1 top FTSE 100 share I keep buying for my kid’s ISA

My daughter is too young to care about FTSE 100 shares or ISA portfolios. She cares about having fun at gymnastics, spending Robux on Roblox, and getting a hamster for Christmas.

However, I obviously care about her financial future, which is why I opened a Junior Stocks and Shares ISA earlier this year. This is a tax-efficient way to help her in future, as only she can access it upon turning 18.

Before then, I will build it on her behalf. Here’s the FTSE 100 stock I keep buying for this Junior ISA.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Looking to the 2030s

My daughter is still a decade away from becoming a young adult. But by 2035, I think advanced technology will be ubiquitous, like the internet is today. Particularly AI, self-driving cars, flying taxis, and possibly even quantum computing and humanoid robots.

Another industry I expect to be a lot larger by the mid-2030s is space. Companies like SpaceX and Blue Origin are making great progress towards space travel becoming a reality. Against all the odds, both have pioneered reusable rockets, bringing launch costs down massively.

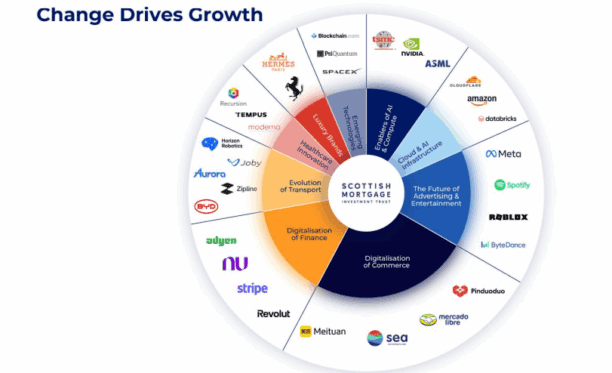

This is why I continue to add shares of Scottish Mortgage Investment Trust (LSE:SMT) to this special ISA. The managers have built a powerful portfolio of growth companies that are literally building the future.

AI exposure? Absolutely. The investment trust holds shares of Nvidia, Amazon, leading chip foundry TSMC, and data analytics firms Snowflake and Databricks. It has also just taken a stake in Anthropic, a company that’s “building the next generation of AI“.

Self driving tech? Also covered. Tesla, Nuro, Aurora Innovation, and Amazon give it tons of exposure here. It also has holdings in Joby Aviation, which is leading the charge to commercialise flying electric taxis, and quantum computing start-up PsiQuantum.

Oh, and that futuristic space travel industry? Scottish Mortgage’s top holding is SpaceX, the undisputed global leader in rockets and space-related innovation.

Ups and downs

Now, I don’t expect this stock to ascend smoothly and silently like a flying electric taxi. There will be many ups and downs along the way, including the odd brutal sell-off in tech shares (an unavoidable risk with Scottish Mortgage).

The trust also has stakes in Chinese firms such as TikTok owner ByteDance, EV giant BYD, and CATL (the world’s largest electric vehicle (EV) battery maker). But US-China geopolitical tensions could escalate in future, while global recessions and currency swings might negatively impact the trust (it owns mainly overseas stocks, priced in foreign currencies).

Fortunately, Scottish Mortgage’s professional managers will do all the long-term stock-picking on my daughter’s behalf. So she won’t have to worry about any of this volatility.

Buying shares opportunistically

With the shares down nearly 10% since October, I intend to buy some more in the Junior ISA soon. Especially while the trust trades at a near-13% discount to its underlying net asset value.

However, as bullish as I am on this stock long term, and think it’s worth considering today, I won’t go all-in. I’ll add other shares to the ISA opportunistically in 2026 and beyond, building a high-quality mix.

After all, this portfolio is for my daughterâs future — and I want it growing steadily for years to come.

The post 1 top FTSE 100 share I keep buying for my kidâs ISA appeared first on The Motley Fool UK.

Should you invest £1,000 in Scottish Mortgage Investment Trust PLC right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Scottish Mortgage Investment Trust PLC made the list?

More reading

- 2 FTSE shares I’m considering buying using my SIPP’s tax relief

- This FTSE 100 stock isn’t the highest-yielding on the index, but it’s been one of the most reliable dividend payers

- Could these FTSE 100 bargain shares bounce back in December?

- 3 exceptional investment trusts that could boost the returns of a Stocks and Shares ISA

- 3 FTSE 100 shares to target a 19% annual return

Ben McPoland has positions in Joby Aviation, Nvidia, Roblox, Scottish Mortgage Investment Trust Plc, and Taiwan Semiconductor Manufacturing. The Motley Fool UK has recommended Amazon, Nvidia, Roblox, Snowflake, Taiwan Semiconductor Manufacturing, and Tesla. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.