My highest-conviction FTSE 100 investment right now is…

According to the consensus of analysts covering the London Stock Exchange Group (LSE:LSEG), itâs the most undervalued company on the FTSE 100.

Now, analysts’ forecasts can be misleading. Sometimes there just arenât many covering a stock and a consensus of two analysts isnât much of a consensus. And some simply arenât very good at their jobs. I recently edited a piece of investment research by an analyst at a major investment bank, and it was an appalling piece of work in every respect.

Thereâs also a time-lag element. Sometimes analysts just donât have the time to update their coverage. A company might report a bad quarter and the share price falls, but the analystsâ forecast remain where they were.

These donât appear to apply here â although I can’t vouch for the quality of all the analysts. The stock’s covered by 17 of them, and with a market-cap of £44.8bn, itâs likely the biggest company in most analystsâ coverage.

Just how undervalued?

Well, according to their average forecast the stock’s undervalued by 43%. That suggests the market’s significantly overlooking this companyâs potential.

On a statutory basis, the stock’s trading around 43 times forward earnings. And while that falls dramatically to 27.2 times by 2027, the adjusted figures are far more illuminating.

The current forecast suggests earnings per share of 399p for the year ahead and 442p for 2026. This gives us a price-to-earnings (P/E) ratio of 21.5 times for 2025 and 19.3 times for 2026. Of course, these figures mean nothing without context. Why would an investor pay 21.5 times earnings for the London Stock Exchange Group but may think twice about paying more than 16 times for a supermarket chain?

Itâs all about the quality of the business and the potential for sustainable earnings growth. Quality’s often indicated by brand strength, market position, and margins.

In the first half of the year, the London Stock Exchange Group reported an adjusted EBITDA margin of 49.5% â up 100 basis points over a year. In other words, every £10 of sales is worth £4.95 of EBITDA.

Most other businesses, especially on the FTSE 100 which is dominated by mature business like banks and miners, canât compete with this.

Everything considered

Despite everything Iâve said above, this isnât a flawless company â anything but. Investors considering the London Stock Exchange Group should note that Annual Subscription Value isnât particularly strong, especially as some products like Eikon being retired.

Remember, data and analytics are now the largest business in LSEG, responsible for nearly half the groupâs total income. This is also where investors are keenly awaiting the fruits of a tie-up with tech giant Microsoft. Losing market share to Bloomberg or FactSet wouldnât be a real concern.

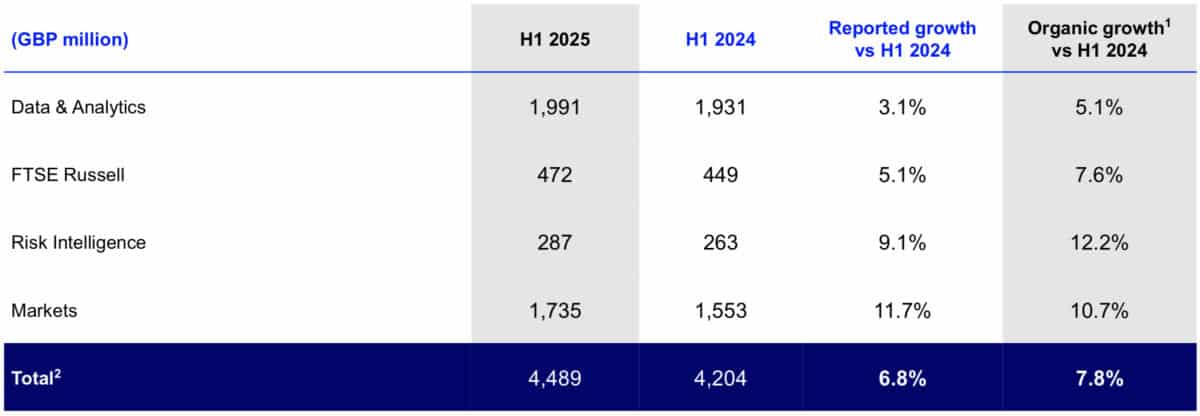

However, there are many reasons why I believe investors should consider this stock. Iâve noted a few, including the margins and the valuation. But the above snippet from the interim results highlights a diversified business with significant growth across multiple divisions.

The post My highest-conviction FTSE 100 investment right now is⦠appeared first on The Motley Fool UK.

Should you invest £1,000 in London Stock Exchange Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if London Stock Exchange Group Plc made the list?

More reading

- 5 FTSE 100 stocks Iâm considering buying for my SIPP â and this one’s top of the list!

- How to aim for £20,000 extra income while working full-time by investing in stocks

- 2 top UK growth stocks analysts say investors should buy in October

- Will the stock market crash in October?

- 2 undervalued FTSE 100 stocks to consider adding to your portfolio in October

James Fox has positions in London Stocks Exchange Group. The Motley Fool UK has recommended Microsoft. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.