2 unique investment trusts to consider for an ISA

I’m a big fan of investment trusts because they can provide instant diversification to a Stocks and Shares ISA portfolio. The good news is that the UK stock market’s packed out with them, and they come in all shapes and sizes.

Here, I want to highlight two that are unique. I think both could be candidates to research for inclusion in an ISA.

Private companies

The first is Schiehallion Fund (LSE: MNTN), run by asset management giant Baillie Gifford.

As well as having a funny name (after a Scottish mountain), the differentiating factor here is that the trust invests only in private growth companies. Then it holds onto them when they go public (most other funds like this exit their positions upon IPO).

The aim of doing this is to capture the full life cycle of growth companies, from late-stage private to (hopefully) public juggernaut.

The late-stage bit’s worth highlighting, as Schiehallion isn’t investing in basement start-ups. These are companies with established products/services and already generating revenue.

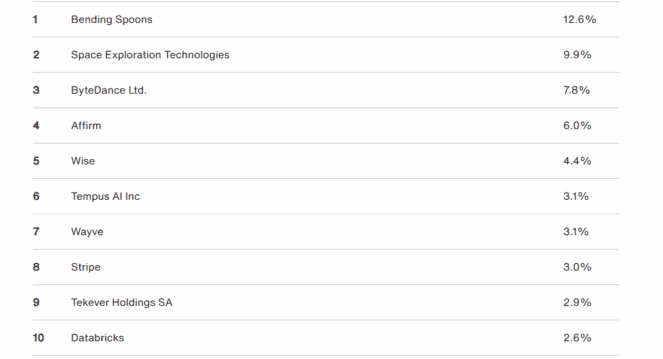

A quick glance at the top 10 holdings shows this to be the case. Rocket pioneer SpaceX is valued at $350bn while analytics firm Databricks’ latest funding round puts it at a $100bn valuation.

Stripe’s current valuation is $91.5bn and TikTok owner ByteDance is even higher (around $350bn). Schiehallion offers investors exposure to these types of game-changing unlisted firms.

Top 10 holdings (as of 31 July 2025)

There are risks with this strategy, of course. One of its larger holdings, Swedish EV battery maker Northvolt, recently went bust. And another, writing assistant software firm Grammarly looks like it could face disruption from generative artificial intelligence (AI).

Itâs worth mentioning that the shares trade in US dollars, meaning investors are exposed to some foreign-exchange risk. However overall, I’m bullish on this trust long term. The shares, which are priced at $1.25 each, are trading at a 16% discount to the calculated net asset value (NAV).

Hedge fund

The second trust is Pershing Square Holdings (LSE: PSH), which is a member of the FTSE 100. Pershing’s run by outspoken hedge fund manager Bill Ackman, who has a tremendous long-term record of outperformance.

The share price is up 117% in five years, before dividends.

Ackman’s been busy this year, adding both Uber and Amazon to the portfolio. The good news for Pershing shareholders is that these top-tier tech firms were picked up for a much lower price than the current level. Amazon, for example, was acquired in April when it was trading at its cheapest valuation ever.

Now, the main risk here is that the portfolio’s extremely concentrated, with just 11 stocks. In fact, Amazon, Uber and asset manager Brookfield alone make up nearly half the portfolio!

This can turbocharge returns when things go well, but it can magnify losses when stock picks go wrong. And while extremely talented, Ackman is only human and makes mistakes, like all investors.

However, the shares are trading at a whopping 30% discount to NAV. And with market volatility likely to increase later this year when the full global impact of tariffs is felt, I think Ackman will have opportunities to exploit.

The post 2 unique investment trusts to consider for an ISA appeared first on The Motley Fool UK.

Should you invest £1,000 in Rolls Royce right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Rolls Royce made the list?

More reading

Ben McPoland has positions in Pershing Square and Uber Technologies. The Motley Fool UK has recommended Amazon and Uber Technologies. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.