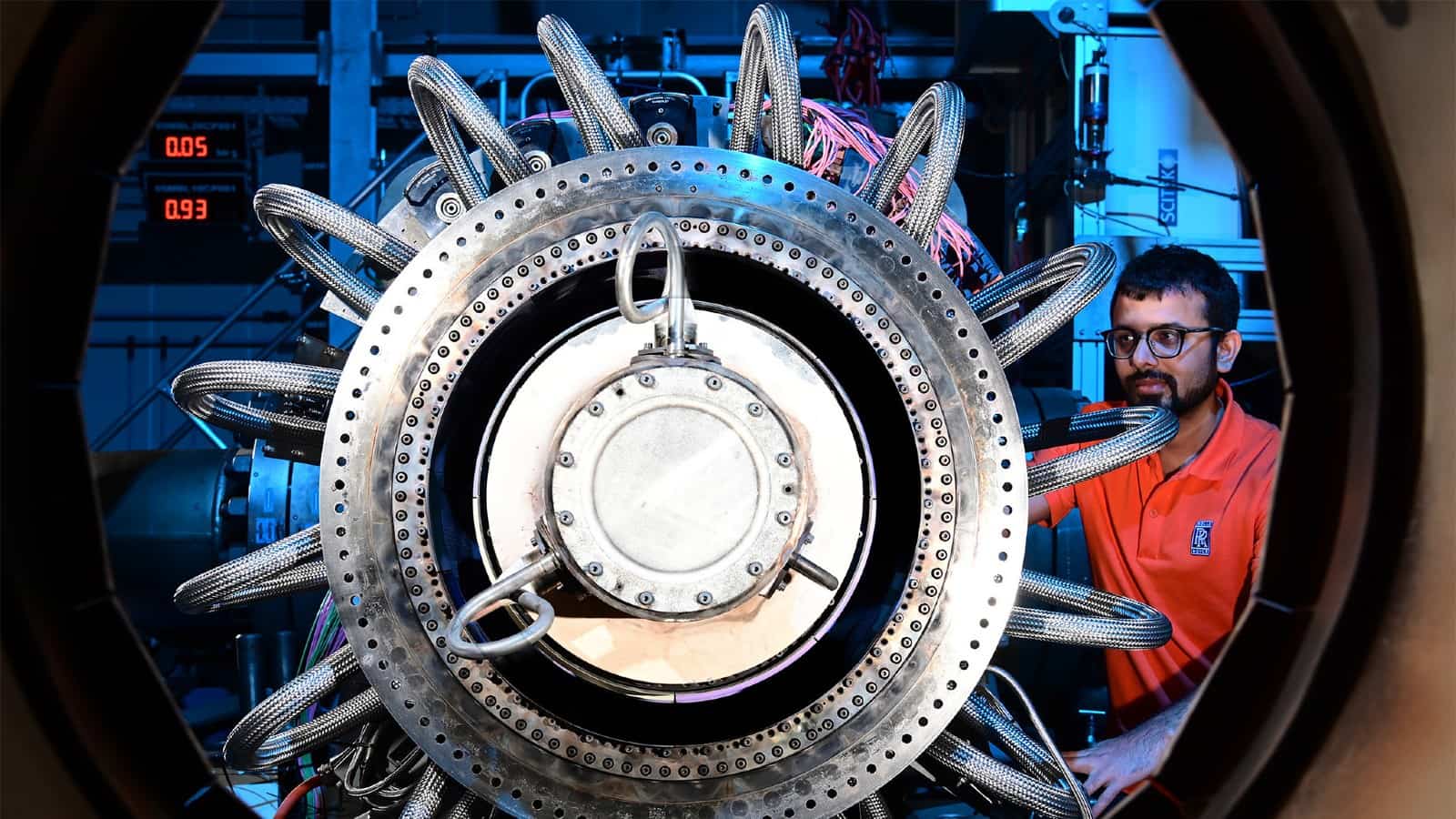

A risk to them is failure in any of the firm’s key products that would be costly to fix and could damage its reputation.

But my feeling is that Rolls-Royce is under-promising now to overachieve later. Indeed, UBS said after the results that: “Consensus is likely to upgrade 2028 and long-term estimates in response to this print [forecast].”

In terms of Rolls-Royce shares’ fair value, a discounted cash flow analysis shows it to be £12.92 currently.

Consequently, I will buy more of the shares very soon.

The post Rolls-Royce’s share price is around a record high, so why am I going to buy more following H1 results? appeared first on The Motley Fool UK.

More reading

- Has this FTSE 100 stock just shown us why people are calling it the ‘next Rolls-Royce’?

- Prediction: if an investor buys 500 Rolls-Royce shares today, here’s how much they might make in 12 months…

- Hunting for the best shares to buy before a market tumble? Here are 3 crucial tips

- Prediction: in 12 months BAE Systems and Rolls-Royce shares could turn £10,000 into…

- The Rolls-Royce share price smashed its own record this week. Is it too late to buy?

Simon Watkins has positions in Rolls-Royce Plc. The Motley Fool UK has recommended Rolls-Royce Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.