Dividend shares can be great for passive income. But be careful to avoid these 3 mistakes…

Dividend shares are stocks that pay out part of their profits regularly to shareholders to signal financial strength and attract investment. For many income-focused investors, these shares are the backbone of passive income streams — but they aren’t all reliable.

Here are three mistakes to avoid when picking dividend shares for passive income.

1. Chasing the highest yields

Itâs tempting to pick the shares with the highest dividend yields, but ultra-high numbers often signal hidden trouble. A yield above ~10% frequently reflects a share price thatâs fallen sharply because business is weak or risk is high. Struggling companies often canât sustain such payouts, which may lead to cut dividends and poor total returns.

A better approach tends to emphasise sustainable yields, ones in the 5%-8% range, backed by solid cash flow and reliable dividend coverage.

Consider DCC (LSE: DCC), a FTSE 100 company specialising in energy sales, marketing and support services. Its yield’s around 4.3%, well below those risky high-yield names. But its income looks durable: free cash flow remains strong and dividend coverage has been consistent.

These qualities make it less flashy but perhaps more dependable than chasing big yields alone.

2. Ignoring payout ratios and cash flow

A companyâs payout ratio measures how much of its earnings are paid out as dividends â but an investor should also check how much cash the firm has and how much free cash flow it generates. If dividends exceed what the business can generate in cash, risk increases.

Looking again at DCC, revenue dropped 4.5% in its full year ended March due to lower energy commodity prices. But its operating profit in the Energy division rose 8.5% on a constant currency basis.

Free cash flow conversion is very high at 84% and the company proposed a 5% dividend increase. This suggests DCCâs dividends are well supported. That said, its Technology division saw a drop in profit, which could drag on group cash generation if not addressed.

3. Overlooking long-term stability and growth

Stable dividend growth over many years compounds nicely. Companies that raise payouts steadily tend to reward patient investors more than those at risk of erratic payments. When choosing dividend shares, look for firms with long records of increasing dividends, manageable debt and predictable sectors.

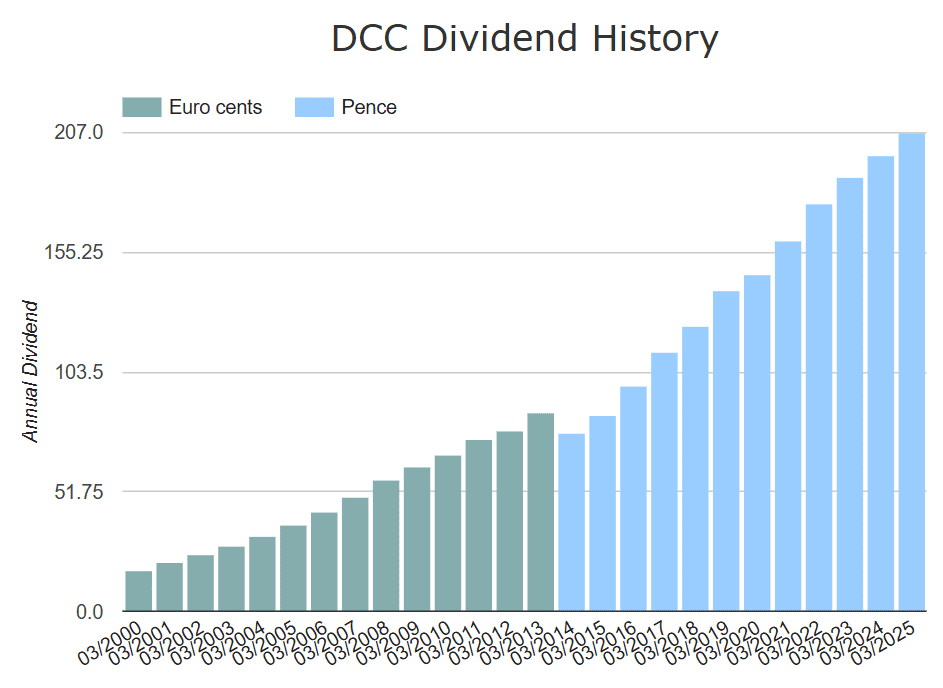

DCC has a strong record: 31 consecutive years of dividend growth, with a compound annual growth rate of 12.9%. Thatâs rare and demonstrates a commitment to shareholder returns.

However, even with DCC there are risks. Revenue declined in some segments, there’s pressure in Technology, and there’s exposure to energy commodity price swings. If it fails to offset these negatives, growth in dividends or profit may stall.

Think sustainable and consistent

Dividend shares can deliver reliable income but not all are created equal. The best income stocks are those that combine sustainable payout ratios, strong cash flow and consistent growth.

DCC stands out among FTSE 100 income names. It has strong financials in its Energy division, good cash flow, and a long history of dividend increases. Itâs a stock investors may consider for income, provided they keep an eye on profit trends, cost pressures and how well the weaker divisions recover.

In the end, building a strong passive income portfolio’s about avoiding traps as much as it is about finding winners â and DCC illustrates both sides of that coin.

The post Dividend shares can be great for passive income. But be careful to avoid these 3 mistakes… appeared first on The Motley Fool UK.

Should you invest £1,000 in DCC plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if DCC plc made the list?

More reading

- These 2 dividend stocks have increased their annual income payments for multiple decades

- These 2 FTSE 100 stocks have raised their dividends for 30 years in a row

Mark Hartley has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.