2 top UK growth stocks analysts say investors should buy in October

For investors looking to build long-term wealth, there are some terrific opportunities in UK growth stocks right now. Or at least, thatâs what some analysts think.

Even the best companies run into temporary difficulties every so often. And when they do, it can be a good time to take a look at them as potential buying opportunities.

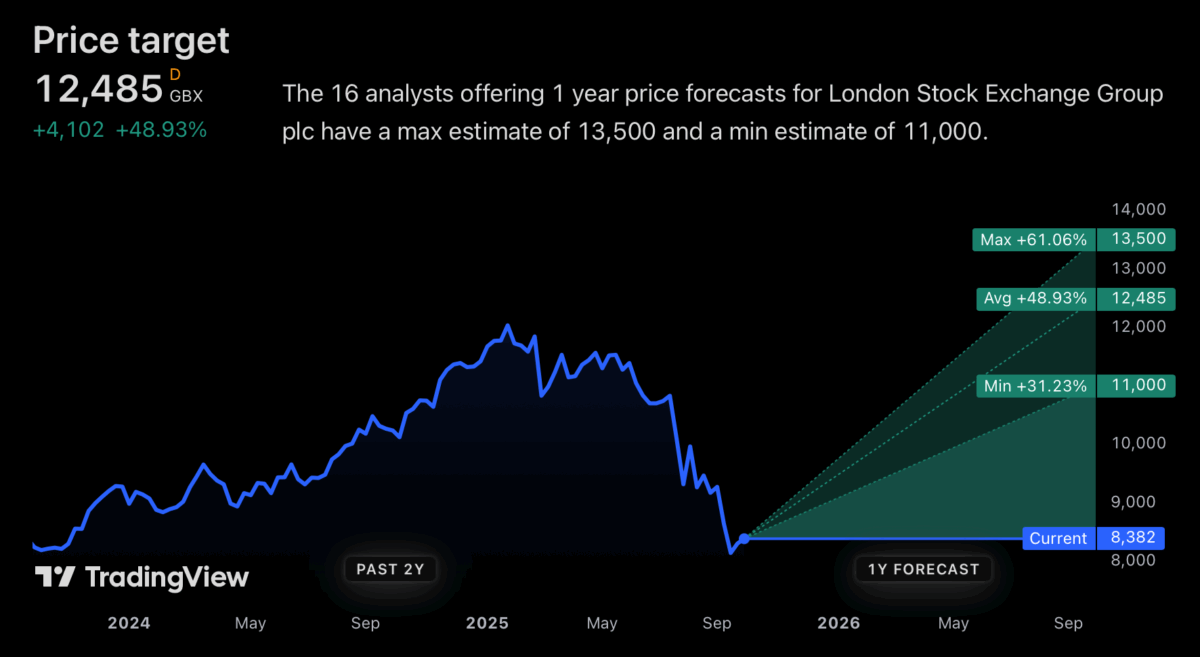

London Stock Exchange Group

The average analyst price target for The London Stock Exchange Group (LSE:LSEG) is around 50% above the current share price. And the lowest is almost 33% higher.

Source: TradingView

Itâs easy to see why. The company has some very strong stock market data and management is talking positively about the future outputs from its partnership with Microsoft.

Investors, however, need to be careful. According to Goldman Sachs, over 42% of S&P 500 firms mentioned AI in their earnings reports from a year ago, but some are more convincing than others.

I think the worst stocks to buy right now are ones that look like AI winners but in fact are not. And this seems to be the marketâs view of London Stock Exchange Group at the moment, with the stock down 28% this year.

The stock is trading at a price-to-earnings (P/E) ratio of 20 based on next yearâs forecasts. Thatâs a lower ratio than usual, but Annual Subscription Value (ASV) growth has been slowing recently.

Given this, I think the stock is riskier than it looks. A number of businesses that have seen AI as an opportunity have found it to be more of a threat. Itâs still not clear to me whether London Stock Exchange Group is one.

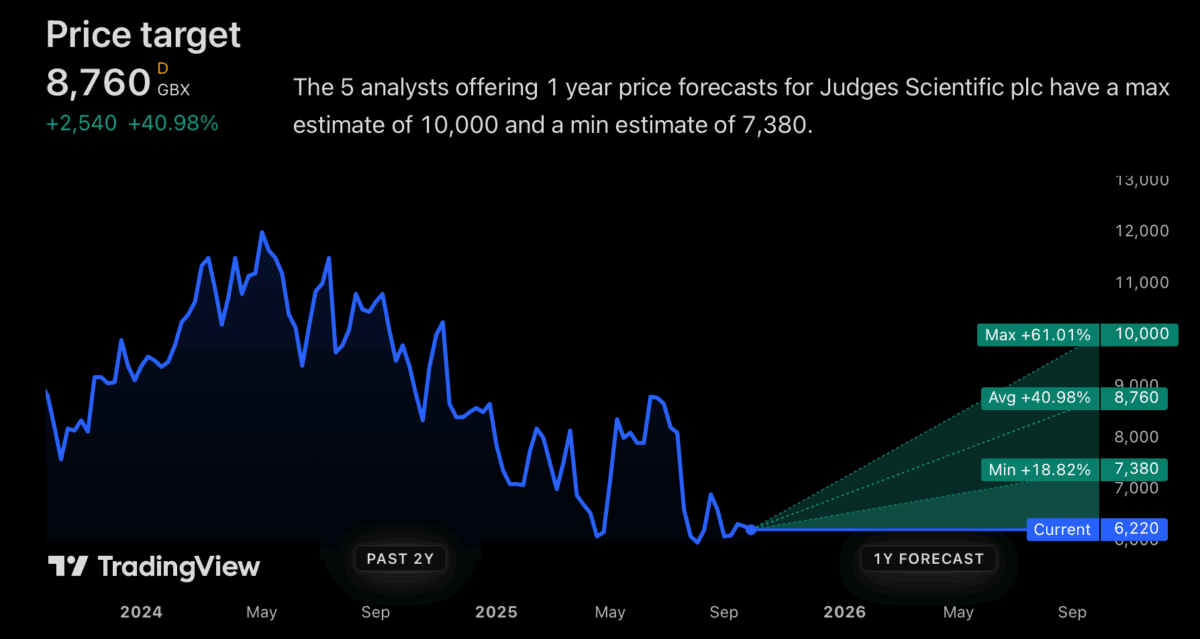

Judges Scientific

Judges Scientific (LSE:JDG) doesnât attract as much attention as LSEG. But the analysts who are looking at the stock have a very positive view of where it ought to be trading.

Source: TradingView

The firmâs business model is built around acquiring scientific instrument companies and helping them grow. This can involve contributing commercial expertise, scale, and capital.

Judges Scientific operates a decentralised approach. This allows subsidiaries to remain agile and responsive to customer needs, but it does come with certain risks.

The most significant is that it means going without the savings that come from fully integrating new operations. And this increases the danger of overpaying for acquisitions.

The companyâs size, however, helps offset this risk. Being relatively small means there are usually opportunities that can boost its growth without being large enough to attract major competition.

Coincidentally, the stock is also down 28% since the start of the year. But I think this is largely due to short-term macroeconomic challenges, making this a great time to consider buying the stock.

Buy low?

Both the London Stock Exchange Group and Judges Scientific are down 28% since the start of the year. And thereâs a decent case to be made for buying either of them.

My own view, however, is that I prefer Judges Scientific. I think I have a much clearer sense of its future prospects than I do with LSEG.

I could be mistaken, but thatâs one of the nice things about growth investing. Even if investors miss a few opportunities, it only takes a few great investments to achieve outstanding results.

The post 2 top UK growth stocks analysts say investors should buy in October appeared first on The Motley Fool UK.

Should you invest £1,000 in Judges Scientific plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Judges Scientific plc made the list?

More reading

- Will the stock market crash in October?

- 2 undervalued FTSE 100 stocks to consider adding to your portfolio in October

- These undervalued FTSE 100 shares could rise more than 50% over the next year, according to brokers

- Should I put money into index funds while the S&P 500âs near all-time highs?

- 3 UK stocks I think could still be paying dividends decades from now!

Stephen Wright has positions in Judges Scientific Plc. The Motley Fool UK has recommended Judges Scientific Plc and Microsoft. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.