SIPP growth made simple: build for retirement with FTSE 100 dividend shares

A SIPP is one of the most powerful ways to build a retirement pot. For a basic-rate taxpayer, every £800 you contribute is boosted to £1,000 thanks to 25% tax relief. Combine this with reinvested dividends and long-term market growth, and even modest contributions can snowball over time.

In yesterdayâs (26 November) Budget, the government confirmed that from 2029 the existing ability to save National Insurance by paying into a SIPP will be significantly scaled back. From that point, only the first £2,000 of salary sacrificed into a SIPP each year will qualify for NI relief. Anything above that threshold will no longer generate additional NI savings, although the usual 25% tax relief on pension contributions still applies.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

My top-paying dividend stocks

The following table shows my top five dividend payers.

| Stock | Price-to-earnings (P/E) â trailing 12 months | Trailing dividend yield |

| Aviva | 27 | 5.5% |

| BP (LSE: BP.) | 251 | 5.2% |

| HSBC | 11 | 4.7% |

| Legal & General (LSE: LGEN) | 84 | 8.8% |

| Shell | 14 | 3.8% |

Among the FTSE 100 options in my SIPP, each offers a solid, recurring income stream. And while Legal & Generalâs yield happens to be the highest, what really counts is the reliability of these payouts. Reinvested over time, steady dividends like these can quietly compound into meaningful long-term growth.

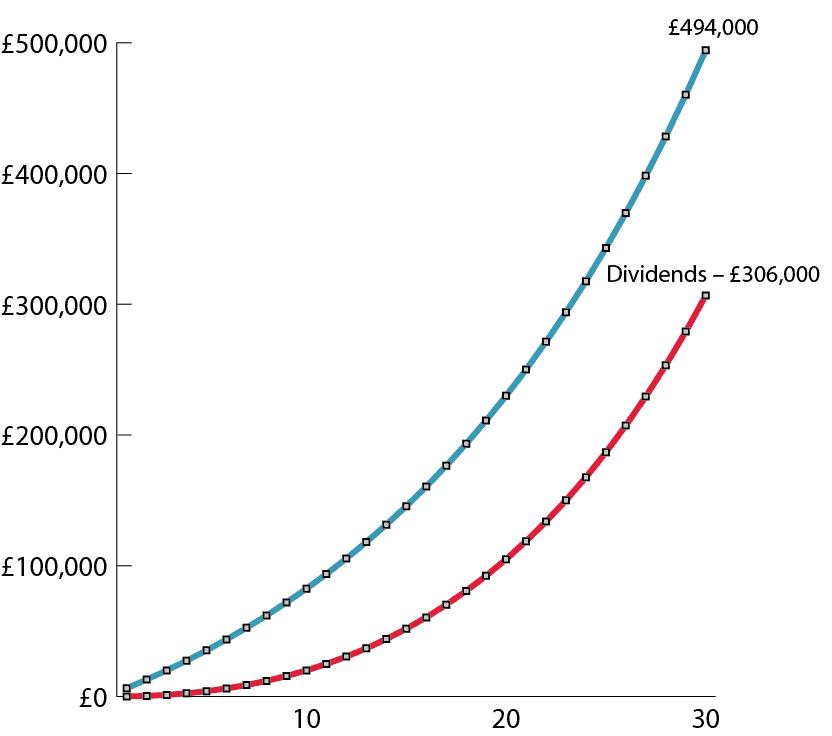

Chart generated by author

As the chart illustrates, consistently contributing £5,000 a year, boosted to £6,250 with tax relief, can really add up. Even at a modest 6% growth, compounding turns these steady contributions into nearly £230,000 over 20 years and almost £500,000 over 30. Thatâs a simple way to aim for regular saving and reinvested dividends to build a substantial retirement pot.

Misleading metrics

Some of the FTSE 100 stocks in my SIPP may look intimidating if you glance only at the headline P/E ratios.

Take BP, for example. Its reported P/E can appear enormous, but thatâs mostly due to accounting swings in reported earnings. What really matters is that its dividend is comfortably covered by cash, with a cash cover of 5.46, underpinned by strong underlying profits.

Legal & General can also show a sky-high P/E, yet it consistently generates a strong operating surplus, comfortably covering its 8.8% dividend.

In both cases, the headline metrics can be misleading. Steady cash generation and reliable dividends are the real story in my SIPP.

Risks

Both BP and Legal & General come with risks investors should be aware of.

BPâs profits and dividends depend heavily on oil and gas prices, which can swing dramatically with global markets. Regulatory changes and the shift toward renewables could also affect long-term returns.

Legal & General faces financial and market risks, including interest rate changes, investment performance, and insurance liabilities that can affect profits.

While both companies pay reliable dividends, investors need to remember that yields arenât guaranteed, and market conditions or business challenges could cause payouts to fluctuate.

Bottom line

The bottom line for BP is that its pivot back to oil positions it to benefit from growing global energy demand.

For Legal & General, growth in pension risk transfer, linked to final salary pension schemes, is its engine of growth. In addition, individuals are becoming increasingly aware of the need to take personal ownership in building a retirement nest egg.

Both companies show how steady dividend payers can thrive in their respective markets, driven by structural trends rather than short-term earnings swings. These are exactly the reasons I hold them in my SIPP: reliable cash flows and dividends supported by long-term trends.

The post SIPP growth made simple: build for retirement with FTSE 100 dividend shares appeared first on The Motley Fool UK.

Should you invest £1,000 in BP p.l.c. right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if BP p.l.c. made the list?

More reading

- Legal & General shares offer one thing no other FTSE 100 stock does â can it last?

- Itâs possible to build a 5-figure second income investing under £100 a week. Hereâs how!

- 2 dividend shares that could benefit after today’s Autumn Budget

- 5 potential problems with building passive income

- I asked ChatGPT to build me the perfect SIPP and it suggestedâ¦.

Andrew Mackie has positions in Bp P.l.c. and Legal & General Group Plc. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.