How much would I need invested in an ISA to earn £2,417 a month in passive income?

ISAs are one of the best ways to build passive income, as all interest earned is completely tax free.

But with the Autumn Budget cutting the annual limit from £20,000 to £12,000, and interest rates falling, hitting £2,417 a month (equivalent to 75% of an average full-time salary) has just become a lot harder with only a Cash ISA. Could a Stocks and Shares ISA beat a 4% cash return?

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

How much will I need?

Before estimating the size of the pot, I need to factor in inflation. £29,000 a year (£2,417 a month) wonât be worth as much in the future as it is today, so Iâm assuming a 2% yearly increase.

Using the classic 4% rule, if I withdraw 4% of my final pot each year and adjust that withdrawal for inflation, a diversified portfolio has historically lasted 30 plus years with a very high success rate.

Based on this, my ISA portfolio would need to be worth £1,120,000!

Compounding gains

Although that £1.12m figure looks huge, itâs important to remember itâs inflation-adjusted.

Without inflation, the required pot would fall to around £725,000, but the annual income would be worth less in real terms.

My real advantage is compounding.

Time is what makes compounding work. By reinvesting dividends year after year, returns begin to build on top of previous returns, creating a snowball effect.

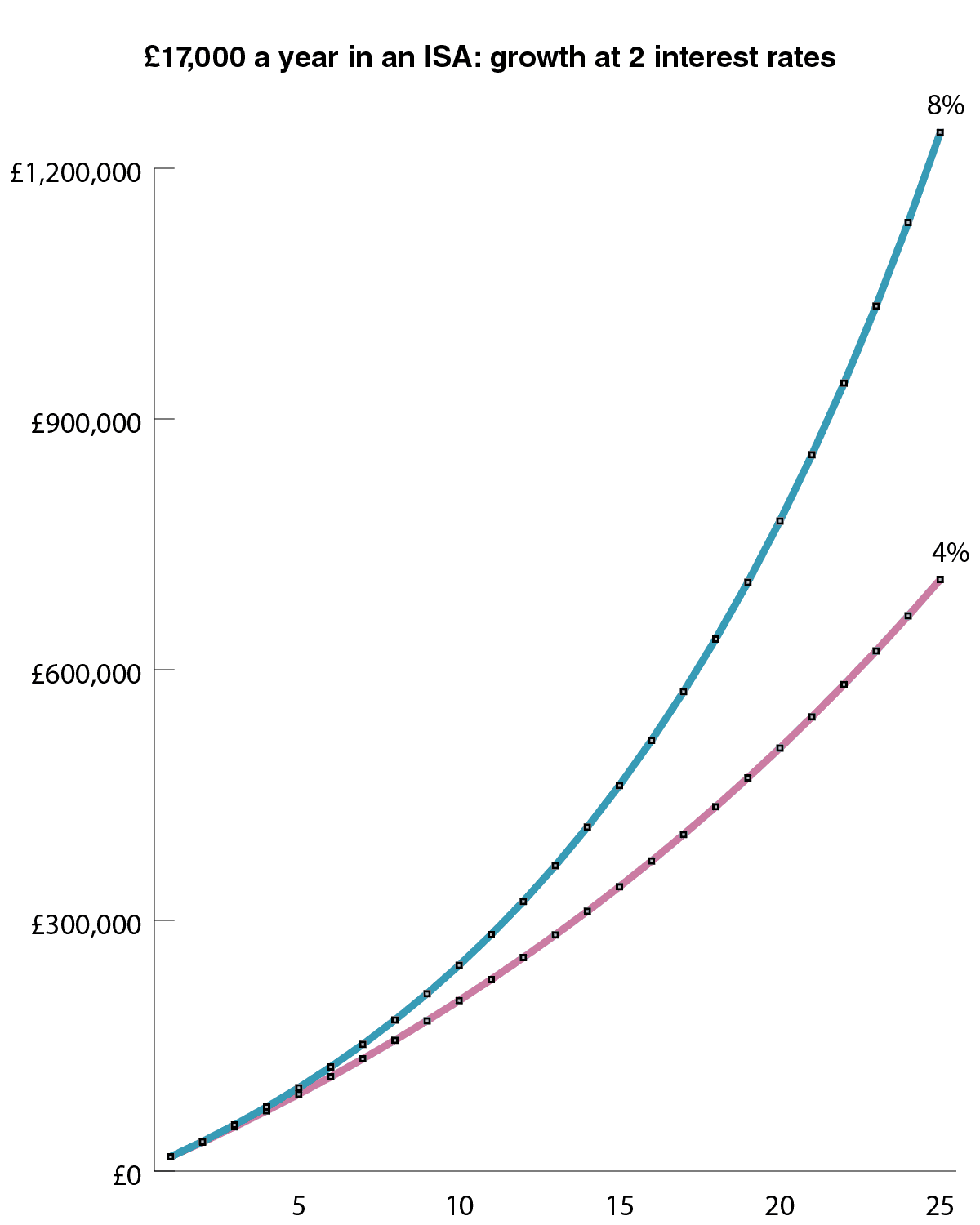

The chart below shows this clearly.

If I invest £17,000 a year into my ISA and achieve an 8% annual return, growth really accelerates after year 15. In just over five years, the portfolio doubles in size.

Keep investing for another five years and it comfortably pushes past my target. Cash ISA gains are almost invisible by comparison.

Chart generated by author

Constructing a portfolio

This year has been strong, with the FTSE 100 up 18%. If I had invested in a tracker fund of all these stocks, I would have comfortably beaten my 8% target. But consistently hitting 8% year after year is unlikely with that approach alone.

I like to combine tracker ETFs with individual stocks. This gives the best chance of maximising returns in good years while cushioning the blow in down years. For example, this year Mexican precious metal miner Fresnillo is up 400%, which more than offsets negative returns from previous years.

My second strategy is to combine growth stocks with dividend-paying ones. While no dividend is ever guaranteed, these stocks tend to be less volatile.

At 8.6%, Legal & General (LSE: LGEN) offers one of the highest dividend yields in the FTSE 100. But for me, sustainability and dividend growth matter more than the headline yield. Apart from a freeze during Covid, it has increased its payout consistently since the global financial crisis.

However, dividend growth is slowing, with only 2% expected over the next two years, down from an average 5%, historically. This is because its earnings have fluctuated wildly recently, due to heightened volatility in investment markets, which has impacted the value of its huge bond portfolio.

Overall, though, Iâm not complaining. Total shareholder returns over the past 10 years have been 83%, far more than a Cash ISA could ever deliver â and in the long term, outsized dividends help me to reach my financial goals.

But this isnât the only investing opportunity Iâve got my eyes on.

The post How much would I need invested in an ISA to earn £2,417 a month in passive income? appeared first on The Motley Fool UK.

Should you invest £1,000 in Legal & General Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Legal & General Group Plc made the list?

More reading

- 7%+ yields! 3 epic FTSE 100 dividend shares for 2026

- £20,000 in savings? Here’s how you can use that to target a £5,755 yearly second income

- Here’s how much you need in an ISA of UK stocks to target £2,700 in monthly dividend income

- How much do you need in an ISA to target a monthly £3,000-£5,000 passive income?

- 7.7% yield! These 3 dazzling dividend shares could generate a £1,573 passive income in an ISA

Andrew Mackie has positions in Legal & General Group and Fresnillo. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.