I asked ChatGPT to build the perfect passive income portfolio. It said…

ChatGPT has revolutionised how we do many things, but can it give me the edge in building passive income?

I gave it a specific task: “Build me the perfect passive income portfolio.” It came up with some interesting ideas. But the AI also threw up some stuff that made me question the wisdom of its selections.

Focus on dividend ETFs

Here’s the “diversified, resilient, and low-maintenance” portfolio that ChatGPT gave me:

| Asset class | Allocation | Expected role |

|---|---|---|

| Global dividend ETFs | 40% | Broad, diversified income with long-term dividend growth. |

| REITs | 20% | Property income without being a landlord; inflation hedge. |

| Investment-grade bonds | 20% | Stability and predictable interest income. |

| High-yield bonds/emerging market debt | 10% | Boosts yield, and balances things out

with safer bonds. |

| Infrastructure/utilities | 10% | Extremely stable, defensive dividends

(pipelines, grids). |

The AI model didn’t lean heavily on purchasing individual shares, which was disappointing (more on this later). But it did provide some food for thought.

ChatGPT described its 40% allocation to dividend exchange-traded funds (ETFs) as “the core engine of the portfolio.” It provides “instant diversification across thousands of companies,” the AI said, and dividends that could grow “3% to 7% yearly.“

Good ideas, I thought. ETFs that hold many stocks can still deliver solid returns even if one or two shares disappoint. Dividend growth is also important to help offset rising inflation.

Its other suggestions

In including real estate investment trusts (REITs), ChatGPT said that I could benefit “inflation-linked rents” and “historically some of the highest risk-adjusted income.”

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Investment-grade bonds, meanwhile, provide “low volatility [and] predictable coupons.” The higher-risk, higher-yield bonds and emerging market debt it discusses deliver “greater payouts to boost your total yield,” the AI said.

It rounded things off with infrastructure and utilities companies, praising the “stable cash flows from their essential services.”

Black hole

Those are worthwhile ideas, in my view. Yet as an experienced dividend investor, I noticed a massive problem ChatGPT’s suggestions.

By not including more individual dividend shares, the AI’s portfolio could leave investors at the mercy of mediocre returns. Indeed, it said a portfolio like this would yield only 4% to 6% annually.

I hold ETFs in my own portfolio for diversification to lower risk picks. But I also own a wide range of standalone stocks to help me achieve market-beating returns.

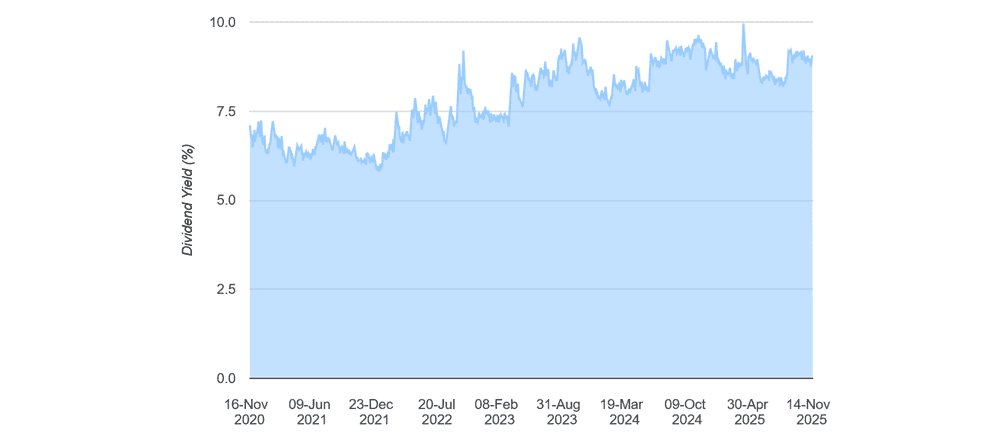

Legal & General (LSE:LGEN) is one I actually own. In fact, it’s the single largest holding in my portfolio. As the chart shows, it’s long-term dividend yield is well above the 4% to 6% that ChatGPT’ said its portfolio may provide:

It’s a record analysts expect to continue. For 2025 and 2026, Legal & General shares deliver dividend yields of 9.1% and 9.4% respectively. This makes it potentially the best-paying passive income stock on the FTSE 100.

The company’s excellent long-term dividend record reflects its excellent cash generation and limited growth opportunities. Combined, these mean the board is committed to prioritising cash rewards for investors.

Legal & General’s cyclical operations mean its share price can struggle during downturns. Yet that strong balance sheet means such events don’t impact its ability to keep paying large dividends. Today, its Solvency II capital ratio is a robust 217%.

ChatGPT has its uses. But as I’ve shown, using it to advise on passive income generation could end up costing investors a packet. When it comes to investing I prefer the human touch.

The post I asked ChatGPT to build the perfect passive income portfolio. It said⦠appeared first on The Motley Fool UK.

Should you invest £1,000 in Legal & General Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Legal & General Group Plc made the list?

More reading

- Got a spare £100 a month? If so, here’s a way to target £10k in passive income

- How much do you need in an ISA to aim for a weekly passive income of £231?

- Buying 4,655 shares in this ultra-high-yield FTSE 100 income stock can give me £1k a year

- I asked ChatGPT for a 5-stock FTSE 100 portfolio to help me retire early. This is what it said…

- Legal & General shares yield an eye-popping 8.7% â now check out its 1-year growth forecast!

Royston Wild has positions in Legal & General Group Plc. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.