Forecast: here’s what £1,000 invested in Nvidia shares could be worth in 2030

Nvidia (NASDAQ:NVDA) shares are up 1,279% over the last five years. Thatâs enough to turn £1,000 into something worth £13,787.

The big question for investors is what comes next. And while Iâm not expecting a repeat performance over the next five years, I think there are reasons for optimism.

Growth

The reason Nvidia shares have been such a good investment over the last five years is simple. The company makes far more money than it did in 2020, mostly due to spectacular revenue growth.

Investors should note, however, that things have started to moderate recently. Quarterly sales growth rates have fallen from 265% in the last three months of 2023 to 56% in the most recent quarter.

| Quarter | Year-over-Year Revenue Growth |

|---|---|

| Q1 2024 | 262.12% |

| Q2 2024 | 122.40% |

| Q3 2024 | 93.61% |

| Q4 2024 | 77.94% |

| Q1 2025 | 69.18% |

| Q2 2025 | 55.60% |

Thatâs entirely normal for a company of Nvidiaâs size, but itâs extremely important. As growth rates slow, the valuation multiples the stock trades at have come to reflect less optimistic assumptions.

Over the last two years, the price-to-earnings (P/E) ratio the stock trades at has fallen from 110 to 50. Thatâs still high, but itâs a significant decline from where it was.

Other things being equal, thatâs enough to cause the share price to fall by more than 50%. But other things arenât equal in this case â wider margins have caused earnings per share to grow more quickly.

Looking ahead, I think revenue growth is likely to keep slowing. But the question for investors is whether growth will stay strong enough to justify a P/E ratio of 49.

Outlook

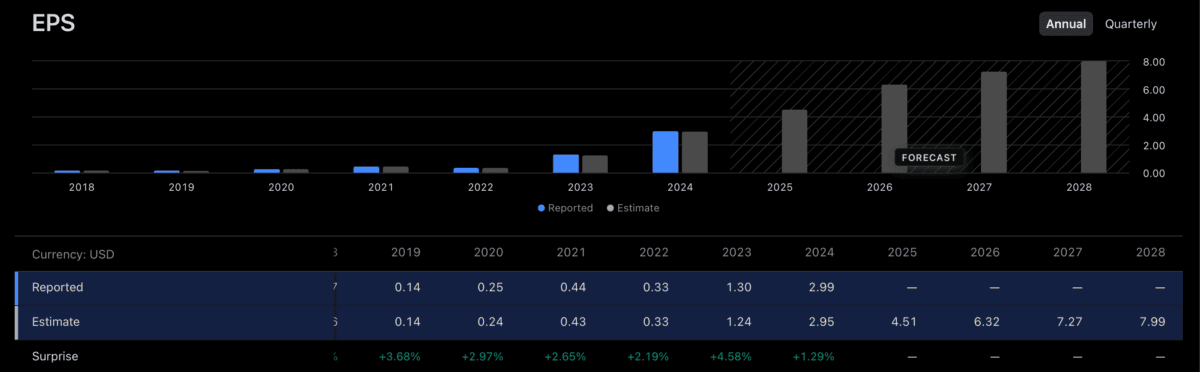

Analysts are expecting sales to grow around 32% in 2026, then 17% in 2027, and 8% in 2028. Thatâs quite a dramatic decline, but earnings per share (EPS) are forecast to grow more quickly.

Nvidiaâs EPS is forecast to reach $7.99 by 2028, which involves 40% growth in 2026, which is set to slow to 10% by 2028. That might be right, but I donât see growth slowing much from there.

Source: TradingView

If Iâm right, Nvidiaâs EPS could reach $9.67 by 2030. In that situation, I expect the stock to trade at a P/E ratio between 25 and 30, which implies a share price in the $241-$290 range.

Thatâs between 38% and 65% above the current level â enough to turn £1,000 into £1,650. Thatâs a long way from the return of the last five years, but it wouldnât be a bad result by any means.

All of this, however, depends on the firm maintaining its competitive position. Right now, Nvidia chips are indispensable to the rise of artificial intelligence and future EPS growth relies on this.

Gauging the risk of competition is difficult. But thereâs a danger that the US restricting exports to China could result in a drive for innovation in Asia, resulting in a DeepSeek-style alternative.

Risks and rewards

As with any stock, investing in Nvidia is about gauging risks and rewards. And while I think thereâs still room for optimism, itâs definitely less attractive than it was five years go.

While there are no obvious competitors, the risk of one emerging needs to be considered carefully. So investors might wonder whether they have better opportunities elsewhere at the moment.

The post Forecast: here’s what £1,000 invested in Nvidia shares could be worth in 2030 appeared first on The Motley Fool UK.

Should you invest £1,000 in Nvidia right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Nvidia made the list?

More reading

- Prediction: I think this AI stock will smash Nvidia and Palantir over the next 12 months

- What do Nvidia’s earnings mean for the global stock market?

- £10,000 invested in Nvidia stock at the start of 2025 is now worthâ¦

- The biggest stock market news of the week was… (no, it wasn’t Taylor Swift’s engagement)

- 3 key takeaways from the latest earnings for Nvidia stock

Stephen Wright has no position in any of the shares mentioned. The Motley Fool UK has recommended Nvidia. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.