No savings at 40? Consider targeting FTSE 250 shares to eventually turn £100 a month into £240k

In these financially challenging times, saving and investing for the future is taking a back seat for many. Government statistics show more than a third (38%) of people in the UK aged 40-75 don’t even have any savings. Investing in the FTSE 100, FTSE 250, or other UK shares is even further down the list of many peoples’ priorities.

This leaves millions of citizens sitting on a timebomb, given the soaring cost of living in retirement. The possibility of seismic changes to the State Pension adds another layer of danger.

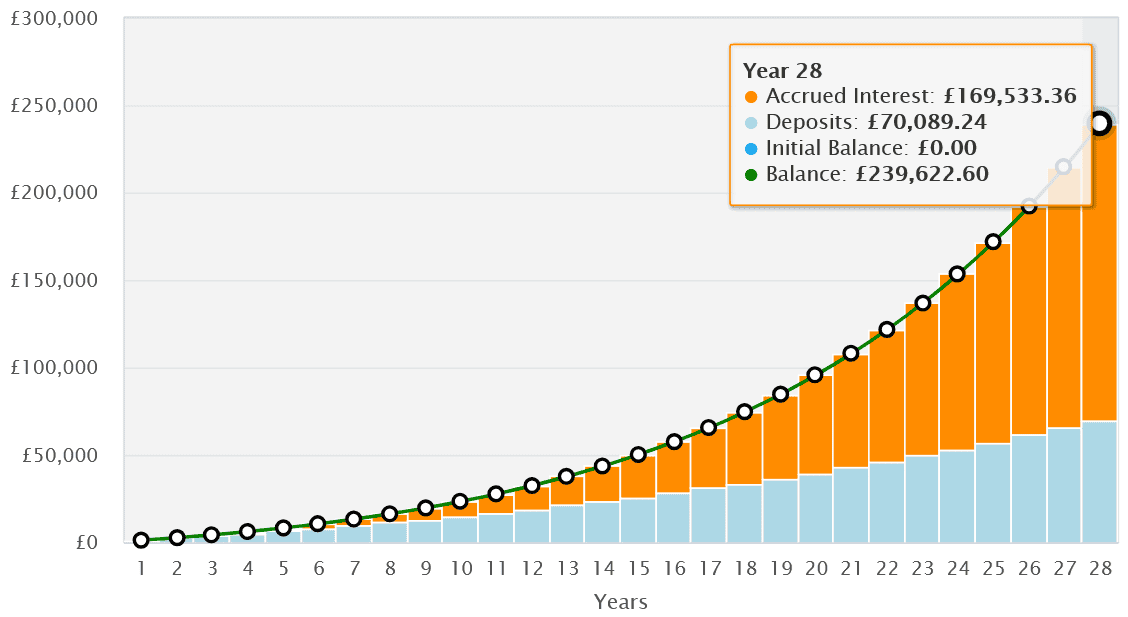

Even a modest monthly investment can provide a buffer against such dangers, though. Let me show you how a middle-aged investor could turn a £100 monthly investment into roughly £240,000 by retirement.

Small acorns

A common misconception is that those who start their investing journey late must take bigger risks to build retirement wealth.

With a diversified portfolio and a tax-efficient product like a Stocks and Shares ISA — and a commitment to steadily increasing monthly contributions — individuals don’t need to take unnecessary risks with their cash, even if they only have small sums to invest at first.

Let’s say we have a 40-year-old who can invest £100 a month in FTSE 250 shares. They can increase their contribution by 5% each year, reinvest all their dividends, and plan to retire when they hit the State Pension age of 68.

Since 2004, the FTSE 250 has delivered an average annual return of 9%. If this continues, our investor would have a nest egg of nearly £240k (or £239,623, to be exact). Bear in mind the index’s return could fluctuate from year to year.

A powerful portfolio

I think a well-diversified portfolio to target this sort of a return could be achieved with as few as 10 stocks.

For growth, I believe software developer Softcat, Georgian bank Lion Finance, defence contractor QinetiQ, and retailer Greggs (LSE:GRI) could be top stocks to consider. Investment trust Allianz Technology Trust would also merit a close look.

And for dividends, I think property stock Tritax Big Box REIT, water supplier Pennon, wealth manager Investec, and renewable energy stock Greencoat UK Wind merit a close look.

I bought Greggs shares for my own portfolio for long-term growth. What makes it worth considering is its ambitious store target — it plans to eventually have 3,000 outlets up and running — and heavy investments in distribution and manufacturing to drive sales and protect margins.

Profits should also be helped by the firm’s rising presence in the evening and delivery segments. The business can also lean more heavily into leveraging its app and loyalty programme to bolster revenues.

Greggs faces competitive threats in the food-to-go market, and sales can cool during economic downturns. This has been an issue over the last year (like-for-like sales rose just 1.5% in the most recent quarter).

But over the long term, I think the company it has the recipe to thrive.

Targeting long-term wealth

With one space left in our portfolio, I think an index tracker like the Vanguard FTSE 250 ETF could be worth serious attention. This would allow our investor to spread risk across the entire share index.

While returns aren’t guaranteed, I’m confident a selection of shares like this could turn even an initial £100 monthly investment into a healthy retirement fund.

The post No savings at 40? Consider targeting FTSE 250 shares to eventually turn £100 a month into £240k appeared first on The Motley Fool UK.

Should you invest £1,000 in Greggs plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Greggs plc made the list?

More reading

- Greggs shares: is the worst over?

- Greggs’ share price spikes 8% following Q3 update! Is the fightback on?

- Hereâs what £1,000 invested in Greggs shares a year ago is worth now

- 3 reasons why Greggs shares could be set to bounce back in October

- Greggs’ shares have turned £1,000 into £500. Hereâs what hedge funds expect to happen next

Royston Wild has positions in Greggs Plc. The Motley Fool UK has recommended Greencoat Uk Wind Plc, Greggs Plc, Pennon Group Plc, QinetiQ Group Plc, Softcat Plc, and Tritax Big Box REIT Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.