Is it time to consider buying this FTSE 250 Christmas turkey?

Shareholders in Playtech (LSE:PTEC), the FTSE 250 provider of software, content, and other technology to the gambling industry, have seen the value of their shares fall by around 60% since December 2024.

But all’s not what it seems.

Although the companyâs share price looks to have fallen off a cliff in May, this resulted from the payment of a special dividend of $5.73 a share following the sale of one of its businesses. But this is the only payout made in the past five years. Income investors will therefore probably need to look elsewhere for their next dividend cheque.

However, even though this year’s share price performance isn’t quite as alarming as it might appear at first, the company still has two big issues to deal with.

Double trouble

Firstly, itâs operating in an industry thatâs being blamed for causing — what economists would describe as — negative externalities. In other words, social harms that remain uncompensated for.

According to the Gambling Commissionâs most recent survey, 1.4m adults have (or are close to having) an addiction problem. Thatâs more than the population of Birmingham. Economic theory suggests that externalities of this kind should be taxed to offset the damage caused.

Whether Chancellor Rachel Reeves was applying lessons learned from her economics degree — or simply trying to fill a hole in the nationâs finances — we’ll never know, but her decision in the Budget to increase taxes on the industry is likely to adversely affect Playtechâs customers.

After she announced an increase in Remote Gaming Duty on online casinos and slots from 21% to 40% (April 2026), and an increase in the Remote Betting Rate on sports bets from 15% to 25% (April 2027), the group said there would be a âhigh-teens millions of euros before mitigationâ impact on its 2026 adjusted EBITDA (earnings before interest, tax, depreciation and amortisation).

Nothing to see here

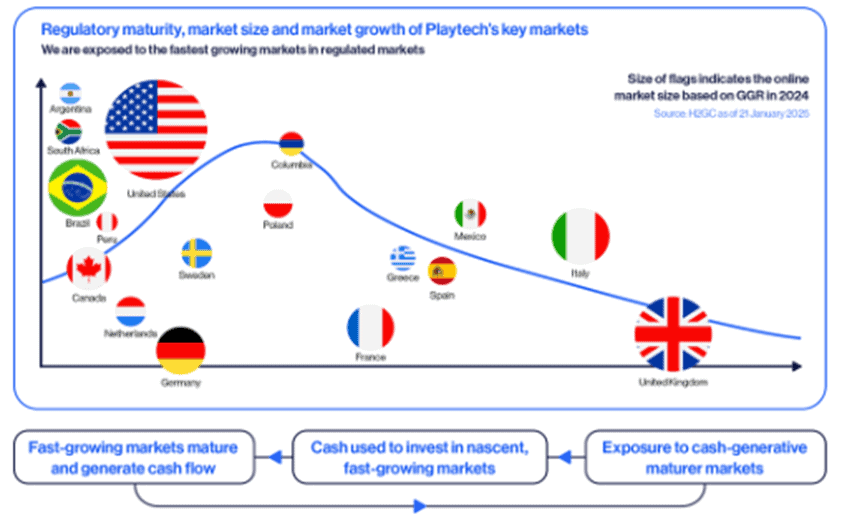

However, it also noted that its âgeographic diversityâ and âstrong performance and prospects outside the UKâ meant it was âcomfortableâ that it could still meet full-year expectations for 2026.

Of course, other governments around the world could follow suit. And there might be more pain to come from Reeves in future Budgets. But speculation concerning the death of the UK betting industry â if the Chancellor increased taxes and/or duties — appears to be wide of the mark.

The second issue that the groupâs having to contend with is legal action from a Swedish rival. Evolution‘s alleging all sorts of skullduggery — which is denied by Playtech, described as âwholly untrueâ â dating back to 2021. Ultimately, it looks as though the courts will determine the rights and wrongs.

My view

In my opinion, investors looking for capital growth could consider Playtech. It has a strong track record of raising its earnings. And itâs significantly reduced its debt in recent years.

But those taking a stake should be mindful of the risks. As well as the industry and legal challenges it faces, the sector in which it operates will probably be a no-go zone for ethical investors. This means the pool of potential buyers is likely to be smaller and could limit future share price growth.

However, on balance, those who are comfortable with the industry could consider adding the stock to their portfolios.

The post Is it time to consider buying this FTSE 250 Christmas turkey? appeared first on The Motley Fool UK.

Should you invest £1,000 in Playtech plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Playtech plc made the list?

More reading

James Beard has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.