£5,000 invested in Tesco shares 3 years ago would be worth this much now…

Letâs be honest â 2025 hasnât been the most exciting year for Tesco (LSE: TSCO) shares. The stockâs only up around 23% this year, which hardly sets the market alight. But zoom out to a three-year view and itâs a different story altogether.

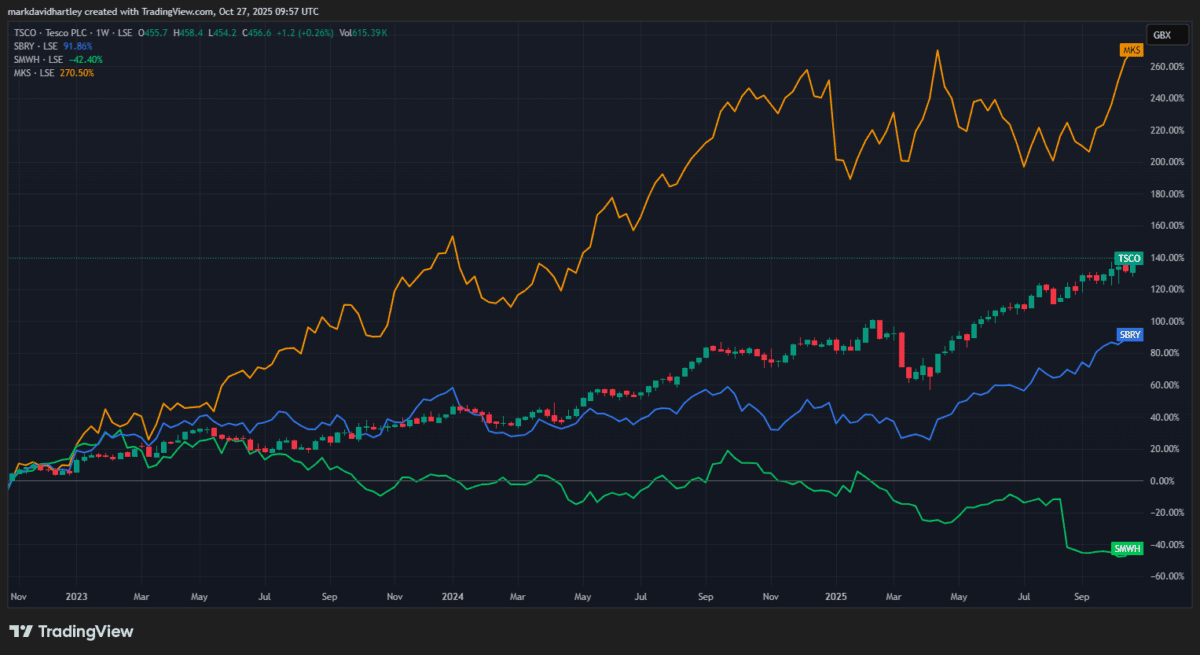

Including dividends, Tesco’s delivered a total return of roughly 140% since 2022. That means a £5,000 investment back then would now be worth around £12,000. A £7,000 return in just three years is a decent chunk of passive income by anyoneâs standards.

But is the performance above average when compared to other similar shares?

Let’s take a closer look.

Competitors’ performance

When compared to rivals, Tescoâs performance still looks fairly impressive. Its closest competitor, Sainsbury’s, has delivered a total return of only 92% in the past three years. Meanwhile, WH Smith — while not solely a grocer — has suffered a loss of 42%.

But the standout winner in UK retail is Marks and Spencer, returning an eye-watering 270% since October 2022. A £5,000 investment back then would be worth £18,500 today — an almost four-fold return. Of course, the retail giant benefits from a broader selection of products, deriving significant revenue from its clothing, beauty, and home products

Other competitors, such as Asda and Morrisons, are harder to evaluate as they’re owned by private equity firms.So that begs the question — what can investors expect from Tesco shares in the next three years?

The three-year outlook

Looking ahead, analysts expect Tescoâs dividend to rise steadily to around 17.2p per share by 2028, implying a 3.8% yield. Earnings per share (EPS) are forecast to climb to 37p in the same period, while revenue could hit £77.85bn â roughly 10% higher than current levels.

However, despite the steady growth outlook, the average 12-month price target from 16 analysts sits at just 471p. Thatâs only about 3.3% higher than the current price. Most analysts still give the stock a Buy rating but expectations are clearly modest.

There are a few risks to consider too. Food inflation continues to pressure margins, while low-cost rivals like Aldi and Lidl are capturing more of the budget-conscious shopper segment. Meanwhile, with a forward price-to-earnings (P/E) ratio of around 17, Tesco could already be fully priced for perfection. The dividend yield’s decent, but itâs not especially high compared to other FTSE 100 shares.

That said, the true value of Tesco â and the reason I hold the stock â lies in its defensive strength. The company dominates UK grocery retail, operates on reliable cash flow and serves as a stable hedge against market volatility.

Long story short: people need to eat, regardless of whether the economyâs booming or contracting.

My verdict

Tescoâs growth prospects over the next three years appear modest, and its yield wonât excite income hunters. But itâs still worth considering as part of a diversified portfolio, offering a layer of defensive stability thatâs hard to find elsewhere.

For me, itâs not a stock thatâll make anyone rich overnight â but itâs one that helps me sleep well knowing my portfolio has a solid defensive foundation.

The post £5,000 invested in Tesco shares 3 years ago would be worth this much now… appeared first on The Motley Fool UK.

Should you invest £1,000 in Tesco PLC right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Tesco PLC made the list?

More reading

- 3 FTSE 100 stalwarts to consider ahead of possible ISA changes

- How big does an ISA need to be to earn a £2,000 monthly passive income?

- Here are the 2 of the fastest-growing FTSE 100 dividends

- £3,000 to invest? Here are 3 UK shares to buy in a Stocks and Shares ISA, according to experts

- With £1,000 to spend, here are 2 UK shares Iâm considering in October

Mark Hartley has positions in Marks And Spencer Group Plc and Tesco Plc. The Motley Fool UK has recommended J Sainsbury Plc, Tesco Plc, and WH Smith. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.