After 100 years, is this FTSE 250 trust about to disappear?

Finsbury Growth & Income Trust (LSE:FGT), from the FTSE 250, was founded in 1926, so itâs approaching its centenary.Â

As part of this milestone, the annual general meeting tomorrow (15 January) will include the trustâs first-ever continuation vote. This is a shareholder vote on whether the company should keep operating under its current strategy and structure.

Might this be a good time for me to invest in this underperforming FTSE 250 stock in case it bounces back strongly?

Disappointing five years

While this is a continuation vote, it can also be viewed as a referendum on manager Nick Train following five years of very disappointing underperformance.

As we can see below, the £978m investment trust has languished since 2020 while the FTSE All-Share Index (the red line) has taken off.

Obviously, this is the complete opposite of what shareholders would have wanted.

If this weekâs vote passes, the trust will continue under its current strategy. However, if it fails, Finsbury could be restructured with new management, merged with another trust, or even wound up to return cash to shareholders.Â

What’s gone wrong?

The manager employs a ‘quality’ investing style, particularly focusing on what he considers durable brands or franchises.

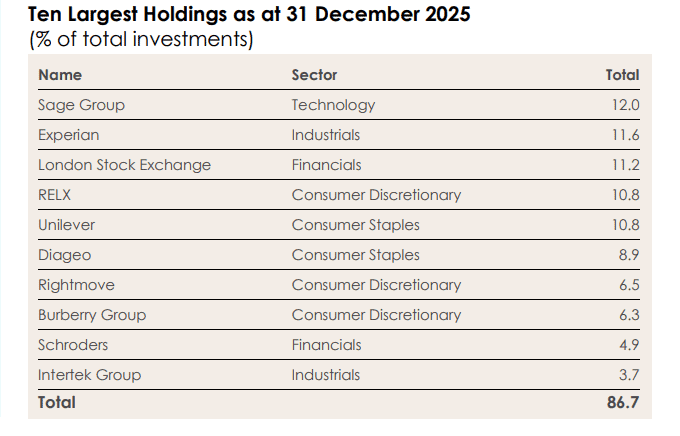

Unlike many fund managers who hold 50-100 stocks to manage risk, Train runs an extremely concentrated portfolio, with the 10 largest holdings making up a whopping 86.7% of assets.

When the selection is this concentrated, the stock picks need to be good. Unfortunately, this is where things have come unstuck. Key holdings Diageo and Burberry are down 55% and 41% respectively in just three years.

To increase his exposure to technology, Train loaded up on stocks like London Stock Exchange, Rightmove, and Auto Trader. However, these three names (along with Sage Group) all fell by double digits in 2025, badly damaging performance. Â

In 2024, Train admitted the trust âreally should be able to do better than this and if we canât, then I absolutely share shareholdersâ growing impatienceâ. He said he was âfrustratedâ by the âmalaise gripping the UK equity marketâ.

There was no malaise in 2025 though, with the FTSE 100 returning around 25% with dividends. Yet the trust managed to post negative returns, which will have left many shareholders questioning the strategy.

Should I invest?

Of course, I have no idea what will happen at tomorrow’s vote, but I doubt the trust will disappear. After all, Train’s performance record over 25 years is still impressive (roughly a 706% share price gain).

One thing I like is he’s apologetic about the underperformance, saying he’s run out of ways to say sorry to shareholders. In contrast, some other fund managers try to blame the market rather than their own stock selection.

Also, Train has significant skin in the game, having ploughed another £206,000 in earlier this month to take his stake to almost 5%. This shows he has faith in the turnaround prospects of the trust, which is trading at a 5.3% discount to net asset value.

It’s entirely possible Finsbury’s portfolio makes a roaring comeback in 2026 (I hope it does). Unfortunately though, I’m not confident enough to invest here due to the persistent underperformance.

Overall, I see better potential in other investment trusts right now.

The post After 100 years, is this FTSE 250 trust about to disappear? appeared first on The Motley Fool UK.

Should you invest £1,000 in Finsbury Growth & Income Trust PLC right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Finsbury Growth & Income Trust PLC made the list?

More reading

- With a P/E ratio of 12 and an 8.55% dividend yield, are Taylor Wimpey shares a no-brainer?

- Starting 2026 with £20k? Here’s how to try and turn that into a second income

- £20k spent on this rocketing FTSE 250 share a year ago is now worthâ¦

- Prediction: in 2026 the BP share price and dividend could turn £10,000 intoâ¦

- 3 UK stocks tipped to grow 100% (or more) in 2026

Ben McPoland has no position in any of the shares mentioned. The Motley Fool UK has recommended Burberry Group Plc, Diageo Plc, Experian Plc, Finsbury Growth & Income Trust Plc, Intertek Group Plc, London Stock Exchange Group Plc, RELX, Rightmove Plc, Sage Group Plc, Schroders Plc, and Unilever. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.