With a 7% dividend yield, this could be one of the stock market’s best growth plays

The UK stock market is packed full of potential. Sometimes it’s just hard to know where to look. Personally, I’m grateful that I get to spend much of my day searching for these stocks, allowing me to build a portfolio backed by data and research.

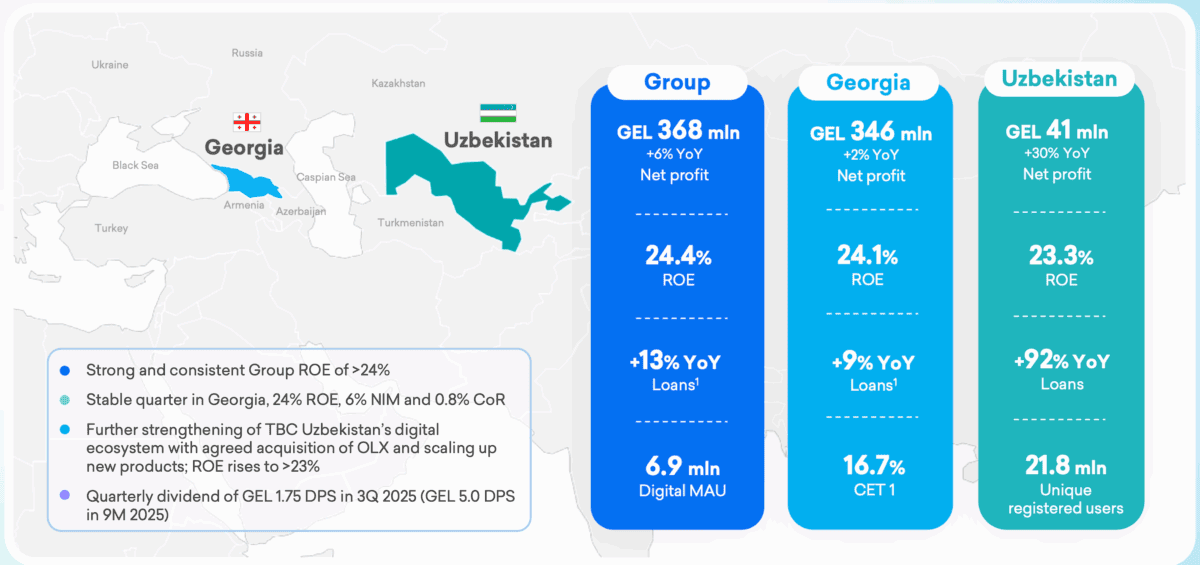

One stock that continues to catch my eye is TBC Group (LSE:TBCG). It’s a Georgian bank with a subsidiary in Uzbekistan. The stock has surged in recent years but lagged its peer, Lion Finance (previously Bank of Georgia), considerably.

However, it’s caught my eye for several reasons. It’s a huge and sustainable dividend player, it trades with really low multiples, and revenue and earnings growth looks really strong after some underperformance in 2025.

Let’s take a closer look.

The numbers don’t lie, on this occasion

Sometimes stocks that appear really cheap can be value traps. But I don’t believe that’s the case here at all. TBC Group currently trades at 5.1 times forward earnings (that’s for the next 12 months, not the current financial year). That puts it at a discount to Lion Finance and all of the big UK banks.

Sometimes stocks are cheap because earnings growth is expected to be poor. But that’s not the case here. Forecasted revenue growth for the next two years is expected to average 17.6%. That’s makes it the 17th fastest company for revenue growth out of the 600 companies on the FTSE All Share index.

Earnings growth also looks strong, somewhere in the region of 11% over the next two years. That’s really strong for a company trading at 5.1 times forward earnings. The price-to-earnings-to-growth (PEG) ratio — which is the forward price-to-earnings divided by the earnings growth rate — is around 0.45.

Coupled with a dividend yield — around 7% for the past 12 months but may be closer to 6% on a forward basis — it’s an incredibly strong proposition. The distribution rate is less than 35%, inferring that the dividend payments are safe.

It’s not just me that thinks this way, it’s a favourite with analysts too. Of the four analysts covering the stock, all have Strong Buy ratings. The average share price target is 34% higher than the current price.

Operational considerations

TBC has underperformed expectations so far this year. It said in November that it would miss expectations for the full year owing to challenges in Uzbekistan.

“The year has […] clearly had its challenges, with the previously flagged headwinds in 1H, while in 2H, we have pivoted our business from microloans to SME lending more quickly than previously anticipated in line with the changing regulatory agenda,” said chief executive Vakhtang Butskhrikidze.

This obviously isn’t great, but it appears to be a speed bump rather than anything to derail the investment thesis. Deeper risks include the threat of more political upheaval in Georgia — although this doesn’t appear to be impacting economic growth — and more regulatory changes in Uzbekistan.

On a macro level, TBC offers exposure to two of the fastest growing economies in the post-Soviet space. And that’s important as banks typically reflect the health of the economies they serve. Loan and revenue growth is strong across the business.

It’s a stock I think investors should consider.

The post With a 7% dividend yield, this could be one of the stock market’s best growth plays appeared first on The Motley Fool UK.

Should you invest £1,000 in TBC Bank right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if TBC Bank made the list?

More reading

- 5 growth stocks on Dr James Fox’s watchlist for 2026

- £10,000 to invest in a SIPP? These stocks could send it surging in 2026

- Using figures not hunches: these FTSE 250 stocks could beat the market in 2026

James Fox has positions in TBC Bank. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.