Is 2026 the year the Diageo share price bounces back?

After a 35% decline this year, could the Diageo (LSE:DGE) share price be set to bounce back in 2026? Analysts are optimistic, but investors need to think carefully.

The FTSE 100 spirits company has a new CEO who sees clear potential for the business. But there are still some big challenges facing the company in the year ahead.

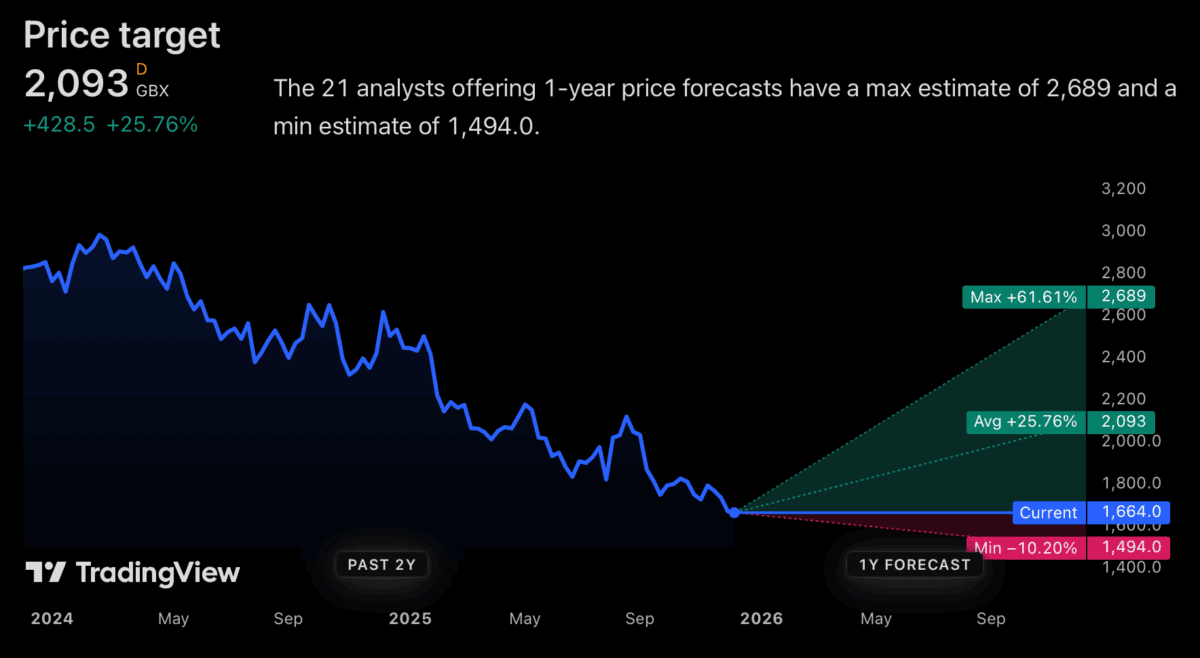

Analyst forecasts

In general, analyst price targets for Diageo over the next 12 months are pretty positive. From what I can see, the average is £20.93, which is 25% above the current share price.

Source: TradingView

That would be a good return in 2026, but is it feasible? Realistically, for the stock to move 25%, the business is going to have to get back to sales and profit growth.

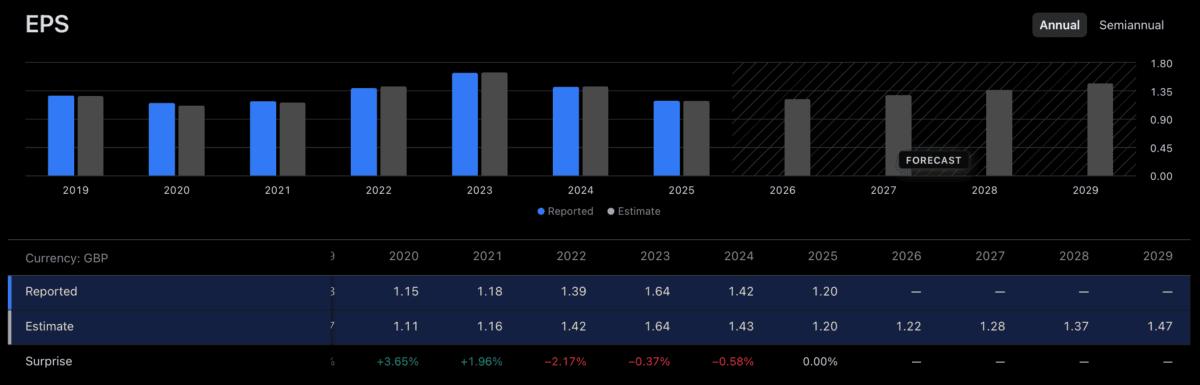

It’s worth noting that analyst forecasts on this front are pretty modest. While 2025’s expected to be a low point, things aren’t expected to get back to 2023 levels any time soon.

Source: TradingView

For 2026, analysts are expecting revenues to climb 0.5% and earnings per share growth of 1%. And I’m not convinced that will be enough to get the stock to nearly £21.

Growth challenges

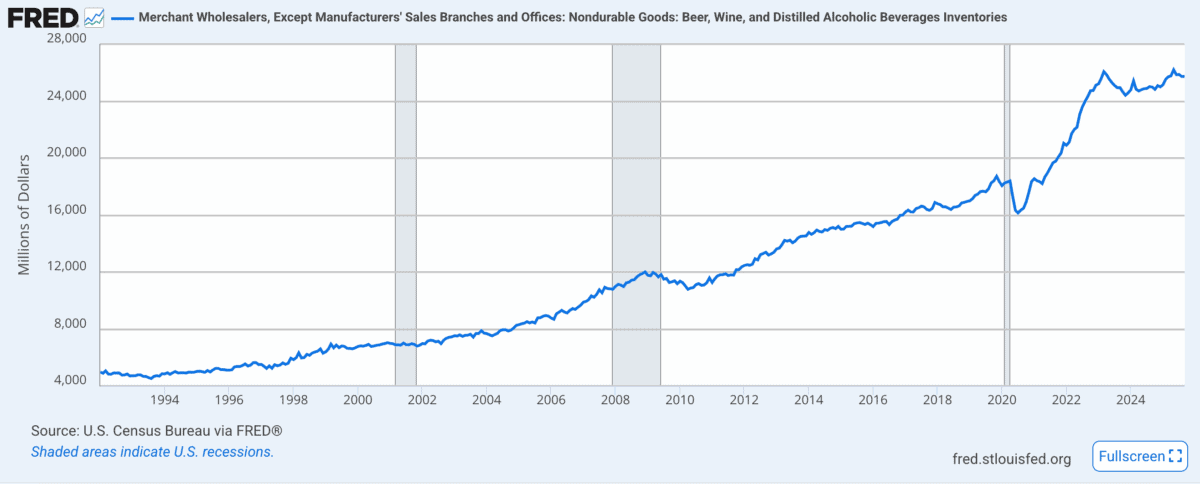

One of the biggest issues for Diageo has been recent weak demand in key markets, such as the US. And there are reasons for thinking this might continue in 2026. In the US, alcohol producers sell to wholesalers, instead of directly to retailers. As a result, wholesaler inventory levels can be a useful data point for investors.

Source: Federal Reserve Bank of St. Louis

The picture isn’t particularly positive for Diageo on this front. High inventories (relative to sales) are likely to mean weak demand and it’s currently close to record levels.

I think this could be a big challenge for the FTSE 100 firm. And that’s why I’m wary about the company’s ability to achieve the kind of growth that can move its share price in 2026.

Beyond 2026

I’m not convinced Diageo shares are set to bounce back in 2026, but this might not matter for long-term investors. In fact, it might be worth looking at as a buying opportunity.

The firm’s recent issues have all been on the demand side and there’s not much the company can do about this. Its competitive strengths however, are still very much intact.

On top of this, the new CEO has an impressive record when it comes to reinvigorating faltering businesses. Thatâs another reason investors might want to be patient with the stock.

Diageo might not get back to its 2023 earnings any time soon, but it might not need to in order to be a good investment. At todayâs prices, steady growth might well be enough.

Long-term investing

I donât think Diageo’s going to be the stock to consider for investors who are looking for action in 2026. But for those with a long-term outlook, the story might be different.

Investing well is about buying shares when theyâre cheap. And that inevitably means when other people think thereâs something wrong with the underlying business.

That might be the case with Diageo. High inventory levels will continue to be a challenge next year, but the firmâs unique assets mean the long-term equation might be different.

The post Is 2026 the year the Diageo share price bounces back? appeared first on The Motley Fool UK.

Should you invest £1,000 in Diageo plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Diageo plc made the list?

More reading

- Down 35%! These 2 blue-chips are 2025âs big losers. But are they the best shares to buy in 2026?

- Should I buy Diageo stock for the 4.7% dividend yield?

- Prediction: in 2026 mega-cheap Diageo shares could turn £10,000 intoâ¦

- Will the Diageo share price crash again in 2026?

- Who will be next year’s FTSE 100 Christmas cracker?

Stephen Wright has positions in Diageo Plc. The Motley Fool UK has recommended Diageo Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.