How much income would an ISA need to match the State Pension?

Today, the State Pension pays £11,502 a year. The obvious question is what size ISA it would take to generate the same income independently â effectively doubling retirement income for someone who also qualifies for the full State Pension.

The drawdown maths

Once the contribution phase of an ISA ends and withdrawals begin, the challenge becomes simple in theory but tricky in practice: balancing portfolio growth with a sustainable income.

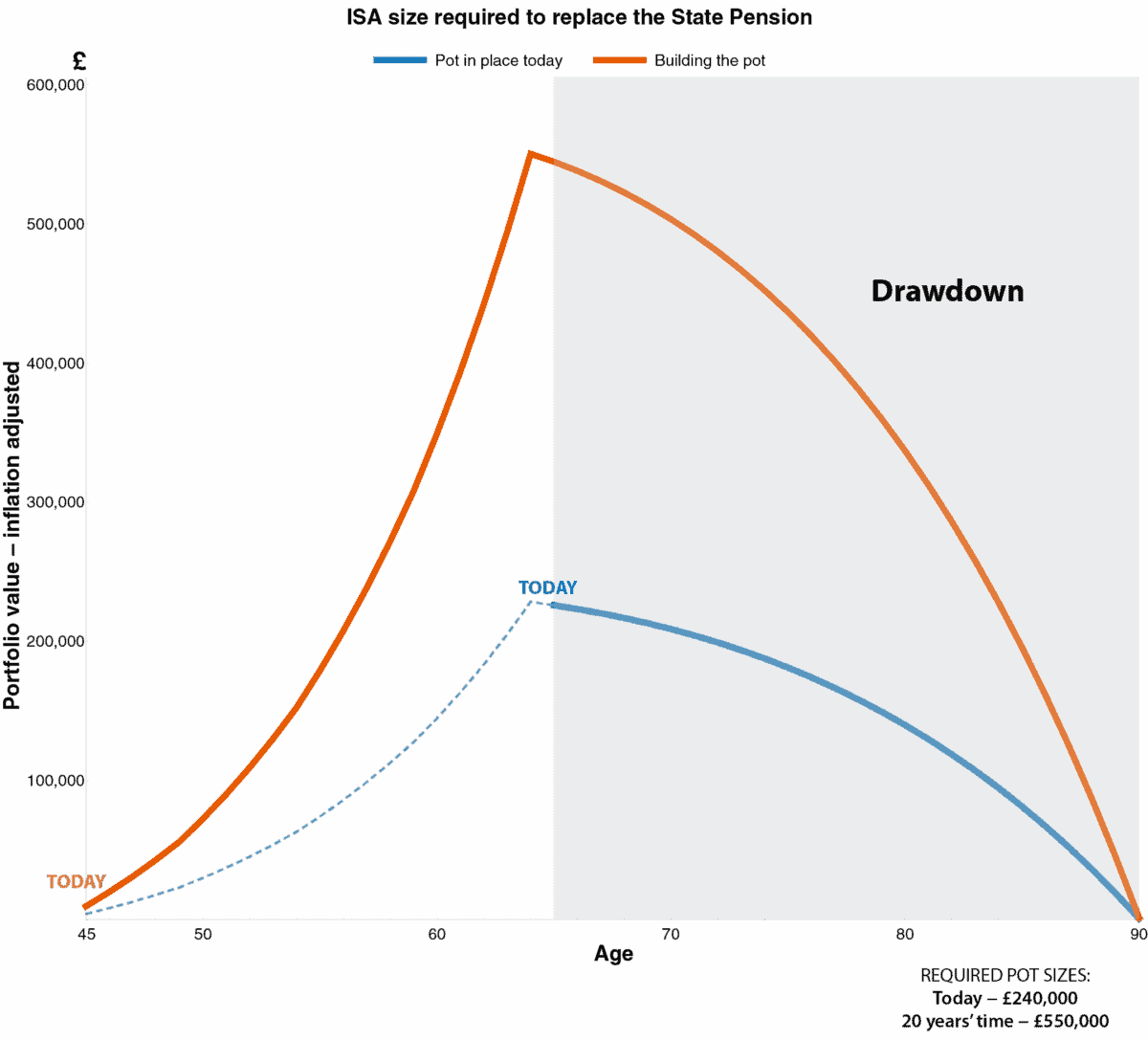

The chart below illustrates this. The blue line assumes contributions stop today and a portfolio is already in place. That portfolio supports a State Pension-matched withdrawal every year until age 90.

I assume the State Pension grows at 4.5% a year, inflation runs at 2%, and the remaining portfolio delivers a conservative 4% annual return. During drawdown, protecting capital matters more than chasing high growth. Under these assumptions, the portfolio required is £240,000.

Chart generated by author

Future contributions

The picture changes if youâre still in the accumulation phase. To illustrate, letâs assume an investor is 45 and planning ahead.

Because the State Pension is assumed to rise by 4.5% a year, its annual value in 20 years would be close to £27,000.

Thatâs where the orange line comes in. As the chart shows, only one trajectory supports a pension-matched withdrawal through to age 90. In this scenario, the required portfolio rises to around £550,000.

Long-term thinking

Reaching a £550,000 portfolio value within a 20-year investing time frame is certainly a challenge. But I believe itâs achievable with a carefully selected portfolio of high-growth stocks and low-volatility dividend stocks.

In the former category, the energy transition provides investors with an opportunity for exposure to a trend that’s still very much in its infancy.

One metal is at the heart of the energy transition: copper and mining giant Glencore (LSE: GLEN) is positioning itself to be one of the biggest copper producers on the planet over the next decade.

The recent merger talks with Rio Tinto highlight the strong position in which the minerâs portfolio puts it. While the deal is far from certain, it underscores how valuable its copper assets are viewed by its bigger peer.

When it reports later this month, copper output will be in the region of 850,000 tonnes. By 2035, its targeting output of 1.6m.

Over the past year, copper prices have exploded 40%. This isn’t only down to increasing demand but also reflects extremely tight supply.

Chile is the undisputed king when it comes to copper production accounting for over a quarter of global production. But new discoveries are becoming increasingly harder to come by and ore grades are in long-term decline.

That said, the recent run-up in the stock can be directly attributable to merger talks. Even if an agreement is reached, a merger of this size brings with it huge risks. Rio Tinto is a pureplay conventional miner, whereas Glencoreâs roots are in trading. Marrying such different corporate cultures could potentially result in a larger cost base.

Bottom line

There are many ways for investors to gain exposure to the biggest macro themes of the day including electrification, onshoring and the AI arms race. But for me the greatest value today lies not in the technologies themselves but upstream: sourcing the critical minerals that turn bold ambitions into reality. Thatâs why Glencore earns a place in my ISA portfolio and could be worth considering.

The post How much income would an ISA need to match the State Pension? appeared first on The Motley Fool UK.

Should you invest £1,000 in Glencore plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Glencore plc made the list?

More reading

- The Glencore share price is up 23% in a month! What’s going on?

- 2 top shares to consider stuffing in an ISA and holding until 2036!

- Glencore share price jumps 8% on Rio Tinto merger talks â copper is the real story

- The FTSE 100 has hit 10,000 â are there any bargains left for investors?

Andrew Mackie has positions in Glencore Plc. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.