How large would an ISA pot need to be to aim for £1,333 a month in passive income in 2026?

The Autumn Budgetâs changes to the Cash ISA limit mean anyone thinking about passive income may need to rethink their strategy. I ran the numbers to see how big an ISA pot someone would need to target a £16,000 yearly income â thatâs £1,333 a month. Could this be achievable with a typical savings plan?

Crunching the numbers

Using the classic 4% rule, an ISA pot of around £400,000 could hypothetically generate £16,000 a year in passive income â a useful benchmark for thinking about the size of the pot needed.

So how much might someone need to contribute to their Stocks and Shares ISA to reach that level?

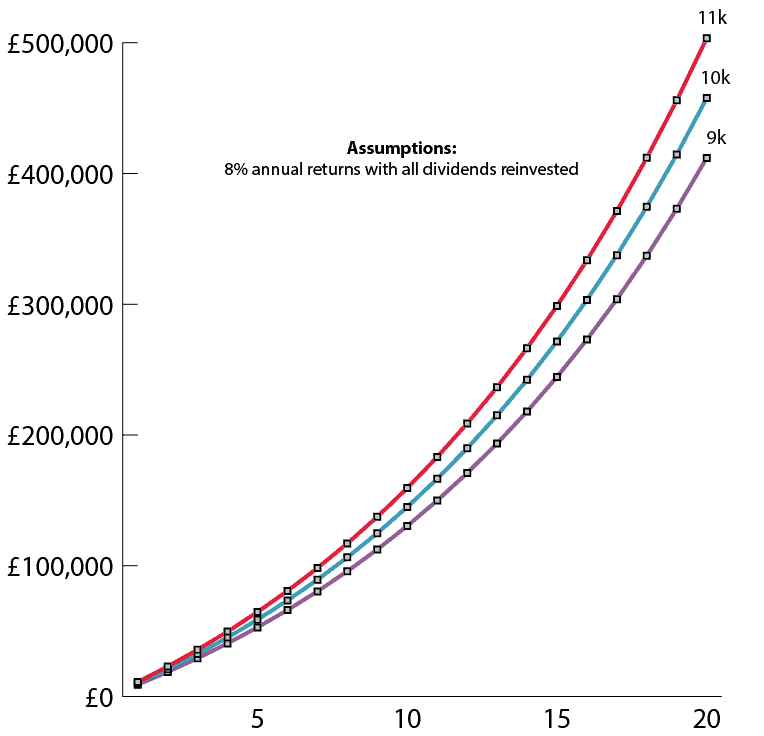

Most people wonât invest the same amount every year, so I modelled three simple scenarios in the chart below. With fixed annual contributions of £9,000-£11,000 over 20 years, reinvested dividends, and an 8% return, the projected ISA balances are:

| Annual contribution | £11,000 | £10,000 | £9,000 |

| Projected pot | £503,000 | £457,000 | £411,000 |

Chart generated by author

Blended portfolio

Reaching a target ISA pot isnât just about dividends. Growth matters too â compounding over time can make a huge difference. A mix of dividend-paying and growth-oriented stocks can help a portfolio aim for an average annual return around 6â8%, which is what the earlier scenarios assumed.

For me, one of my favourite growth stocks right now is Fresnillo (LSE: FRES). The Mexican miner has surged alongside silverâs explosive rally, a move that has left gold and the Magnificent 7 stocks far behind.

Commentators have predicted a pullback for months, yet the shares keep powering on. Theyâre up 400% in 2025 and another 9% this week, making it the FTSE 100âs standout performer.

The appeal is obvious. With an all-in sustaining cost near $17 and silver at $64, margins are huge. The firm expects to produce roughly 50m oz ahead, with demand driven not just by central banks but fast-growing industrial use in solar panels, EVs, electronics, and defence tech.

But the risks remain. Silver is extremely volatile, and Fresnilloâs share price tends to move in lockstep. Operational setbacks or regulatory issues at its mines could also hit output and margins even if the metal stays elevated.

Solid player

For ballast, my ISA portfolio includes Aviva (LSE: AV.). Its latest updates showed real momentum, helping justify a 39% jump in the share price in 2025. General insurance premiums climbed 12% to £10bn, boosted by the Direct Line acquisition and strong growth across both Personal and Commercial Lines. Wealth inflows were up 8% too, showing customers are still putting money to work.

For me, the main draw remains the dividend. Itâs no longer the superstar it once was, but a 5.4% yield is still comfortably ahead of the FTSE 100 average. And while dividend cover looks thin on an earnings basis, the cash story is far stronger â operating cash flow was more than nine times the payout, which reassures me on the sustainability front.

There are risks, though. Aviva depends heavily on bond income, so falling interest rates or rising corporate defaults could squeeze returns and slow future dividend growth.

Bottom line

To build passive income in my ISA, I need both growth and steadiness. Fresnillo gives me momentum, Aviva gives me ballast, and together they keep me moving toward my income goals.

The post How large would an ISA pot need to be to aim for £1,333 a month in passive income in 2026? appeared first on The Motley Fool UK.

Should you invest £1,000 in Aviva plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Aviva plc made the list?

More reading

- FTSE shares: a simple way to build long-term wealth?

- With silver soaring to $60, the Fresnillo share price is turning into a runaway express train

- Iâm targeting £11,363 a year in retirement from £20,000 in Aviva shares!

- How on earth is this FTSE 100 stock up 319% in 2025?

- 2 incredible FTSE 100 shares I canât stop buying!

Andrew Mackie has positions in Aviva Plc and Fresnillo Plc. The Motley Fool UK has recommended Fresnillo Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.