Meet the 6p penny stock that has smashed Nvidia in 2025

Agronomics (LSE:ANIC) is a penny stock that has outperformed AI juggernaut Nvidia this year.

As I type, this intriguing small-cap is trading for 6p per share, which means it’s up roughly 70% year to date and outperforming Nvidia.

Yet 6p is a far cry from the 35p Agronomics hit back in 2021. So, might it still be worth considering for 2026 and beyond?

Agro…what?

Agronomics is a company that invests in start-ups developing technologies with the potential to displace animal husbandry. In other words, firms that are growing animal proteins and animals-derived products (beef, chicken, fish, leather, palm oil, etc) without the need to raise and slaughter animals or destroy forests.

To be clear then, this isn’t a portfolio full of plant-based food brands (similar to Beyond Meat). They’re producing actual meat, grown directly from animal cells rather than made from plants.

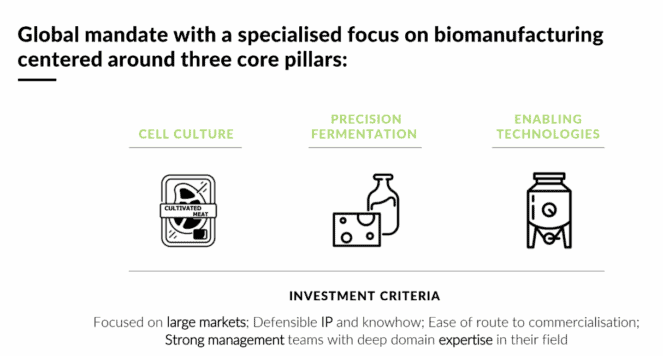

As well as lab-grown fish and meat, Agronomics is also invested in precision fermentation and other biomanufacturing-enabling technologies. So its focus is across three core areas.

Portfolio progress

We are on the cusp of the deepest, fastest, most consequential disruption in food and agricultural production since the first domestication of plants and animals ten thousand years ago. Agronomics.

Given they’re still in the early stages of commercialisation, most of the holdings will sound unfamiliar. We have start-ups including BlueNalu (cultivated seafood), SuperMeat (cultivated chicken), and Liberation Labs (contract manufacturer for precision fermentation).

However, some are making notable progress. In September, Clean Food Group received approval for its clean oil product to be used as a cosmetic ingredient in the UK, US, and Europe.

In October, Geltor received a âNo Questionsâ letter from the FDA related to its PrimaColl ingredient (the worldâs first bio-designed vegan collagen polypeptide).

Then in November, SuperMeat announced a major cost-efficiency breakthrough. It produced 100% cultivated chicken (85% muscle, 15% fat) at approximately $11.79 per pound at scale. This matched the cost of premium pasture-raised chicken in the US.

Unfortunately, another holding (Meatable) was recently dissolved, taking Agronomics’ carrying value of £11.9m down with it. This highlights how this stock is in the high-risk category.

Nevertheless, the global commercial opportunity for clean meat remains substantial.

Not situatable for all investors

But will consumers baulk at this technology? Will they start scanning the back of the pizza box in supermarkets to make sure the meat toppings were reared on a farm and not cultivated? I suspect not, but we don’t know.

Another uncertainty I have is whether Agronomics will be too quick to cash in on its winners. Take Liberation Labs. It could one day float on the Nasdaq at a much higher valuation, validating Agronomicsâ strategy.

It might exit the position, netting shareholders a few million in the process. Fine. But what if Liberation Labs then goes on to become a global giant â the precision fermentation equivalent of TSMC in semiconductors? How much money would then be left on the table?

Spotting an opportunity is one thing. But selling at the wrong time could reduce shareholder returns.

On balance though, I think Agronomics is worth thinking about as a high-risk, high-reward penny stock. At 6p, it’s trading at a significant discount to the portfolio’s most recent net asset value.

But it’s only suitable for very adventurous investors.

The post Meet the 6p penny stock that has smashed Nvidia in 2025 appeared first on The Motley Fool UK.

Should you invest £1,000 in Agronomics Limited right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Agronomics Limited made the list?

More reading

- Rolls-Royce shares or Melrose Industries: Which one is better value for 2026?

- 3 top Vanguard ETFs to consider for an ISA or SIPP in 2026

- 5 growth stocks on Dr James Fox’s watchlist for 2026

- Forget buy-to-let! Aim for a million with a Stocks and Shares ISA instead

- Will the surging Nvidia share price double in 2026?

Ben McPoland has positions in Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool UK has recommended Nvidia and Taiwan Semiconductor Manufacturing. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.