Is RELX stock a bargain in the FTSE 100 after a 50% fall?

Shares in FTSE 100 data company RELX (LSE: REL) have been absolutely crushed recently. Amid investor concerns over the threat of artificial intelligence (AI) technology from the likes of Anthropic and OpenAI, the stock has fallen around 50% over the last six months.

Could we be looking at a major bargain here? Letâs take a look at todayâs full-year 2025 results for clues.

Solid performance in 2025

RELXâs results for 2025 were solid. For the year:

- Revenue was up 7% on an underlying basis to £9,590m

- Adjusted operating profit was up 9% on an underlying basis to £3,342m

- Adjusted earnings per share (EPS) were up 10% at constant currency to 128.5p

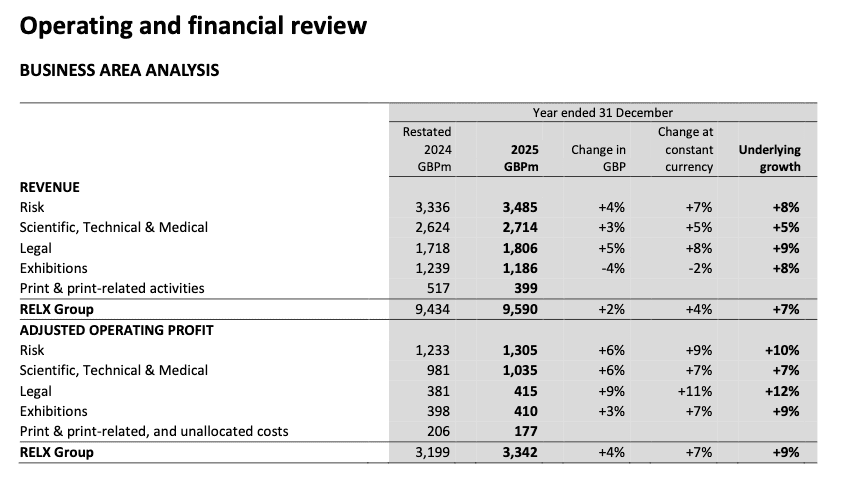

The table below shows a breakdown of performance in the companyâs different divisions. Its biggest segment, Risk, performed well, delivering 8% growth, as did Legal, with 9% growth.

Upbeat guidance for 2026

Of course, this is all backward looking and the threat of AI is a future issue. So, what did the company say about the future?

Well, for 2026, it highlighted “positive momentum across the group”, and expectations of “another year of strong underlying growth in revenue and adjusted operating profit.â

Meanwhile, for both the Risk and Legal segments in 2026, the company said: âWe expect continued strong underlying revenue growth with underlying adjusted operating profit growth exceeding underlying revenue growth.â

On the topic of AI, CEO Erik Engstrom added that it’s enabling it to add more value for customers, “as we embed additional functionality in our products, and to develop and launch products at a faster pace, while continuing to manage cost growth below revenue growth”. It will “remain a key driver of customer value and growth in our business for many years to come.â

All of this suggests that the company does not see AI as much of a threat in the near term. If anything, management appears to believe that AI will help to drive growth.

Itâs worth noting that the company increased its dividend by 7% to 67.5p per share. Would it have done that if it saw AI as an existential risk?

A FTSE 100 value play?

So, are we looking at a bargain in the Footsie here? I think so.

For a start, the companyâs forward-looking price-to-earnings (P/E) is just 14. That’s low for a data company growing at a healthy rate.

Secondly, with a relative strength index (RSI) of just 17, the stock looks massively oversold. The RSI is a technical analysis indicator that measures the magnitude of recent share price movements (a reading under 30 indicates oversold).

Third, the firm said that it plans to buy back £2,250m worth of stock in 2026 (versus £1,500m in 2025). That suggests management sees the stock as undervalued.

Of course, AI does add uncertainty because there are some parts of its business that could be disrupted by the likes of Anthropic and OpenAI. An example is its Lexis+ platform, which allows lawyers to draft briefs.

Overall though, I like the risk/reward proposition at current levels. I think this stock is worth a closer look right now.

The post Is RELX stock a bargain in the FTSE 100 after a 50% fall? appeared first on The Motley Fool UK.

Should you invest £1,000 in RELX right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if RELX made the list?

More reading

- 2 FTSE shares experts think will smash the market this year!

- Ouch! This FTSE 100 stock’s just become 14% cheaper

- 2 battered growth stocks down 45% to consider buying right now

- Some of the best FTSE 100 growth stocks have gone mad. Time to snap them up?

- A once-in-a-decade chance to buy FTSE 100 tech stocks like LSEG, Rightmove, and RELX?

Edward Sheldon has no positions in any shares mentioned. The Motley Fool UK has recommended RELX. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.