£5,000 invested in Rolls-Royce shares at the start of 2025 is now worth…

It’s no secret that Rolls-Royce (LSE:RR.) shares have been a phenomenal investment in recent years. And even in 2025, its stellar momentum has continued delivering over a 77% share price return.

That means anyone who jumped aboard at the start of the year with £5,000 now has £8,850. And yet, looking at the latest analyst forecasts, even more explosive growth could be just around the corner.

So just how much money could investors make by this time next year?

Exploring forecasts

As one of the most popular stocks in Britain, Rolls-Royce is followed by a long list of institutional investors. That includes UBS, which currently has one of the most aggressive 12-month share price projections for this business.

Looking at their investment thesis, the UBS analyst team has highlighted several key factors behind their bullish stance. This includes ongoing operational improvements, the subsequent expansion of profit margins, and growth in both the civil and defence aerospace markets.

With a continued record backlog of civil aircraft, demand for Rolls-Royce’s engines is on the rise. But the real money maker is its aftermarket services. With supply chain disruptions slowing the aircraft manufacturing process and elevated interest rates making debt expensive, airlines are delaying the retirement of their existing fleets.

Combining this with increased air travel, the need for more regular engine maintenance and inspection is translating into some handsome cash flows for Rolls-Royce. And that’s before considering the extra tailwinds from higher European defence spending and rising demand for its Power Systems division as well.

As such, the group remains on track to deliver up to £3.2bn in underlying profits, £3.1bn of which is expected to be free cash flow. That represents a 28% and 29% year-on-year increase respectively. So with that in mind, it’s not surprising to see Rolls-Royce shares massively outperform in 2025.

What to watch

Other analyst teams have cited similar bullish stances. And while there is a mix of opinions regarding share price targets, the overall tone continues to be bullish, with 14 out of 19 experts recommending Rolls-Royce as a Buy or Outperform.

Having said that, even investors as bullish as UBS have highlighted some critical risks to consider. A global economic slowdown from tariffs or stubborn inflationary forces could prove disruptive. With the bulk of profits coming from the civil aerospace sector, any reduction in air travel doesn’t bode well for aftermarket services.

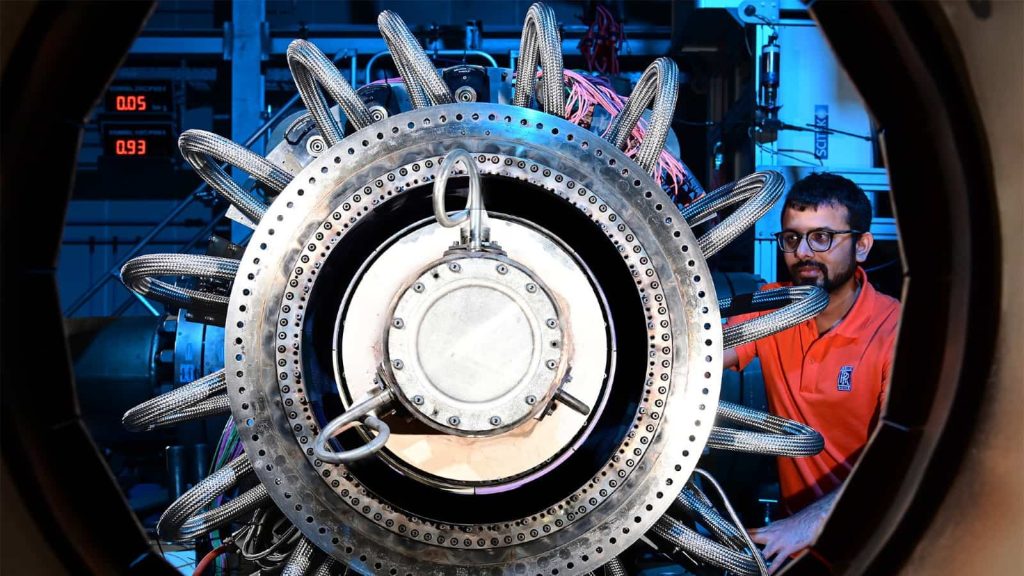

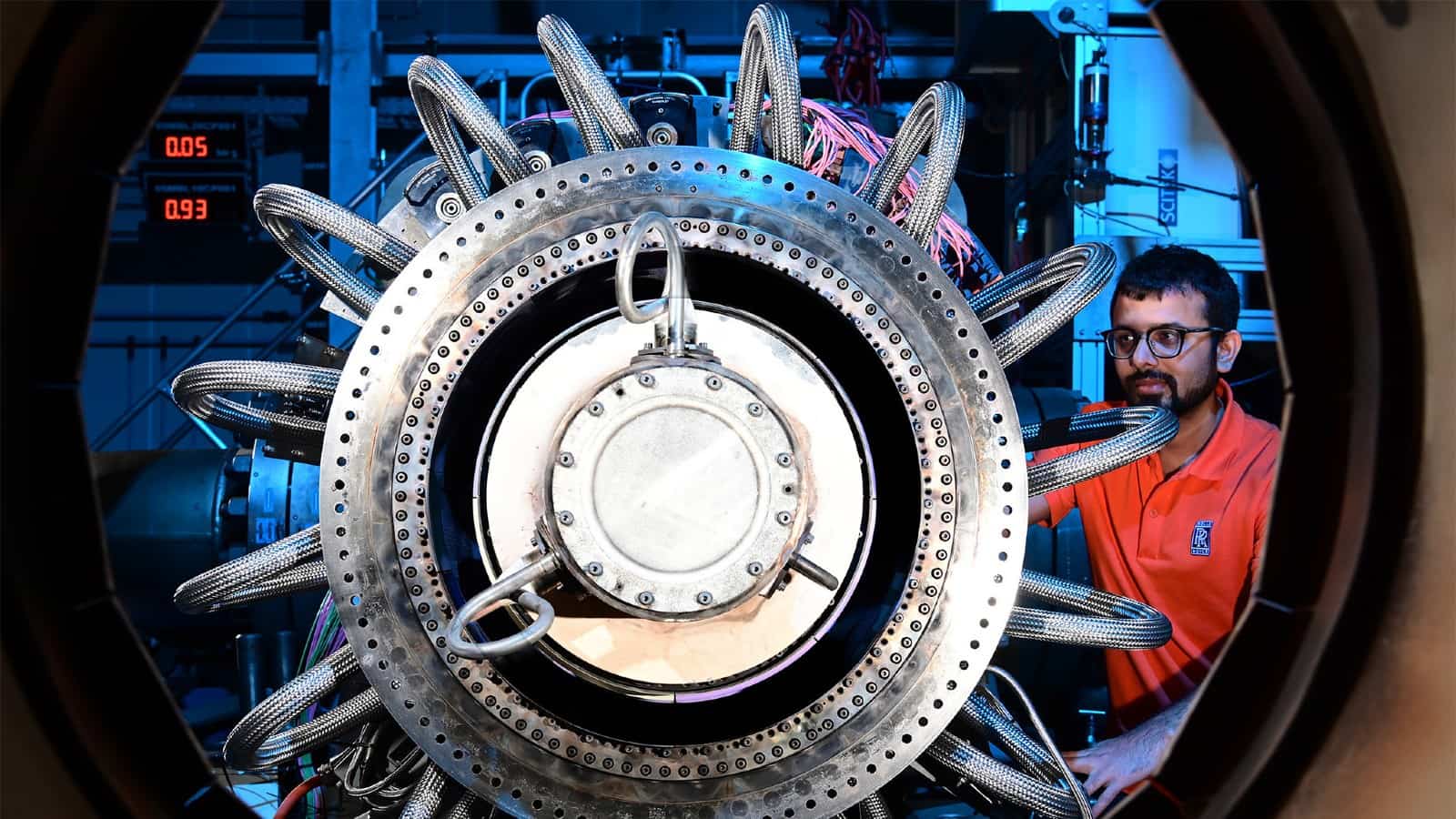

Even if this cyclical market remains strong, there’s also a question mark over the group’s R&D spending. Rolls-Royce is making some big bets on its small modular reactor (SMR) technology. And to management’s credit, things seem to be moving in the right direction with the group being selected as the preferred provider by the government.

However, this market’s much larger than just the UK. Rolls-Royce is already making steps to penetrate the US, where competition within the SMR space is significantly fiercer. If the firm can’t capitalise on international opportunities, long-term growth could fall short of current expectations, resulting in share price volatility.

Nevertheless, underestimating Rolls-Royce has proven to be a costly mistake. And while the share price projections aren’t guarantees, I think it’s smart to investigate Rolls-Royce’s potential even further. But it’s not the only FTSE 100 aerospace enterprise on my radar today.

The post £5,000 invested in Rolls-Royce shares at the start of 2025 is now worth… appeared first on The Motley Fool UK.

Should you invest £1,000 in Rolls-Royce Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Rolls-Royce Plc made the list?

More reading

- Meet the growth stocks tipped to outshine Rolls-Royce’s share price!

- The risks are rocketing for Rolls-Royce shares â time to bank that profit?

- Down 12% in weeks, has the Rolls-Royce share price started a downwards slide?

- How on earth are Rolls-Royce shares up 1,556% since 2022?

- £20,000 invested in Rolls-Royce shares 5 years ago is now worth £220,000! What’s next?

Zaven Boyrazian has no position in any of the shares mentioned. The Motley Fool UK has recommended Rolls-Royce Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.