This FTSE 100 stock’s forecast to outperform Rolls-Royce shares over the next 12 months

Brokers have a 12-month price target for Rolls-Royce shares of 1,075p. With a current (13 August) price of 1,098p, this suggests thereâs no room for further growth.

But given its post-pandemic performance â the groupâs now worth around £90bn more than when it announced its life-saving rights issue and debt restructuring in October 2020 â this probably shouldnât come as much of a surprise.

Having said that, the most optimistic broker reckons the shares are worth around 31% more.

Something else

However, thereâs another FTSE 100 company that the âexpertsâ believe offers better value. Unlike Rolls-Royce, which generates around a quarter of its revenue from the defence sector, Babcock International Group (LSE:BAB) earns all of its profit from the sale and maintenance of military equipment. And brokers have set a 12-month share price target of 1,180p â approximately 20% more than todayâs price.

But I think itâs fair to say that itâs a relatively unknown stock. From the start of 2025 to the end of July, itâs been the 85th most-traded UK share. By contrast, over the same period, Rolls-Royce ranked seventh.

However, this hasnât stopped Babcock’s share price from soaring over the past five years. Since August 2020, itâs risen nearly 250%. The group joined the FTSE 100 in March.

A dangerous world

Like many in the sector, itâs benefitted from increased global security concerns. This could be a problem for some ethical investors. However, those who believe that itâs the primary responsibility of a government to protect its citizens are likely to see this as an opportunity.

Pressure from President Trump has forced NATO members to commit to spending 5% of Gross Domestic Product on national security, although some of this is a little creative with expenditure on intelligence and cybersecurity counting towards the total. The UK’s announced an increase to 2.6% with effect from April 2027.

The government sees increased defence spending as a means of boosting economic growth. This means itâs likely to place as many orders as it can with home-grown companies like Babcock. At the moment, the groupâs the second-largest supplier to the Ministry of Defence.

Impressive growth

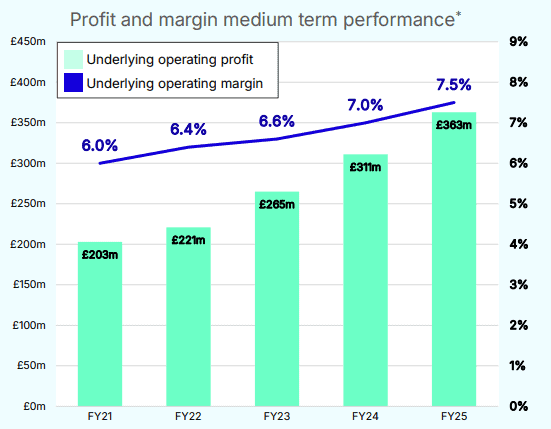

Babcock reported another strong set of results for the year ended 31 March 2025 (FY25). Its underlying operating profit has increased by 79% over the past five financial years. Also, its margin’s improved 1.5 percentage points to 7.5%. Itâs targeting a further improvement to 9% over the medium term.

However, these underlying FY25 figures exclude a £90m provision made for cost over-runs on one of its contracts with the Royal Navy. This remains a concern and demonstrates the complexity of some of the groupâs projects.

For FY25, it’s announced a 30% increase in its dividend to 6.5p. But with a yield of less than 1%, income investors will probably want to look elsewhere.

Final thoughts

But despite rallying over the past five years, I think the shares still offer good value compared to others with exposure to the sector. Underlying earnings per share in FY25 was 50.3p, implying an historical price-to-earnings ratio of 19.4. The equivalent figures for Rolls-Royce and BAE Systems are 54.2 and 25.6 respectively.

Combined with an order book of £10.4bn and a strong balance sheet, long-term growth investors could consider the stock for their portfolios.

The post This FTSE 100 stock’s forecast to outperform Rolls-Royce shares over the next 12 months appeared first on The Motley Fool UK.

Should you invest £1,000 in Rolls Royce right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Rolls Royce made the list?

More reading

- Here are the latest share price forecasts for Rolls-Royce, BAE Systems and Babcock International

- 3 high-flying UK stocks Iâd love to buy in the next stock market dip

- These 2 FTSE 100 stocks have doubled investorsâ money in 2025! Too late to consider buying?

- Is now the time to buy FTSE 100 shares instead of S&P 500 stocks?

- How does this relatively overlooked FTSE 100 defence stockâs valuation line up against Rolls-Royce and BAE Systems?

James Beard has positions in Babcock International Group Plc and Rolls-Royce Plc. The Motley Fool UK has recommended BAE Systems and Rolls-Royce Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.