Down 37%, is there a once-in-a-decade chance for me to buy this FTSE 100 stock?

A handful of high-quality FTSE 100 stocks have sold off recently due to panic about AI disruption. Chief among these is Sage Group (LSE:SGE), the software firm whose share price has crashed 22% year to date.

This steep sell-off leaves the stock up just 42% over five years, way behind the FTSE 100’s gain of 59%.

Indeed, Sageâs share price is barely above where it stood in September 2016, almost 10 years ago. Yet when I look at the business, as opposed to the share price, I don’t see anything fundamentally wrong. Quite the opposite, in fact.

So, might this be a once-in-a-decade opportunity for me to take?

The power of narratives

For those unfamiliar, Sage provides accounting, HR, and payroll software for small and medium-sized enterprises (SMEs). Over 2m customers use its products in 26 countries.

Investors have been flapping recently because they fear AI automation tools from the likes of Anthropic are going to replace specialised software products. The sort that Sage has spent 40+ years perfecting while building countless trusted relationships with customers.

While acknowledging this risk, I’m very much of the opinion that the powerful AI-will-destroy-software narrative is wildly exaggerated in some cases.

Long-time Sage CEO Steve Hare is quite clear where he stands. “On social media you can find people claiming they have an AI agent that can replace your chief financial officer and that no one needs accountants any more,” he told The Mail on Sunday. “That is one of the most ridiculous things I have ever heard in my career. It’s completely ludicrous.”

AI theatre

Hare called the belief that the technology will replace all sorts of things “AI theatre“. Surely he’s right when you think about it. Can a mid-cap firm (or any actually) afford an AI hallucination in their financial reports? Accuracy is non-negotiable.

In the medium segment, accountants and chief financial officers (CFOs) use Sage. They like proven solutions and are obviously risk-averse. And as the firm points out, even in the small business segment, entrepreneurs “are taking advice from their accountants“.

Sage has a massive installed base of users, with deep insights into not just their general ledgers but also workflows. Its powerful AI CoPilot is trained on vast amounts of accurate data, and some customers are already enjoying five to 10 hours a week in efficiency savings.

So, where is the incentive to risk leaving Sage’s AI-powered platform? I just don’t see it.

In Q1 2026, revenue grew 10% to £674m, with 15% growth in Sage Business Cloud. There was impressive 13% growth in the massive North American market. Even in Europe, revenue increased by 7%, with solid growth across its accounting, HR, and payroll solutions.

Sage on sale?

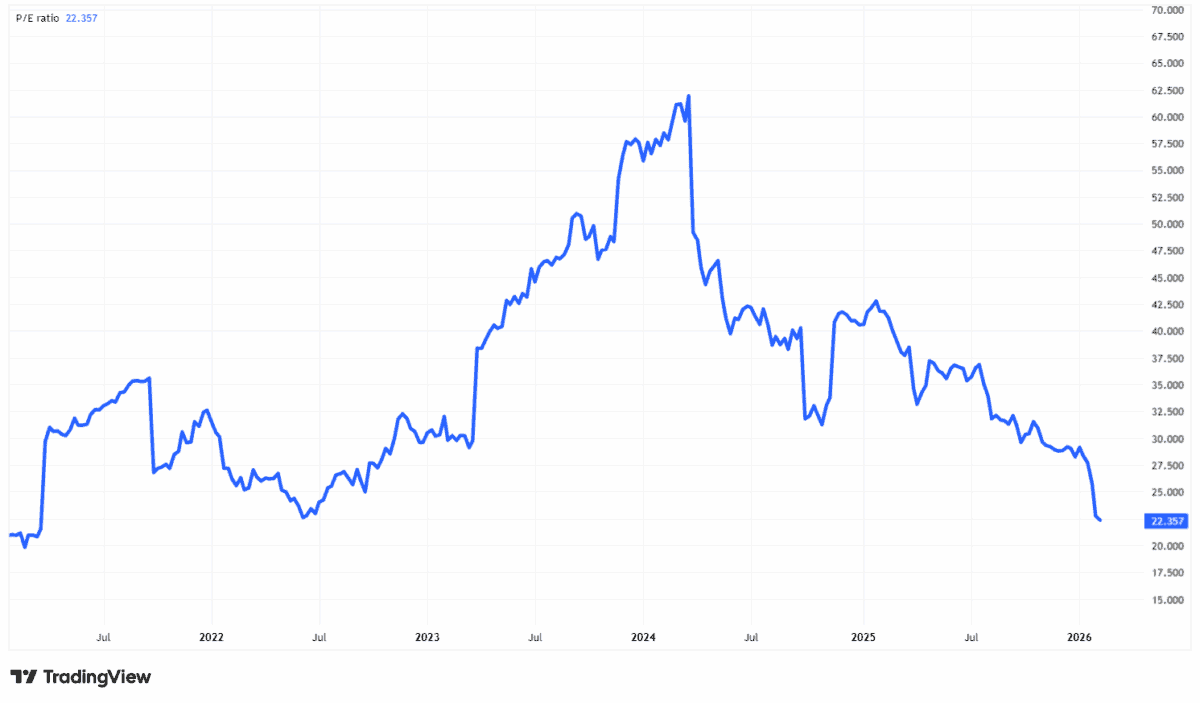

The stock’s price-to-earnings (P/E) ratio has fallen to just 22, down from a 10-year median of 30. The last time it was this cheap was during 2022’s tech stock bear market.

Looking ahead, though, City analysts expect 18% growth in earnings per share this year, then another 13.7% in FY27 (starting October). This actually puts Sage on a dirt-cheap P/E multiple of 15 for FY27.

Putting all this together, I think there’s a once-in-a-decade chance to consider here with this FTSE 100 stock. It’s a buying opportunity I’m going to take soon.

The post Down 37%, is there a once-in-a-decade chance for me to buy this FTSE 100 stock? appeared first on The Motley Fool UK.

Should you invest £1,000 in The Sage Group plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if The Sage Group plc made the list?

More reading

- FTSE 100 software stocks RELX, LSEG, Sage, and Rightmove have been hammered. Whatâs the best move now?

- Be greedy when others are fearful: 2 shares to consider buying right now

- As the FTSE 100 hits record highs, these top shares are still dirt cheap!

- Thank goodness I didnât buy these 2 UK stocks 1 year ago. Should I consider them today?

- Prediction: 2 FTSE 100 losers I think could explode in 2026!

Ben McPoland has no position in any of the shares mentioned. The Motley Fool UK has recommended Sage Group Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.