Could a 22% fall in the share price of this FTSE share be a major buying opportunity?

Playtech (LSE:PTEC), a member of the FTSE 250 share index, lost over a fifth of its market cap yesterday (21 October). This was after the provider of technology solutions to the gambling industry was accused by one of its rivals of engaging in a âdefamatory smear campaignâ.

Evolution, the Swedish âprovider and innovatorâ of online casino games, commenced legal action in December 2021 against a US law firm alleging defamation and trade libel. After an exchange of legal documents, it now says itâs âunmaskedâ Playtech as engaging a third-party investigator to âprepare and disseminate a 2021 report containing highly inflammatory and knowingly false claims about Evolution and its business practicesâ. According to the group, the purpose was to âsubstantially harm the company for anti-competitive reasonsâ.

Playtech responded by saying that the claims were âwholly untrueâ and that it lawfully commissioned a report âto better understand and verify concerns of significant regulatory and commercial importanceâ.

Iâm going to leave it to the courts to decide the rights and wrongs of all this. Needless to say, I donât think the bosses of these two will be exchanging Christmas cards this year.

One person’s trash is another’s treasure

However, after reflecting overnight, it appears as though some investors have spied a buying opportunity. By mid-morning on 22 October, the Playtech share price had recovered by around 6%.

Are they right? At first glance, Iâm not so sure.

Thatâs because, aside from this legal case, Playtech has another important issue to contend with. There are persistent rumours that the government will raise taxes on the gambling industry in Novemberâs budget. If this happens, the demand for the groupâs technology platform is likely to take a big hit.

And there are calls to further regulate the industry. The World Health Organisation claims that 1.2% of adults are affected by a gambling disorder and has called for a ban on advertising. It also wants to see binding loss limits and stricter controls on availability introduced.

My verdict

However, on balance, I think Playtech has lots going for it.

Although any increase in taxes on the industry is likely to damage the group’s revenue and earnings, itâs important to remember that it’s a global operator. It has over 200 licensees in 45 different jurisdictions. In 2024, it earned 11.8% of its revenue in the UK. Its Italian business is five times bigger. Mexico is a significant market too.

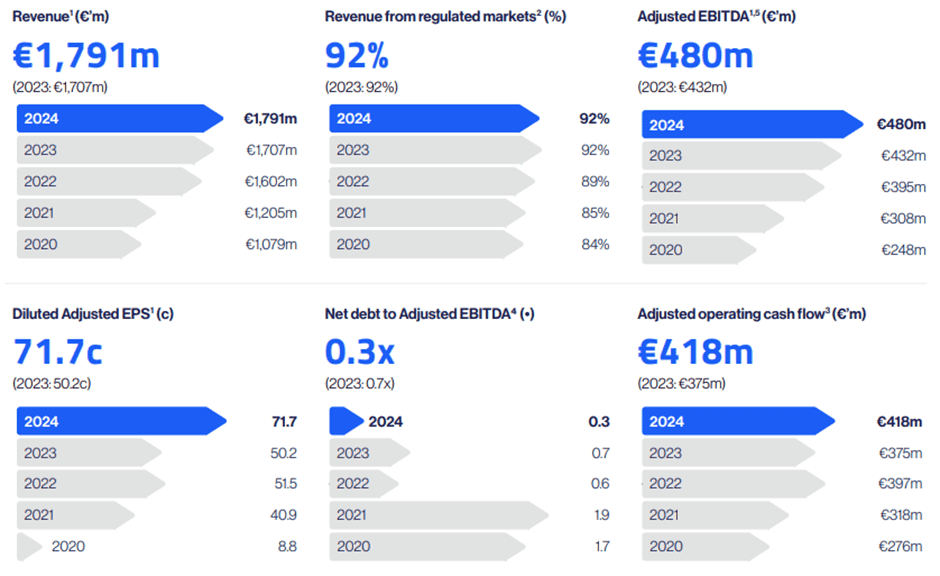

And the group has an excellent track record of growth. From 2021-2024, revenue grew by 49% and adjusted earnings per share were 75% higher.

Some will be concerned that this hasnât helped its share price. Since October 2020, itâs fallen 22%.

However, much of this can be explained by the groupâs decision to sell one of its businesses for â¬1.8bn in May (£1.57bn at current exchange rates) — more than its current market cap of approximately £825m. It then used some of the proceeds to return â¬5.73 a share to shareholders by way of a special dividend, which explains the large drop in its share price as the stock went ex-dividend.

Encouragingly, current trading also appears to be strong. In September, it upgraded its earnings expectations for 2025. Although Iâm mindful of the risks, I think Playtech’s a stock worth considering.

The post Could a 22% fall in the share price of this FTSE share be a major buying opportunity? appeared first on The Motley Fool UK.

Should you invest £1,000 in Playtech plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Playtech plc made the list?

More reading

James Beard has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.