2 top growth shares to consider right now!

Investing in growth shares can be a turbulent journey at times, and especially during uncertain periods. But the scope for market-beating returns are also considerable, as — over the longer term — these shares can deliver spectacular capital gains as earnings rise.

With this in mind, here are two top growth stocks I think are worth serious attention this October.

Case for the defence

FTSE 250-listed Chemring (LSE:CHG) is capitalising on soaring defence budgets as NATO members respond to growing perceived threats.

The business manufactures sensors, countermeasures and explosives directly to the UK, US, Australia and Norway. This diversified approach helps reduce dependence on one region and provides a multitude of growth opportunities.

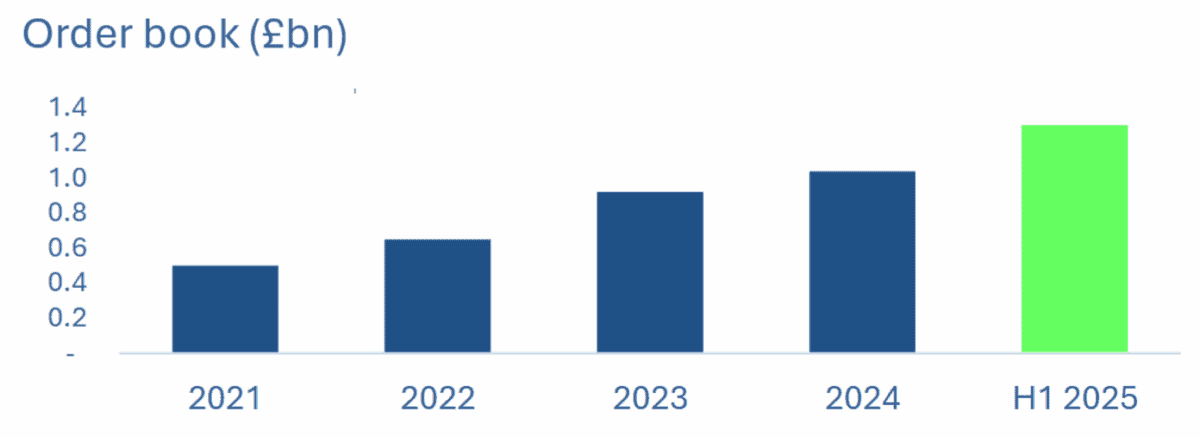

Latest financials showed its orders rose 42% in the six months to April. This pushed its order book to record peaks of £1.3bn. As the chart below shows, demand for Chemring’s hardware has been rising steadily in recent years:

And that robust order book provides Chemring with excellent medium-term profits visibility. City analysts expect the business to follow a 17% earnings rise in the last financial year (to October 2024) with increases of 25% and 17% in fiscal 2026 and 2027 respectively.

I think it’s a top growth stock to consider, although supply chain issues remain a notable risk over the period. With a price-to-earnings (P/E) ratio of 28.5 times, its shares trade at a discount to the broader European defence sector.

Move over, gold

Earnings at metal producers can be extremely volatile according to market conditions. Even when mining operations are performing smoothly, profits can tank if prices of the commodity they produce drop.

This is a risk for Valterra Platinum (LSE:VALT), which was spun off from FTSE 100 miner Anglo American in June. But I’m confident its share price can continue soaring given the bright outlook for platinum group metal (PGM) prices.

Like gold and silver, prices of these precious metals are rising sharply as investors seek safe havens. Platinum’s risen 58% in value in 2025, and looks well placed to keep climbing, in my view. Rising inflation, geopolitical instability, weak growth and US dollar weakness are just a few potential drivers in the short term and probably beyond.

Investors can purchase a simple tracker fund to follow metal prices. But purchasing platinum stocks like this can be a more profitable (if higher-risk) option. Because their revenues rise but costs remain largely fixed, profits can rise substantially during bull markets.

City analysts agree with my bullish view on PGM values. And so they expect Valterra’s earnings to rise 57% this year and a further 53% in 2027. With capacity of 4.5m ounces, Valterra is the world’s largest PGM producer and well placed to capitalise on further price rises.

And today it trades on a sub-1 price-to-earnings growth (PEG) ratio of 0.5. This makes it a great option for value investors to consider.

The post 2 top growth shares to consider right now! appeared first on The Motley Fool UK.

Should you invest £1,000 in Chemring Group PLC right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Chemring Group PLC made the list?

More reading

- No savings at 40? Consider targeting FTSE 250 shares to eventually turn £100 a month into £240k

- What’s the best way to capitalise on surging gold prices?

- 3 high-dividend investment trusts to consider for passive income

- 3 simple steps to grow your wealth with ISAs

- With a 22% annual return, I think this growth stock may be too good to ignore

Royston Wild has no position in any of the shares mentioned. The Motley Fool UK has recommended Chemring Group Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.