My top FTSE 100 stock to consider for a SIPP

A Self-Invested Personal Pension (SIPP) is the perfect vehicle for long-term investors. That’s because the money can’t be accessed until age 55 (57 from April 2028).

The benefit is that compounding can happen over many years, with SIPPs eliminating the temptation to sell shares to fund something (cruise holiday/Christmas/new car, etc).

As Charlie Munger said: âThe first rule of compounding is to never interrupt it unnecessarily.”

Of all the shares in the FTSE 100, I reckon Scottish Mortgage Investment Trust (LSE: SMT) is the most suitable for a SIPP. Here are five reasons why.

1. Long-term perspective

Scottish Mortgage manages a global portfolio of public and private growth companies, with a five-to-10-year investment horizon. It explicitly asks shareholders to view performance through this long-term lens.

Therefore, it chimes with the long-term point I’ve just made about SIPPs. These are the ideal accounts to ride out short-term noise (tariffs, inflation, interest rates, etc) and allow powerful structural trends to play out over time.

2. Growth themes

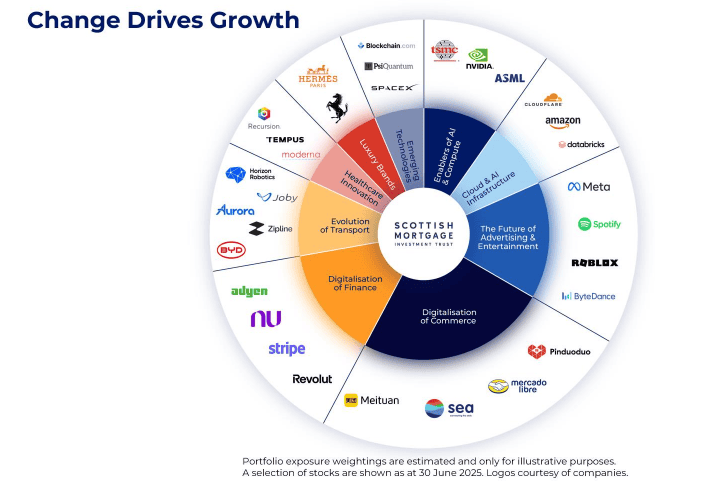

Speaking of powerful trends, Scottish Mortgage is bullish on a handful of them. These include the digitalisation of finance, healthcare innovation, e-commerce and, of course, artificial intelligence (AI). Such themes are expected to drive growth over the next two decades.

Below are key portfolio trends and the companies at the very centre of them.

There are some truly world-class firms here, and I’d be surprised if many don’t become a lot more valuable in future.

If you want to invest in the biggest winners, find the companies harnessing powerful waves of change — new technologies, new markets, new behaviours.

Scottish Mortgage.

3. Private markets

Another reason I think the stockâs worth considering for a DIY pension is due to the private companies in the portfolio. It has chunky positions in high-growth companies including SpaceX, Databricks, and TikTok owner ByteDance.

In FinTech, it has invested in internet payments giant Stripe and Revolut. These types of game-changing firms are choosing to stay private for longer, meaning retail investors are missing out on their growth.

Scottish Mortgage provides exposure to unlisted companies as well as public ones. And while this does add a bit extra risk (younger companies can go bust), the strategyâs generally been working well for shareholders.

4. Double-digit discount

A quirk of investment trusts is that they can trade at a premium or discount to their underlying net asset value (NAV). This is a risk because the discount on Scottish Mortgage can widen quite significantly during times of market stress.

Right now, the discount to NAV is 10.65%. There’s no guarantee this will narrow, but it’s certainly better to buy shares at a double-digit discount than a hefty premium.

5. Outperformance

Finally, Scottish Mortgage has a tremendous long-term record of outperformance. According to AJ Bell, the trust has delivered a 10-year annualised return of 15.7%.

Of course, this level of performance might not persist. But even if it were to be a bit lower — say 12% — that would still turn £300 invested every month for 25 years into £506,402.

Moreover, every contribution into a SIPP gets tax relief from the government. So the portfolio would grow even larger if the top-up were also invested in Scottish Mortgage or stocks delivering similar returns.

The post My top FTSE 100 stock to consider for a SIPP appeared first on The Motley Fool UK.

Should you invest £1,000 in Rolls Royce right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Rolls Royce made the list?

More reading

- Here’s how a 40-year-old could target a £743,338 retirement fund with UK stocks

- How much do you need in an ISA to aim for £10,000 a month in passive income?

- 3 reasons this investment fund could keep trouncing the rest of the FTSE 100

- The AI boom could be an opportunity for Britons to build a second income stream

- Starting with nothing? Hereâs how to begin building a second income portfolio worth £2k a month in August

Ben McPoland has positions in Cloudflare, Ferrari, Joby Aviation, MercadoLibre, Moderna, Nu Holdings, Nvidia, Roblox, Scottish Mortgage Investment Trust Plc, Shopify, and Taiwan Semiconductor Manufacturing. The Motley Fool UK has recommended Aj Bell Plc, Amazon, ASML, Cloudflare, MercadoLibre, Meta Platforms, Moderna, Nu Holdings, Nvidia, Roblox, Shopify, and Taiwan Semiconductor Manufacturing. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.