Want a £50k passive income? Here’s how much you may need at 50

Are you on track to enjoy a robust passive income in retirement? With the cost of living and social care rising, it’s critical to take steps today to ensure financial security later on. And especially as uncertainty concerning the State Pension grows.

Yet it’s tough to predict exactly how much money we’ll need in savings or pensions to retire comfortably. Fortunately, analysts at Fidelity have crunched the numbers for us. Want to know if you’re on course?

The key numbers

There’s a wealth of research showing that a second income of £50,000 can help fund a comfortable retirement. Fidelity has run with this number and predicts someone age 65 will need a nest egg worth £1,000,0000 to earn income of this size.

The financial services provider then calculated how much people will need at different ages to be on course for this target, assuming 5% investment growth each year and annual contribution growth of 2%.

Its analysts found that:

- A 30-year old needs £34,826 in savings and to be contributing £544 a month.

- A 40-year old requires £149,159 in savings and to be contributing £664 per month.

- A 50-year-old needs £357,567 saved up and to make £809 a month in contributions.

- A 60-year-old requires £725,323 in savings and to be contributing £986 a month.

Are you on track?

The earlier one starts on their retirement savings journey, the better. Beginning sooner gives people more time to build up their pensions pot, naturally. Furthermore, the longer investments are left to grow, the greater the impact compounding has, where all previous returns generate earnings of their own.

So based on Fidelity’s findings, are you where you need to be for a healthy retirement income? If so, great! If not, you may have work to do, but there could still be plenty of time for you to catch up.

Thanks to the wealth-building power of the stock market, even a 50-year-old has time to build a sizeable retirement fund.

Building wealth at 50

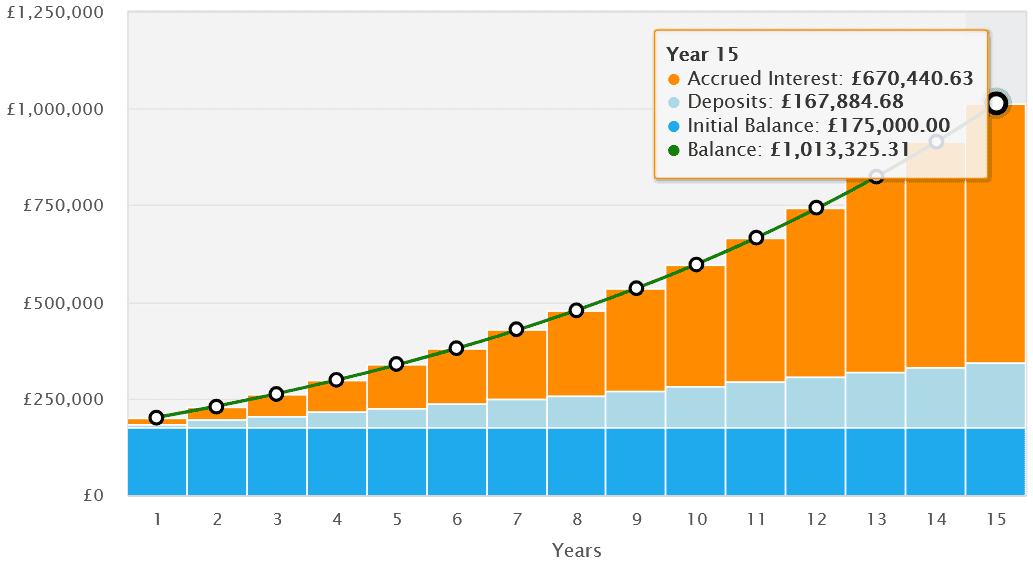

Let’s say we have someone looking to retire 15 years from now at age 65. They have 175k in savings, which is less than half the £357,567 Fidelity suggests.

If they can make £809 monthly contributions that rise 2% a year, they’d still have a portfolio above £1m by the time they retire. That’s based on the long-term average annual return of 9% that stock markets have delivered long term.

Past performance isn’t always a reliable guide to future returns. However, holding a diversified range of shares can reduce volatility and risk, and maximise the wealth-building power of share investing.

Targeting retirement income

Want a quick and cheap way to achieve this? Consider investing in an exchange-traded fund (ETF) like the Vanguard FTSE All-World ETF (LSE:VWRP), which holds a wide variety of global shares.

In total, this product holds positions in 3,794 different companies. These include US tech stocks, UK miners, Japanese carmakers, and Canadian banks. This cross-industry and country approach provides a range of investment opportunities and protects investors from localised risks. And it’s paid off handsomely — over 10 years, this Vanguard product’s delivered an average annual return of 12.7%.

Like any stock-based ETF, returns could disappoint during periods of broader market weakness. But I’m confident that, over the longer term, it should continue helping people build a considerable income for retirement.

The post Want a £50k passive income? Here’s how much you may need at 50 appeared first on The Motley Fool UK.

Should you invest £1,000 in Vanguard Funds Public Limited Company – Vanguard FTSE All-World UCITS ETF right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Vanguard Funds Public Limited Company – Vanguard FTSE All-World UCITS ETF made the list?

More reading

- Want to boost your retirement fund? Consider a Stocks and Shares ISA

- I just dumped Fundsmith Equity from my Stocks and Shares ISA and SIPP. Hereâs why

Royston Wild has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.