Here’s how UK shares could boost savers’ wealth by £37k!

Savings and investment accounts both serve important roles in building long-term wealth. I myself hold products like the Cash ISA to keep my emergency cash and manage risk. I also have a Stocks and Shares ISA and Self-Invested Personal Pensions (SIPPs) to buy UK and overseas shares to target greater returns.

The lion’s share of my surplus cash each month is used to purchase stocks, investment trusts and exchange-traded funds (ETFs) on the stock market. History shows that holding too much money in a low-risk, low-return cash accounts can leave a hole in an individual’s pension pot.

A £37k shortfall

Fresh research from Moneybox underlines the size of this potential shortfall. It highlights “a £37,000 difference in average investment holdings between financially confident individuals and those who lack confidence, regardless of income.

It says that “investments have historically outperformed cash over time,” but that a lack of confidence and financial education is impacting demand for riskier assets.

Moneybox says that investment confidence among Britons has risen to 39% in 2025 from 33% last year. However, confidence in saving remains far higher, at 84% today versus 79% in 2025.

The financial services provider notes that “this contrast is highlighted by the fact that since the start of 2025, only 11% of individuals have transitioned money from savings into investments.”

Better returns

The added risk that accompanies share investing is why — understandably — many people are drawn to savings accounts. Unlike cash savings, the value of stock investments can fall as well as rise over time.

Yet while past performance isn’t always a reliable guide, share investing has over time proved a powerful way to control risk while still delivering strong returns. According to Moneyfacts, the average Stocks and Shares ISA investor has enjoyed a 9.64% average annual return since 2015.

That figure sits way back at 1.21% for Cash ISA users.

Harnessing shares with investment trusts

Furthermore, modern investors can choose from a wide range of assets to mitigate risk. They can purchase lower-risk shares like utilities, defence contractors, and manufacturers of consumer staples to limit volatility.

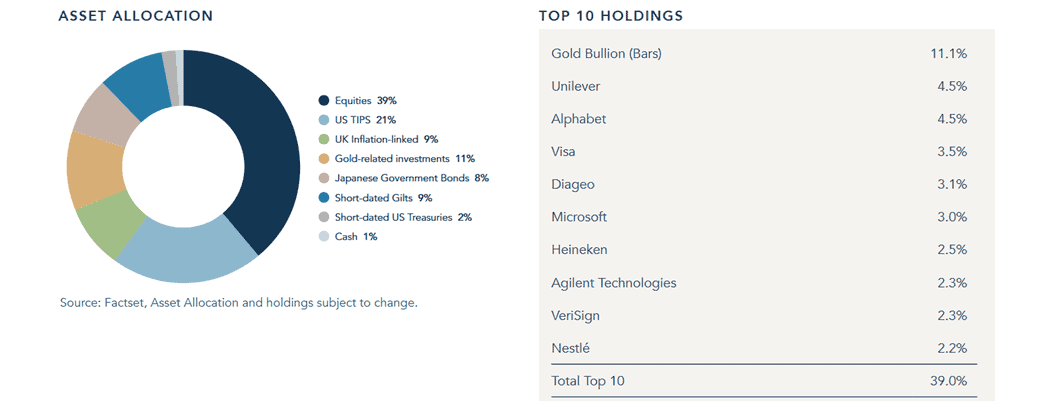

They can also build a diversified portfolio spanning different sectors and regions to spread risk. Investment trusts like Personal Assets Trust (LSE:PNL) offer a simple (and low-cost) way to achieve this kind of resilience.

Since 2015, it’s delivered an average yearly return of 5.5%. That’s far ahead of what a Cash ISA saver would have made over the period.

The trust has achieved this thanks to a strong rating of equities of equities. Just under 40% of it is tied up in global shares, but its holdings are well diversified. What’s more, less than 5% of it is tied up in one single company, which reduces concentration risk.

The remainder of the fund is locked up in safe-haven assets like gold, government bonds and cash, which balances investor risk and helps provide a smooth return across the economic cycle.

Personal Assets Trust remains vulnerable to broader movements on stock markets. But I think it’s still a great investment trust to consider to manage risk and target super returns.

The post Here’s how UK shares could boost savers’ wealth by £37k! appeared first on The Motley Fool UK.

Should you invest £1,000 in Rolls Royce right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Rolls Royce made the list?

More reading

- Alex Karp appears to be the ‘new Elon Musk’. So should I buy Palantir stock?

- I just bought more of this world-class FTSE 100 stock while itâs down 24%

- Why the JD Sports share price rocketed 7% yesterday

- Time is money: when aiming for a second income, both play a key role

- Is the BT share price overvalued? A 48% rally continues despite lacklustre results

Royston Wild has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.