2 FTSE 100 and FTSE 250 shares to consider this September

I think these FTSE 100 and FTSE 250 shares could be worth a very close look right now. Here’s why.

In recovery

Berkeley Group (LSE:BKG) shares have dropped by almost a third over the past year. This reflects two substantial threats to the UK’s housing market recovery: rising inflation with its impact on Bank of England interest rate policy; and the possibility of a prolonged economic downturn.

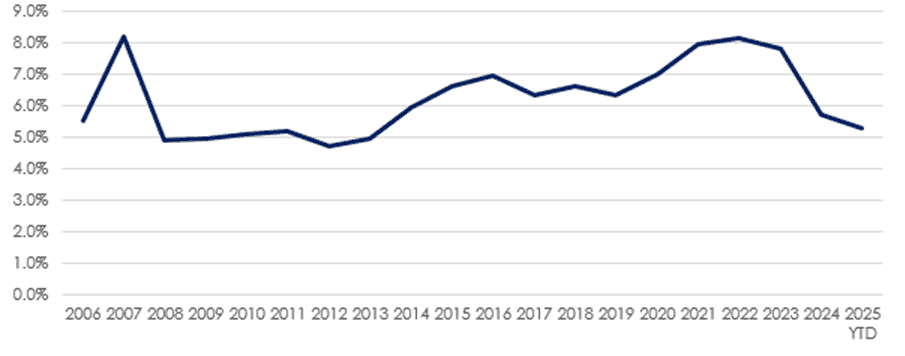

I think London-focused Berkeley’s price decline may represent an attractive dip-buying opportunity, though. Migration out of London continues to slow rapidly, and reached its lowest level since 2013 in the first seven months of the year:

Londoners purchased just 5.3% of homes outside the capital in the period, according to estate agent Hamptons. Interestingly, this was also below the 5.9% average between 2010 and 2020.

There’s no doubt weaker home price growth in London is encouraging people to stay put. That’s a risk. But other factors, like a greater appeal for city living and the decline of working from home are also boosting demand. As a result, some analysts expect property value growth in London to outpace that of the broader UK over the next few years.

I believe Berkeley is well placed to capture this opportunity. The FTSE 100 company has a strong balance sheet, underpinning its plans to make £2.5bn of land acquisitions over the next 10 years. I also like its decision to enter the red-hot rental sector by building and renting out 4,000 properties to tenants in the coming decade.

Latest financials last week showed that its steady rebound remains intact, with 85% of pre-tax profits already secured for this financial year (ending April 2026). While risks remain, I think it’s a great recovery share to consider.

Bursting higher

Unlike with Berkeley, shares in precious metal miner Endeavour Mining (LSE:EDV) have taken off over the past year, rising more than three-quarters in value.

Prices have been driven by a strong and sustained increase in gold prices. Bullion is up more than 40% in value over the last year, reaching record peaks above $3,600 per ounce on a range of macroeconomic and geopolitical factors.

And I feel the yellow metal can continue rising given growing tension over global inflation, Western nations’ debt levels, and economic and political conditions in the US. Sustained weakness in the US dollar is also boosting investor demand for safe-haven gold.

Gold isn’t just receiving support from retail investors either, with central bank gold demand also rising sharply. These institutions now hold more bullion in their reserves than US Treasuries for the first time since 1996, a trend driven by mounting concerns over US debt levels.

I think Endeavour’s an attractive way to capitalise on gold’s bull run. The unpredictable nature of metals mining means it’s a higher-risk way of investing in the commodity. However, purchasing gold stocks can also lead to profits — and thus share price gains — that grow faster than the metal price.

Thanks to buoyant bullion prices and increased production, Endeavour’s EBITDA more than trebled between January and June, to $1.1bn.

With the business also offering a healthy 2.8% dividend yield, I think it could be a great gold stock to consider. Remember that owning physical bullion or a price-tracking gold fund doesn’t provide an income.

The post 2 FTSE 100 and FTSE 250 shares to consider this September appeared first on The Motley Fool UK.

Should you invest £1,000 in The Berkeley Group Holdings plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if The Berkeley Group Holdings plc made the list?

More reading

- Up 75%, is this still one of the best stocks to consider buying in 2025?

- Down 30%, here’s a fallen FTSE 100 share to consider today

- Here are the latest share price and dividend forecasts for Taylor Wimpey, Persimmon and Berkeley Group

Royston Wild has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.