£1,000 buys 15,900 shares in this penny stock that’s been smashing Greggs

Agronomics (LSE:ANIC) is a penny stock that has done well in the past year. Currently at 6p, it’s up around 50% over this period.

That’s better than many well-known UK stocks like Tesco (up 16%) and Greggs (down 23%).

But why am I comparing an obscure penny share with household names like Tesco and Greggs?

Food production innovation

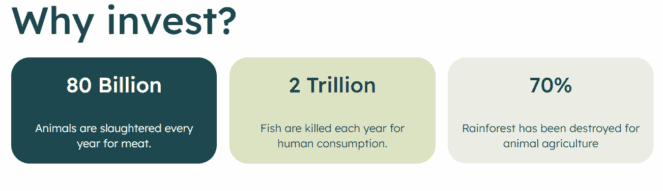

It’s down to food, basically. Agronomics is a venture capital company with stakes in start-ups in the nascent cellular agriculture space. This technology can create meat and products like eggs and dairy directly from animal cells. It’s like brewing food, not farming it.

But what’s wrong with modern agriculture? Agronomics says its “dependence on complex, fragile supply chains leave the system exposed to geopolitical tensions, zoonotic diseases, and climate change, resulting in widespread instability and inefficiency“.

For example, wheat prices jumped by 40% in 2022, according to the firm. And in the 12 months to December 2024, retail egg prices surged by 65%. I know I’m paying a lot more now for a carton of eggs (when they’re even available).

Instead of raising and slaughtering livestock, cell culture technology makes it possible to grow meat quickly and cleanly, without needing imports. Agronomics is invested in firms making cell-cultivated beef, pork, chicken, and seafood, as well as one building commercial-scale fermentation facilities (where programmed microorganisms produce specific proteins).

Agronomics estimates that the cultivated meat market will see a compound annual growth rate (CAGR) of 16.5% by 2030, reaching $2.6bn. However, the precision fermentation could grow even more rapidly, reaching $34.2bn by 2031, representing a 40% CAGR.

Meaty write-off

Now, it’s very important to recognise that this is a high-risk penny stock. Not only is this technology still in the early stages of commercialisation, but there’s no guarantee that Agronomics has backed the right horses.

We saw evidence of this risk in an update from the company yesterday (9 February). It has written off its entire investment in Meatable, a Dutch cultivated meat start-up that failed to secure more funding. This stake was previously carried at a valuation of £11.9m.

There were also unrealised fair value losses on other holdings, including Solar Foods (£1.2m) and Bond Pets (loss of £0.7m). As a result, Agronomics’ calculated net asset value (NAV) per share at the end of 2025 was 13.78p, down 5.9% from 30 September.

The firm’s market cap today is £68m. This indicates that the company is trading at roughly a 54% discount to NAV (including £2.1m in cash).

Jim Mellon, Executive Chair of Agronomics, commented: “The fourth quarter of the year was a reminder that progress in clean food does not move in a straight line. While parts of the sector continue to face real pressure, we also saw evidence that the companies best positioned to scale are beginning to separate themselves.“

Challenging conditions

One share currently costs 6.3p. So a £1k investment would buy about 15,900 shares, ignoring trading commissions.

Personally, I wouldn’t invest a grand here because Mellon describes current market conditions as “challenging“. Perhaps more portfolio holdings will go bust?

While the 12-month performance has been good, Agronomics is down 65% over five years. Far worse than Tesco and Greggs.

Therefore, adventurous investors should know what they’re getting into when they consider this high-risk, high-reward penny stock.

The post £1,000 buys 15,900 shares in this penny stock thatâs been smashing Greggs appeared first on The Motley Fool UK.

Should you invest £1,000 in Agronomics Limited right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Agronomics Limited made the list?

More reading

- An 8.8% yield but down 15%, should I buy more of this FTSE 100 passive income gem now?

- 8.25% yield! Could this FTSE 100 stock net investors a big second income?

- Why I expect the Tesco share price to make 52-week highs this spring

- £1,000 buys 10,750 shares in this red-hot FTSE defence stock thatâs crushing Rolls-Royce and BAE Systems

- FTSE 100: could the boring become fashionable?

Ben McPoland has no position in any of the shares mentioned. The Motley Fool UK has recommended Greggs Plc and Tesco Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.