Meet the 10p penny stock that’s outperformed global stock markets this month!

On the stock market, micro-cap shares are often a lottery. They can vanish into obscurity for years, only to suddenly roar back to life on a single announcement. Thatâs exactly whatâs just happened with ImmuPharma (LSE: IMM), a small biotech thatâs spent most of the past five years languishing under the radar.

The company is focused on discovering and developing peptide-based therapeutics. Its flagship candidate is Lupuzor (P140), a treatment being developed for lupus and potentially other autoimmune conditions. The company briefly caught fire in late 2017 and early 2018 when excitement over Lupuzor was running hot. But everything came crashing down in April 2018, when the drug failed a pivotal Phase 3 trial. The shares promptly collapsed by 75%, and investor confidence evaporated.

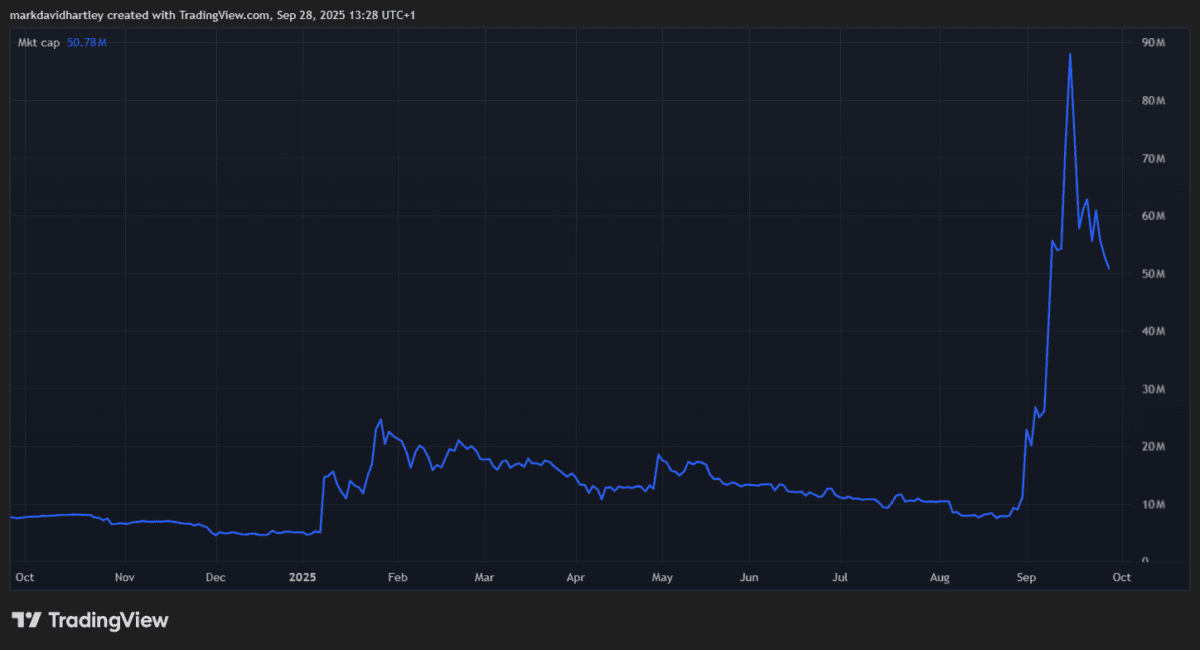

Over the following years, the stock slid further, drifting below 2p as little progress was made. But this month, things suddenly changed.

Shares in the stock have soared from around 2p to over 10p â thatâs a staggering 530% increase in a matter of weeks. In fact, this has made it one of the best performers across global stock markets in September.

Whatâs behind the surge?

ImmuPharma is still a tiny company, valued at just £50.78m today, but it has managed to grab the marketâs attention once more. Its revenue remains at zero, as Lupuzor isnât yet approved for commercial sale. The big news is that itâs pressing ahead with a fresh Phase 3 trial in the US, this time in partnership with Avion Pharmaceuticals.

And in late August, the company filed a new patent application for Lupuzor. Management describes the treatment as an âimmunormalizerâ â a potential diagnostic and therapeutic approach for a wide range of autoimmune diseases. If granted, the patent could provide 20 years of commercial exclusivity. Even more striking, the company believes the therapy could have potential applications in up to 50 different autoimmune conditions.

That announcement briefly sent the market cap surging to nearly £90m, before settling back around current levels.

Is it worth considering?

This is where investors need to tread carefully. Drug development is inherently risky, and the biotech sector is notorious for creating dramatic winners and losers. A positive clinical trial result can transform a tiny company overnight. But one setback can wipe out years of progress and shareholder value. ImmuPharma itself is proof of this â the collapse in 2018 shows just how brutal late-stage trial failures can be.

Financially, the company isnât in dire shape. At the end of the first half of 2025, it reported short-term assets of £1.5m against liabilities of £1.24m. Cash and equivalents stood at around £400,000, and it carries no debt. Net income has improved in recent years too, moving from a loss of £8.17m in 2021 to a profit of £2.48m in 2024.

Still, this remains a tiny operation with limited resources compared to larger pharmaceutical players.

For that reason, I think ImmuPharma is a stock that should only be considered as a speculative small allocation within a much larger portfolio. If the new patent and trial results pan out, the rewards could be spectacular. But until more concrete data emerges, thereâs no way of knowing whether this resurgence is sustainable.

For now, itâs a fascinating example of how fast fortunes can change on the stock market â especially for penny stocks.

The post Meet the 10p penny stock that’s outperformed global stock markets this month! appeared first on The Motley Fool UK.

Should you invest £1,000 in ImmuPharma plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if ImmuPharma plc made the list?

More reading

- This resurgent FTSE 100 passive income star now has a forecast dividend yield of 6.1%!

- Trading around a 10-year high, is Lloyds share price overpriced against âfair valueâ now?

- Down 25%, this undervalued FTSE share boasts a reliable, well-covered dividend yielding 5.4%

- 2 top UK growth stocks analysts say investors should buy in October

- Could buying NIO stock at $7 be like investing in Tesla in 2015?

Mark Hartley has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.