Historically, November tends to be a good month to buy stocks

Investors who believe in selling in May and going away tell the rest of us that November is a good month to buy stocks. And â in fairness â they have the weight of history on their side.

My own view is that trying to work out the best time of year to buy shares is a bad plan. But I do think there are opportunities in the stock market that are worth considering right now.

Sell in May⦠and buy in November?

At the start of May, Fresnillo shares were trading at £10.02. Fast forward to today and the share price is £22.72 â 127% higher than it was six months ago.

There arenât many guarantees when it comes to the stock market. But one of the few things investors can count on is that itâs not better to buy things at higher prices than lower ones.

Fresnillo is the top-performing FTSE 100 stock of the last six months. The index as a whole, however, is up almost 17%, so share prices are generally higher now than they were then.

Investors who decided to stay in cash since May havenât been able to make up that difference. And this shows why waiting for share prices to fall is a risky business.

A different strategy

That doesnât mean investors should always be piling into stocks without regard for prices or fundamentals. Over the long term, thatâs a risky business.

The best strategy, in my view, involves buying shares on a regular basis and looking for the best opportunities at any particular time. And this can change from one month to another.

For example, MondelÄz International (NASDAQ:MDLZ) stock has fared badly recently. But I think it might be a good time to look at buying shares in the company behind Cadbury, Oreos, and Toblerone.

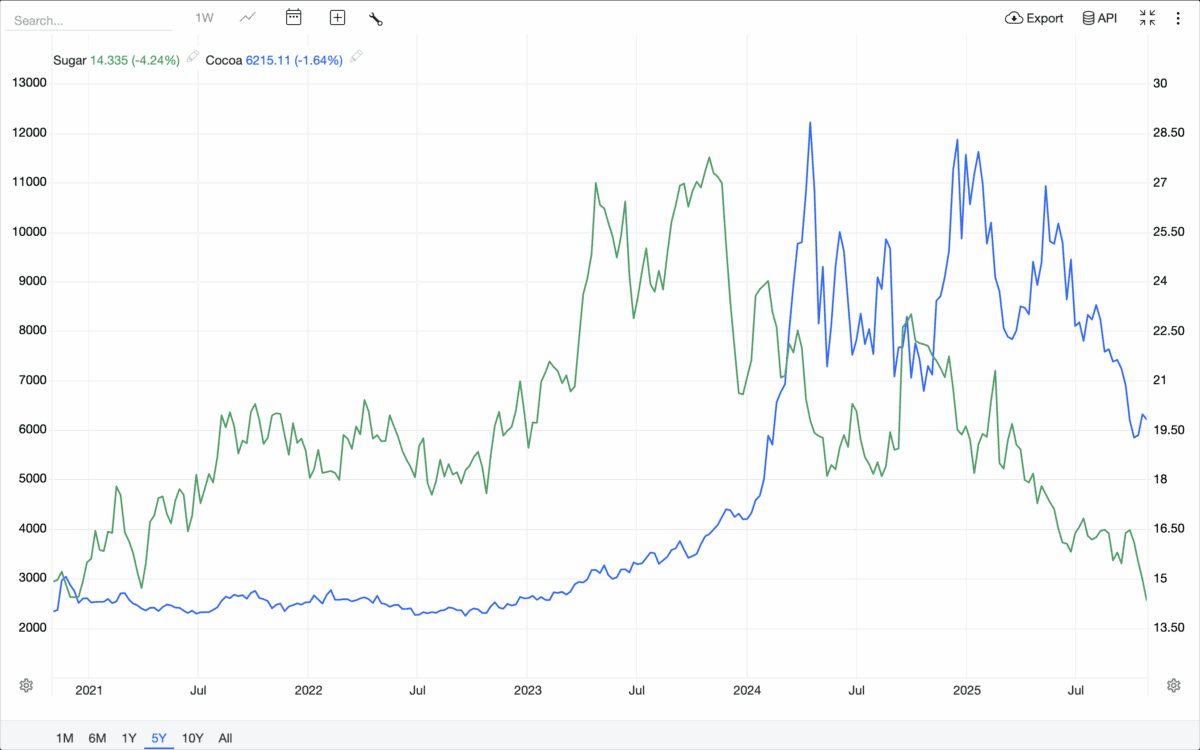

The firm has been battling increased input costs in the form of cocoa and sugar prices and this is a key reason the stock has faltered. But there are signs that things are turning around.

Commodity prices

Since the start of 2025, cocoa prices have fallen by 50% and sugar has reached its lowest level in five years. That should give MondelÄz a boost in terms of its future margins.

Source: Trading Economics

This isnât the only challenge facing the company â the rise of GLP-1 drugs is a potential threat to demand. And this is another reason the stock has underperformed over the last few years.

MondelÄz, however, has a strategy for dealing with this. Rather than changing recipes, itâs looking to reduce the size of its products to make them accessible to users of the drug.

The stock market seems suspicious, but with only 25% of the firmâs sales coming from the US, CEO Dirk van de Put thinks the likely hit to sales is around 1.5% by 2030. And thatâs not a lot.

Finding investment opportunities

I think thereâs a good case to be made for MondelÄz as a stock to consider buying right now. But that has pretty much nothing to do with the fact itâs November.

What it comes down to is the fact the companyâs share price hasnât really moved despite some big declines in its input costs. Thatâs why I think thereâs a potential opportunity to check out.

The post Historically, November tends to be a good month to buy stocks appeared first on The Motley Fool UK.

Should you invest £1,000 in Mondelez International, Inc. right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Mondelez International, Inc. made the list?

More reading

- Is Lloyds’ share price the FTSE 100’s worst value trap?

- Should I buy Unilever shares before the stock goes ex-dividend on Thursday?

- Prediction: I think this stock can rise 500% by 2035

- Up 90% in a year, can Tesla stock keep on going?

- How much do you need in a SIPP to aim for a £37,430 pension income?

Stephen Wright has positions in Mondelez International. The Motley Fool UK has recommended Fresnillo Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.