Here’s how much money you need in an ISA to target £628 of passive income per week

Everyone wishes they had a passive income stream that just rolls in. To earn £628 a week â about £32,650 a year â at a 5% yield, an investor would need roughly £653,000 inside a Stocks and Shares ISA.

The advantage is that every penny of that income is tax-free. No dividend tax, no capital gains, no paperwork â just clean, sheltered returns.

Hitting the number is purely arithmetic, but sheltering it in an ISA is what makes the income usable. Inside the wrapper, those dividends can flow straight into an investorâs pocket without HMRC taking a cut.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Building the portfolio

Reaching a £653,000 ISA isnât about heroic stock-picking; itâs about steady compounding. Regular monthly contributions, reinvested dividends, and a long time horizon do the heavy lifting.

A balanced mix of stocks, bonds, investment trusts, and low-cost equity funds provides diversification and stability.

It’s also about avoiding pitfalls. This means avoiding concentration risk and trimming positions that become overstretched to keep the portfolio healthy.

With patience and consistent contributions, the pot can scale up far faster than expected â especially when reinvested income starts compounding on itself.

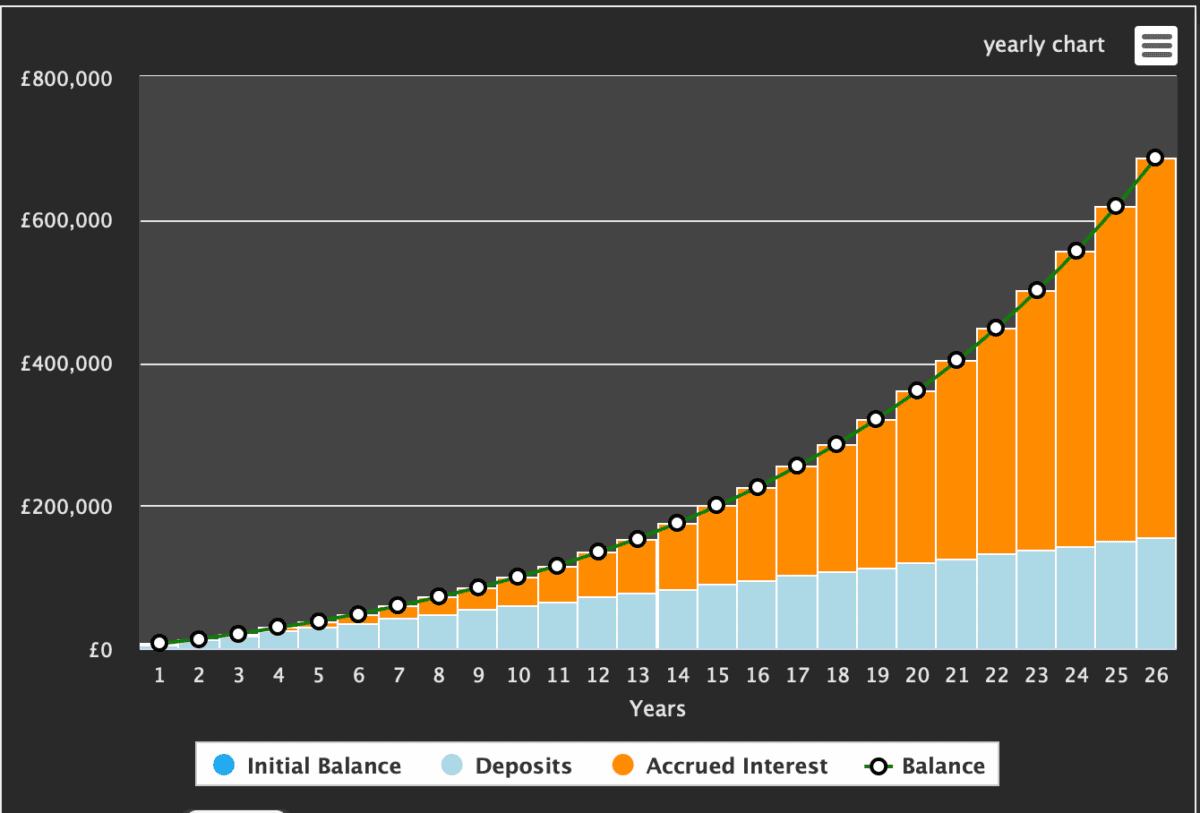

Over the past decade, the average Stocks and Shares ISA has generated returns of roughly 9.6% a year. So, let’s imagine an investor puts in £500 per month and achieves that same growth, but this time over 26 years. Well, at the end of the period they’d have £688,372.

It’s all great in theory

On paper, this all sounds great. Simple investments and strong returns. But poor investment decisions can result in losses.

So, where to invest?

Well, it might be a good time to consider investing in UK banking minnow Arbuthnot (LSE:ARBB). The most off-putting aspect here is the spread between the buying and selling price, which as I write, is sitting around 4%.

It’s also important to note that the upcoming Budget does introduce a level of uncertainty, and new loan issuance is falling.

Despite this, I believe the business looks really strong. Arbuthnot had an impressive Q3, with customer deposits up 17% year on year to £4.4bn. Its wealth arm also grew, with funds under management rising 5% to £2.5bn after £88m of quarterly inflows. Net inflows for the year now total £191m, which management described as âstrongâ across both divisions.

For me, however, it’s the valuation data that stands out. It trades at 7.9 times forward earnings. This is much cheaper than its peers. The dividend yield is also an impressive 6%. What’s more, earnings are projected to grow 20% in 2026 and the dividends with it.

With that in mind, I certainly believe it’s worth considering as a long-term alternative to the major high-street banks. Analysts agree, with the average share price target being 80% above the current share price.

The post Here’s how much money you need in an ISA to target £628 of passive income per week appeared first on The Motley Fool UK.

Should you invest £1,000 in Arbuthnot Banking Group PLC right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Arbuthnot Banking Group PLC made the list?

More reading

- I asked ChatGPT to describe the perfect passive income stock. Here’s what it said…

- As the Lloyds share price skyrockets, what are the alternatives?

- Up to 79% returns! Analysts say these are some of the cheapest UK shares

- Investing for a second income? This overlooked bank offers a 6% dividend yield

James Fox has positions in Arbuthnot Banking Group Plc. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.