The simple way to try and build a £27m SIPP

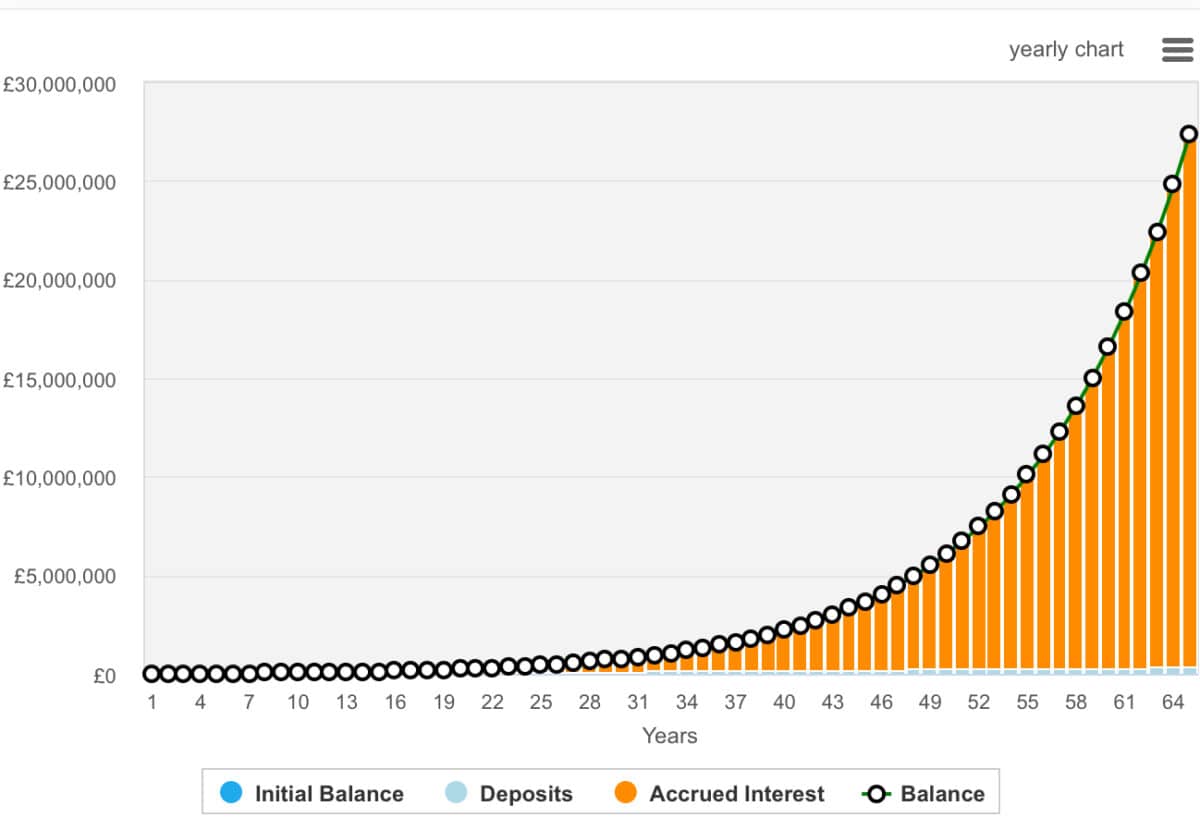

It sounds implausible. A £27m Self-Invested Personal Pension (SIPP) from just a few thousand pounds a year. But with a long enough runway and the power of compounding, it becomes a mathematical possibility.

A SIPP opened at birth and topped up consistently could, in theory, accumulate a fortune over time. Using HMRC’s maximum child SIPP contribution of £3,600 a year (including tax relief), the numbers stack up compellingly if invested wisely from day one.

Assuming an average annual return of 10% â reflective of US market returns over the past decade â the balance grows modestly at first. By age 10, the pot might stand around £68,000. But the compounding effect gathers pace. By 25, it could top £450,000. By 40, it may pass £2m.

Keep going, and at age 65 â without increasing contributions beyond inflation â the balance could exceed £27m. The secret? Time, tax relief, and long-term exposure to growth assets like equities. This calculation also includes a 1% increase in annual contributions each year to account for potentially larger contributions in the future.

Of course, future returns aren’t guaranteed, and inflation would eat into purchasing power. UK investors may also earn more modest returns with UK-focused investments and poor investment decisions can see us lose money. But even under more conservative assumptions, a childâs SIPP could become a meaningful financial asset later in life.

Parents, grandparents, or guardians funding early SIPP contributions could give a child an extraordinary head start. And itâs not just financial, but contributes to an understanding the value of investing early and often. This calculation also involves the child going on to make contributions themselves as they start working. It requires a long-term commitment.

Itâs not the flashiest strategy. It doesnât have to involve hefty bets on tech disrupters or shorting overvalued stocks. Itâs simply about starting early and letting compound returns do the heavy lifting.

Where to invest?

Anyone opening a SIPP for a child or loved one has several options when it comes to investing. A simple, hands-off approach might involve low-cost index-tracking funds or investment trusts. These offer instant diversification and a long-term growth orientation, making them ideal for compounding over decades.

Alternatively, more active investors might prefer to build a portfolio one or two stocks at a time. One company Iâm watching closely right now is Synectics (LSE:SNX). Itâs an AIM-listed specialist in advanced security and surveillance systems.

At just over £53m in market-cap, Synectics trades on just 12.2 times forward earnings, falling to 9.5 times by 2027. Adjusting for its net cash position of £12.1m, that gives a price-to-earnings-to-growth (PEG) ratio of 0.72. This implies the shares could be significantly undervalued based on growth forecasts.

Recent interim results showed revenue up 35%, operating profit up 48%, and earnings per share up 59%. Its growing order book, international expansion, and debt-free balance sheet are all really positive feature.

Of course, as a small-cap, it carries more risks. This including contract concentration and macroeconomic sensitivity as well as a large spread between buying and selling prices. But for long-term investors, Synectics might be worth a closer look. Iâve added it to my watchlist.

The post The simple way to try and build a £27m SIPP appeared first on The Motley Fool UK.

Should you invest £1,000 in Rolls Royce right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Rolls Royce made the list?

More reading

- The stock market may be overheating, but these shares don’t look overvalued

- An undervalued stock with operating momentum⦠tell me more!

James Fox has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.