2 FTSE 100 stocks to target epic share price gains in 2026!

FTSE 100 stocks have (largely) come out swinging in 2025. Up 17%, the UK’s premier share index has benefitted from resilient earnings, falling inflation, and growing demand for cheap shares.

With all of these catalysts still in play, 2026 could be another year of titanic share price gains. Naturally some blue-chip stocks are likely to perform much better than others.

Barratt Redrow (LSE:BTRW) and Antofagasta (LSE:ANTO) are two FTSE shares I think could take off next year. Wanna know why?

Home run?

Investors still doubt the housing market’s underlying strength, but I think theyâll come around. And when they do, I think housebuilder shares could detonate.

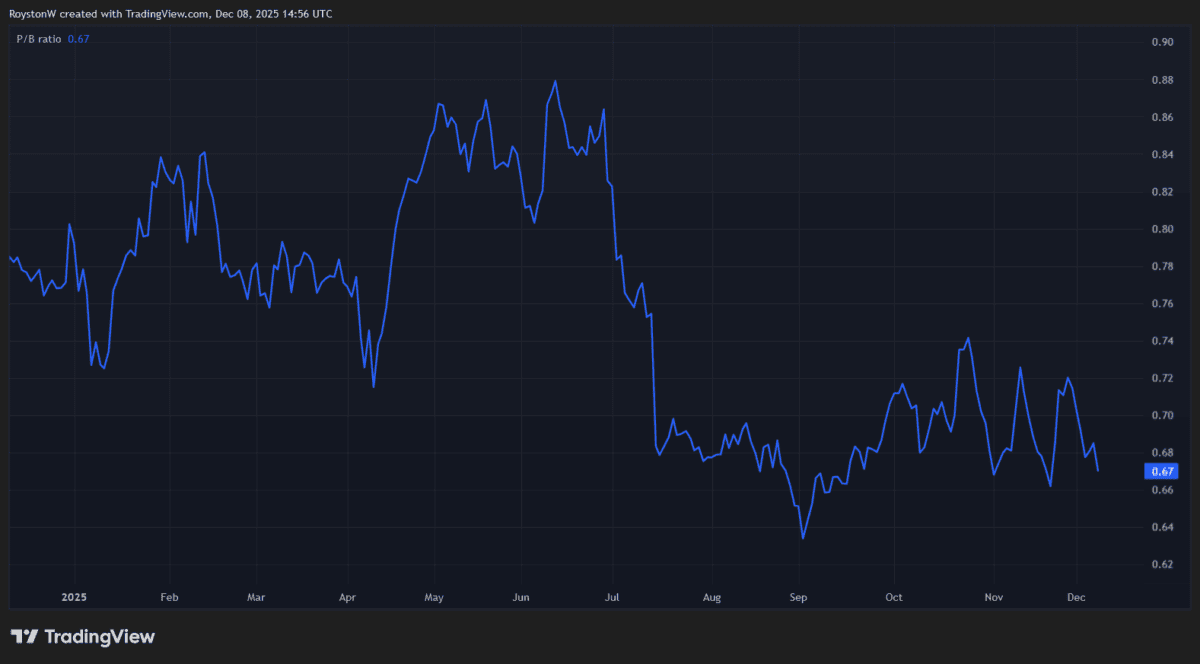

Barratt Redrow is one I think could rebound owing to its rock-bottom valuation. The UK’s largest housebuilder has tumbled 15% in value since 1 January, leaving it trading on a price-to-book (P/B) ratio of 0.7. Any reading below one shows a stock trading below the value of its assets.

Housebuilders are among the most economically sensitive shares out there. So on one hand, it’s understandable that Barratt’s dropped sharply since mid-summer — economic forecasts for the UK haven’t exactly been brimming with confidence.

Yet Barratt’s valuation still looks far too low to me. And as I said at the top, the homes market remains pretty sturdy despite weak economic conditions.

Can the market keep up the momentum though? I think it can, as lending conditions steadily improve. Average rates on two- and five-year mortgages are now at their lowest rate since Liz Truss’ disastrous mini-Budget in 2022, according to Moneyfacts.

This reflects an increasingly bloody rate war among Britain’s lenders. With the Bank of England tipped to keep lowering rates next year, too, I think things will keep getting better for homebuyers.

Barratt’s rock-bottom valuation could attract serious dip-buying interest in this scenario, driving its share price higher.

Getting started?

Antofagasta’s share price has headed in a very different direction in 2025. It’s up a mammoth 84% since 1 January. I think it could just be getting started.

I’m not expecting it to attract attention from bargain hunters like Barratt’s shares. It trades on an high price-to-earnings (P/E) ratio of 31.5 times. But the copper miner could still stride higher as prices of the industrial metal balloon.

Copper is up 32% in the year to date as shrinking supplies have sparked panic buying. With the US stockpiling metal, mine disruptions ongoing, and demand from data centres and the renewable energy sectors booming, 2026 could be another strong year for the red metal.

Citi analysts think prices could hit $14,000 a tonne next year. They were last around $11,600.

I like the idea of buying copper stocks to capitalise on this opportunity. As Antofagasta’s share price action shows, they can rise more sharply in value during bull markets than the metal itself. This reflects the ‘leverage’ effect, where revenues balloon while costs remain unchanged. It’s a blend that can supercharge profits.

There are risks though. Fresh trade tensions and other economic shocks could damage copper demand and therefore prices. Antofagasta is also at risk of profits-sapping production stops, a constant risk for mining companies.

Yet on balance, I think it’s a top FTSE 100 stock — like Barratt — to target large returns next year.

The post 2 FTSE 100 stocks to target epic share price gains in 2026! appeared first on The Motley Fool UK.

Should you invest £1,000 in Antofagasta plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Antofagasta plc made the list?

More reading

- 3 FTSE 100 and FTSE 250 shares to consider after the Autumn Budget!

- 3 FTSE 100 shares that might surge after a December rates cut

Royston Wild has positions in Barratt Redrow. The Motley Fool UK has recommended Barratt Redrow. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.