Does AI disruption mean these 3 cheap shares are bargain buys right now?

A cheap share doesnât necessarily mean itâs worth buying. Investors may have good reasons to be nervous about a companyâs prospects. Indeed, following on from mechanisation, electrification and automation, we’re now in an era of digitialisation with artificial intelligence (AI) leading the way.

Inevitably, there will be winners and losers from the fourth industrial revolution. And judging by the share price performance of these three stocks, investors have already made up their minds about who the losers might be. But could this be a potential buying opportunity?

Hazel’s here!

The St Jamesâs Place (LSE:STJ) share price has come under pressure after Altruist, an online provider of services to investment advisors, launched Hazel, its new AI tax planning tool.

For up to $150 a month (large firms will pay more), the US company claims its new software will âtransform your practiceâ with interactive scenario modelling. Although the tool itself is unlikely to directly impact St Jamesâs Place, it raises questions as to what might follow.

In 2024, the wealth manager charged £1.089bn for investment advice, 34% of its total income. And even if its clients would rather rely on humans for advice, AI could open up the market to low-cost challengers.

The timing of the arrival of Hazel’s unfortunate. Over the course of 2025, the groupâs assets under management increased by £29.8bn, helped by net inflows of £6.2bn and a 94.9% retention rate.

However, even though the stockâs trading close to its 52-week low, I donât want to invest given the uncertainty.

What about Claude?

By contrast, I like the look of London Stock Exchange Group (LSE:LSEG). I think it remains a stock to consider even though its share price is coming under pressure from anxiety about how Anthropicâs AI-powered legal assistant, an add-on to its Claude platform, could impact data and software companies.

Again, the software itself isn’t a particular threat, but whatâs coming down the line? However, I think AI could work to LSEGâs advantage. The technology requires data, which the group has in bucket loads. Its propriety data’s spread across five distinct operating divisions.

Elliott Management appears to agree with me. The Financial Times claims the activist investor has been building up a âsignificantâ stake. The firm’s established a reputation for investing in underperforming companies.

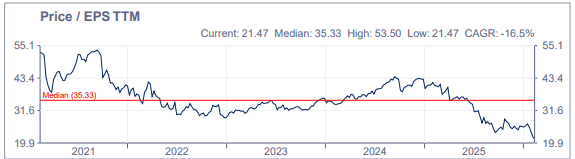

LSEGâs shares are now trading at their lowest earnings multiple since the pandemic. And they’re changing hands for what they were in the first quarter of 2023. I think the stock offers good value and is worth considering.

And finally…

Another stock under the AI cosh is MONY Group (LSE:MONY), owner of a number of websites designed to save households cash, including MoneySupermarket. Its share price is now back to where it was in 2013.

Itâs been affected by Insurify, another US company, releasing what it claims is the insurance industryâs first ChatGPT app. Drivers will be able to explore personalised quotes.

MONY Group’s vulnerable because, in 2024, it generated nearly 54% of its revenue from insurance referrals. Obtaining quotes though ChatGPT sounds appealing to me, especially if it avoids having to answer all those tedious questions that are usually asked.

The direction of travel is clear and Iâm not sure what the group can do about it. For this reason, investing now would be too risky for me.

The post Does AI disruption mean these 3 cheap shares are bargain buys right now? appeared first on The Motley Fool UK.

Should you invest £1,000 in London Stock Exchange Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if London Stock Exchange Group Plc made the list?

More reading

- Has the 2026 stock market crash already begun?

- These 2 UK stocks are forecast to rocket 65% this year â time to consider buying them?

- Hereâs how investors can target £22,491 a year from £20,000 in this overlooked income share

- Could the FTSE 100 index smash 11,000 this year?

- A once-in-a-decade chance to buy FTSE 100 tech stocks like LSEG, Rightmove, and RELX?

James Beard has no position in any of the shares mentioned. The Motley Fool UK has recommended London Stock Exchange Group Plc and Mony Group Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.