3 reasons why the BAE share price could soar 20% to £20.55

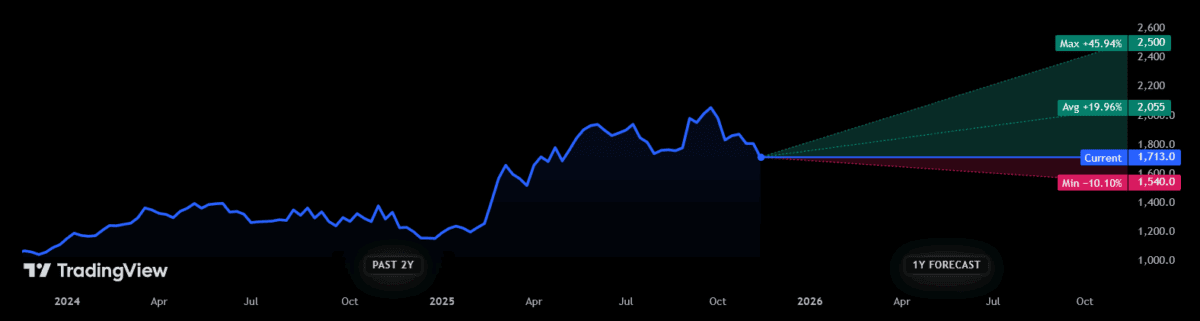

The BAE Systems (LSE:BA.) share price has lost power since rocketing to record highs in early October. Since hitting its peak of £20.73 per share, the global defence giant has backpeddled sharply. It was last changing hands at £17.13.

But City analysts reckon this is a mere hiccup before the FTSE 100 stock soars again. Currently, 12 different brokers have ratings on BAE shares, providing a decent range of opinions.

The average 12-month share price forecast among this grouping is £20.55 per share. That would represent a 20% rise from current levels. But how realistic are current estimates?

Here are three reasons why I believe BAE’s share price could spring higher.

1. Strong defence spending

Perhaps the most obvious driver is the probability of strong and sustained spending from key NATO clients. Some uncertainty persists as the US pushes for a peace deal in Ukraine. A break in hostilities (however welcome from a humanitarian perspective) could have an obvious impact on weapons demand.

Even so, Iâm betting defence orders will keep roaring higher. NATO countries — especially in Europe — are on alert for further Russian expanisionism after its invasion of Ukraine. Elsewhere, there’s also tension over Chinese foreign policy, along with the prospect of fresh volatility in the Middle East.

NATO countries have pledged to spend 5% of their GDPs on their core defence capabilities by 2035. That’s more than double today’s levels and Tier 1 suppliers like BAE are in the box seat to capitalise on this market boom.

2. Leader across markets

BAE’s near-record order book underlines its critical role in the defence industry. The company’s a lead contractor across multiple defence programmes, including the Eurofighter jet project where orders are expected to accelerate.

Analysts at Panmure Liberum have said Eurofighter “could be the driver of Air Systemsâ revenue and profits growth for at least the remainder of the decade“.

The company not only has an excellent track record of developing cutting-edge tech, but its expertise spans a multitude of markets, which also puts it in pole position in growth markets like cybersecurity and submarine building.

I’m expecting the contracts to keep flowing in, pushing BAE’s share price higher. It’s sealed more than $27bn worth of business so far in 2025, including a deal last week to sell 44 extra CV90 infantry fighting vehicles to Denmark.

3. BAE shares are cheap

Viewed from an historical perspective, BAE shares don’t exactly stand out as a potential bargain. Today, its forward price-to-earnings (P/E) ratio is 22.9 times. That towers above the 10-year average of 14.1.

A valuation like this could leave the shares exposed if the news flow starts to sour.

Yet compared with the broader sector, the company actually look pretty cheap and worth considering. This could make it a prime target for value investors seeking top defence stocks, pushing its share price higher. The wider global defence sector trades on a far higher P/E ratio of around 35 times.

The post 3 reasons why the BAE share price could soar 20% to £20.55 appeared first on The Motley Fool UK.

Should you invest £1,000 in BAE Systems right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if BAE Systems made the list?

More reading

- 3 top UK shares to consider buying if the stock market melts down

- What will happen to the UK stock market in 2026? Here’s what experts think

- Prediction: in 12 months Babcock, BAE Systems shares and Rolls-Royce could turn £10,000 intoâ¦

- The BAE share price is tipped to blast through £21! Can it?

- BAE Systems or Rolls-Royce? Hereâs the Cityâs share price verdictÂ

Royston Wild has no position in any of the shares mentioned. The Motley Fool UK has recommended BAE Systems. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.