Look who’s back! Loss-making British retailer THG has rejoined the FTSE 250. Time to buy?

The past yearâs been anything but dull for THG (LSE: THG), having re-entered the FTSE 250 in September, just months after a dramatic exit.

After the British nutrition and beauty digital retailer’s rollercoaster year, many are asking: is this comeback for real, or just a sugar rush for investors thinking about bargain hunting?

A hard-earned turnaround

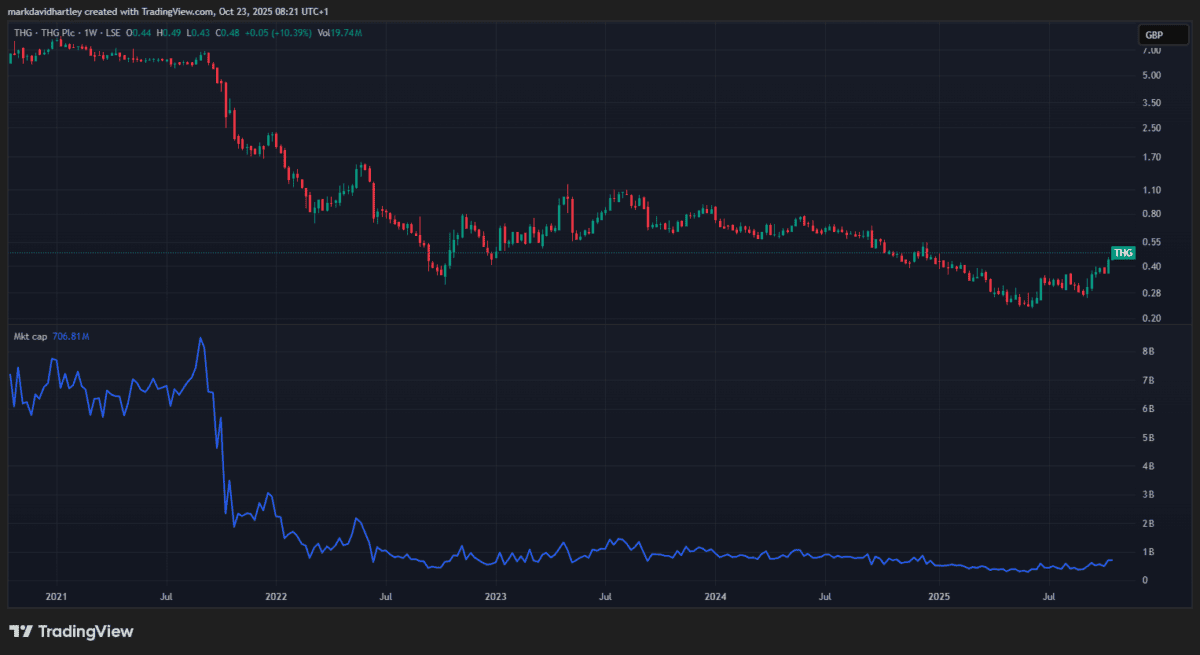

With a £664m market-cap, THG sits at the lower end of the index, on par with the likes of Aston Martin Lagonda and Close Brothers. Thatâs a far cry from its peak, when it was worth close to £8.5bn.

Most recently, revenue growth in Q3 has shifted sentiment â itâs the strongest quarter of organic sales since 2021, with revenue up 6.3% to £405.2m. JP Morganâs recent rating upgrade didnât hurt either, and CEO Matthew Moulding has called this turnaround a hard-earned victory after years of chaos and restructuring.

The company, which owns brands including Myprotein and Cult Beauty, suffered devastating losses in late 2021, with the price crashing by over 70%.

Now, after years of struggles, it seems determined to rise up through the ranks again. So does that make the current price an opportunity — or a value trap?

Let’s take a closer look.

Assessing value

THGâs still loss-making, so thereâs no price-to-earnings (P/E) ratio for investors to weigh up. Instead, its price-to-sales (P/S) ratio comes in at just 0.4, which could suggest undervaluation, but the price-to-book (P/B) ratio of 1.59 is a tad rich. Itâs this blend of numbers that often draws value investors to the story.

The share price performance has certainly been impressive. Itâs up 68% over the past six months â but donât forget, THGâs still down more than 90% from its all-time high. That leaves plenty of room for growth if the firm can deliver consistent results.

But whatâs the city saying?

Most brokers reviewing THG rate it Neutral or Hold, with an average 12-month price target predicting little-to-no growth in the next year. Some are optimistic about the operational improvements and brand portfolio, while others remain cautious amid profitability issues and competitive threats.

Risks to consider

THGâs debt stands at £601m. Itâs not massive for a business of this size, but it outweighs equity, which isnât ideal. Add in its quick ratio below 1, and itâs clear THG doesnât have enough liquid assets to cover its short-term liabilities.

Thatâs worth thinking about, especially as online retailâs a crowded territory and rivals are quick to pounce on any weakness.â

Analysts note the companyâs ongoing restructure â including selling non-core assets and automating operations â should help in the long term. But any slip in consumer demand or further volatility could cut short the rally.

My verdict

After years in the wilderness, THG appears to be getting its act together. Sales are up, and forecasts predict profitability by the end of fiscal 2025. Value investors looking for turnarounds might want to consider THG, since the low share price and improving numbers could merit a closer look.

Personally though, itâs still a bit too risky for my portfolio just yet. The mix of weak liquidity, debt, and fierce competition gives a lot to weigh up. Still, Iâll be watching to see if it grows stronger as the year ends.

The post Look who’s back! Loss-making British retailer THG has rejoined the FTSE 250. Time to buy? appeared first on The Motley Fool UK.

Should you invest £1,000 in THG right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if THG made the list?

More reading

Mark Hartley has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.