How much do you need in an ISA to target £1,000 of monthly passive income?

Generating £1,000 a month from a Stocks and Shares ISA may sound ambitious, but it’s realistic with time, discipline, and compounding.

At a 5% annual yield, that income equates to £12,000 a year â implying a portfolio worth roughly £240,000. Reaching that figure doesn’t require a windfall, but it does require starting early and allowing reinvested returns to do the heavy lifting inside a Stocks and Shares ISA.

The challenge then becomes choosing investments capable of growing capital steadily before eventually supporting a sustainable income stream.

The beauty of an ISA is that the compounding and the dividends are free from capital gains and tax.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

One stock to consider

To reach a £240,000 portfolio, the early focus should be less on headline yield and more on total return.

Businesses with strong cash generation, structural growth drivers, and scope for future shareholder returns tend to offer better long-term outcomes than high-yield but low-growth shares.

One stock worth considering in this context is Sanmina Corporation (NASDAQ:SANM).

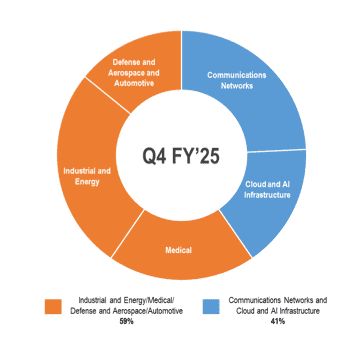

Sanmina’s a US-listed electronics manufacturing specialist and it sits at the heart of several long-term growth trends, including cloud computing, AI infrastructure, and advanced industrial systems.

The company has recently moved further up the AI value chain following its acquisition of ZT Systemsâ data-centre infrastructure manufacturing business. This deal materially reshapes what Sanmina does and how it earns money.

Historically, Sanmina was best described as a high-quality electronics manufacturing services (EMS) provider, producing boards, sub-assemblies, and finished units to customer specifications. The ZT transaction changes that profile.

With ZTâs assets, Sanmina can now manufacture and integrate entire data-centre racks, combining compute, networking, power, and advanced cooling into fully assembled, tested systems ready for deployment.

This pushes the group beyond component-level manufacturing into systems-level delivery, where average selling prices are higher, customer relationships are deeper, and switching costs are materially greater.

Importantly, Sanmina also becomes a strategic manufacturing partner to AMD (from whom it’s buying ZT) for cloud and AI infrastructure. This means it’s much more embedded into hyperscaler supply chains. Over time, this shift should support a higher-quality revenue mix, stronger margins, and more resilient earnings than traditional EMS alone.

The value proposition

From a valuation perspective, the shares look attractive relative to growth prospects. Sanmina trades on a forward non-GAAP price-to-earnings of 15.9, around 35% below the sector median, while its forward non-GAAP price-to-earnings-to-growth (PEG) ratio of 0.63 suggests growth isn’t fully reflected in the share price.

This combination of strong earnings growth and modest valuation makes it worth considering. Especially when we compare it with Celestica. Celestica’s an EMS player with significant AI offerings. I banged on about it for ages, but it now trades at 51 times forward earnings having surged 3,853% over three years.

To me, this comparison suggests Sanmina might have a lot of room to run. However, it’s worth noting that the ZT deal could compromise the balance sheet, especially if there’s any slowdown in global AI spending.

The post How much do you need in an ISA to target £1,000 of monthly passive income? appeared first on The Motley Fool UK.

Should you invest £1,000 in Sanmina Corporation right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Sanmina Corporation made the list?

More reading

- 3 S&P 500 growth stocks that could make index funds looks silly over the next 5 years

- Here’s how to start building a passive income portfolio worth £2k a month in 2026

- Will the S&P 500 crash in 2026?

- How much do you need in a SIPP to generate a brilliant second income of £2,000 a month?

- Will Lloyds shares rise 76% again in 2026?

James Fox has positions in Celestica and Sanmina Corporation. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.