How much do you need in an ISA to aim for a weekly passive income of £231?

Passive income could be your ticket to a retirement beyond the measly State Pension amount of £231. With compounding on your side, even modest ISA savings, built steadily over time, could generate a reliable income to top up your retirement income.

Crunching the numbers

If you want £924 a month in todayâs money when you retire, inflation means youâll need more than that in the future. Assuming 3% annual inflation, in 25 years the same purchasing power would require around £23,200 a year.

Using the 4% withdrawal rule, a pension pot of roughly £580,000 would be needed to generate that income.

Letâs assume an individual has a 25-year investment horizon and will increase their yearly ISA contributions according to the table below.

| Tiered years | Yearly ISA contribution |

| 1-5 | £5,000 |

| 6-10 | £10,000 |

| 11-15 | £15,000 |

| 16-25 | £20,000 |

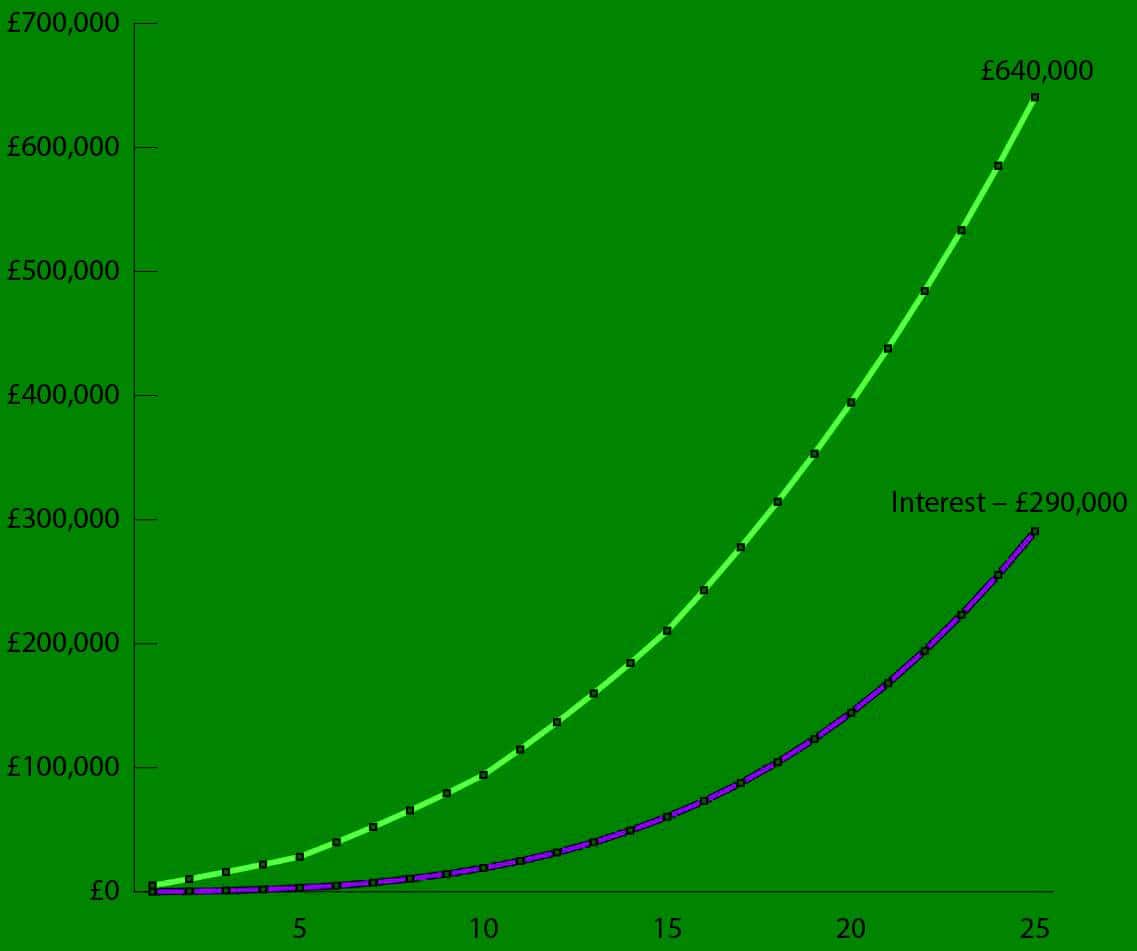

The following chart models these contributions, assuming a modest 6% annual return. As shown, the individual not only surpasses their target but also demonstrates the power of compounding, which alone contributes around 45% of the final total.

Chart generated by author

In order to reach that sizeable pot size, my preferred choice is a blend of both growth and dividend shares. One stock in the latter category that I think investors should consider is Legal & General (LSE: LGEN). Its trailing dividend yield is 9.2%, comfortably ahead of the 6% target.

Dividend sustainability

Over the past 10 years total shareholder returns have amounted to 83%. But of course itâs the future that matters.

Dividend cover currently stands at 0.94, meaning that earnings donât fully cover the payout. That naturally raises questions for an income stock.

For insurers, cash dividend cover is usually the real safety net. Even when profits fluctuate, steady operating cash flows from premiums and investment income normally back up the dividend.

But last year was an exception. The company reported negative operating cash flow of £4.4bn, leaving no cash cover for the payout. On the face of it, that looks like a flashing warning light.

Why I still think the dividend is safe

Despite that, I think the risk of a cut still looks low. Thatâs because what really underpins insurer dividends isnât short-term cash flow â itâs the capital the business reliably produces to fund both distributions and growth. It’s measured as Solvency II operational surplus generation (OSG).

OSG is expected to rise around 5% in 2025, comfortably above the planned 2% increase in dividends per share.

The forthcoming £1bn share buyback adds further support. By reducing the share count, it cuts the annual dividend bill by roughly £100m, further bolstering OSG.

Bottom line

Iâve long held Legal & General shares in my Stocks and Shares ISA for their reliable, market-beating dividends.

Last year was challenging, yet the company still grew the cash cost of its dividend. Its long-term growth drivers remain solid.

The real engine is pension risk transfer. Trustees rely on the insurer to derisk final salary schemes; a highly lucrative, expanding market with a total addressable market set to hit £1trn over the next decade. This combination of reliability and growth could make the shares a solid source of passive income for patient investors.

The post How much do you need in an ISA to aim for a weekly passive income of £231? appeared first on The Motley Fool UK.

Should you invest £1,000 in Legal & General Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Legal & General Group Plc made the list?

More reading

- Buying 4,655 shares in this ultra-high-yield FTSE 100 income stock can give me £1k a year

- I asked ChatGPT for a 5-stock FTSE 100 portfolio to help me retire early. This is what it said…

- Legal & General shares yield an eye-popping 8.7% â now check out its 1-year growth forecast!

- Here’s why Legal & General’s share price is a beautiful bargain!

- £5,000 buys 2,065 shares in this FTSE 100 passive income monster

Andrew Mackie has positions in Legal & General Group Plc. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.