A once-in-a-decade chance to add some tech to a Stocks and Shares ISA?

There’s not long left in this financial year to add to a Stocks and Shares ISA. But with 43 days to go, there might be some unusual opportunities for investors with cash on hand.

It’s rare to see US tech stocks selling cheap, but investors are concerned about artificial intelligence (AI) disruption. And in some cases, that might be a big opportunity.

Positioning

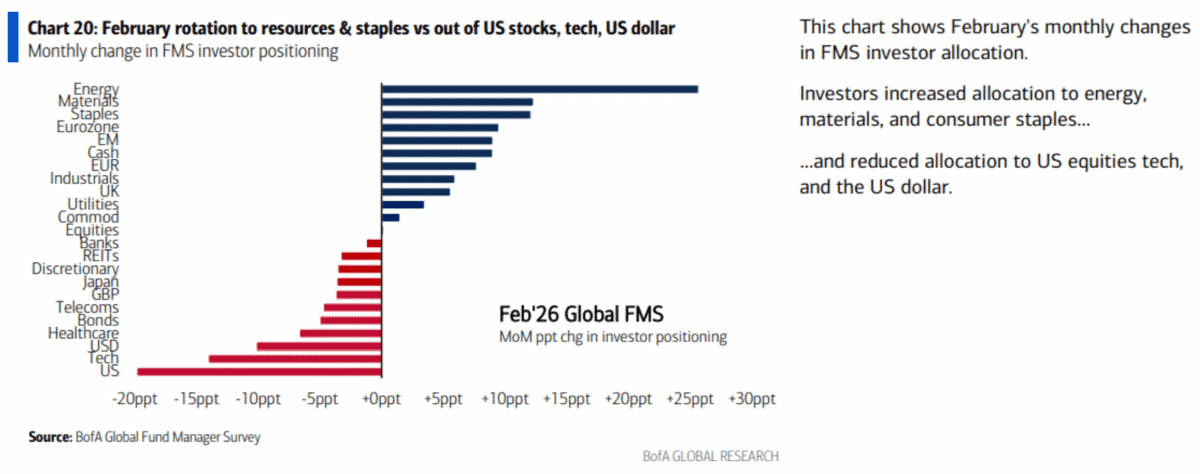

According to the latest data from Bank of America, fund managers have been shifting away from US equities in general â and tech in particular. And it’s easy to see why.

Source: HedgeFund Tips

With high margins and strong recurring revenues, software companies have been investor favourites. But there are real concerns about the threat of disruption from agentic AI.

The magnitude is real. If an AI agent can do the work of several humans without the need for a user interface, a lot of the value that software businesses add â and charge for â goes away.

As a result, investors are starting to see the high valuation multiples these stocks trade at as a risk. But while the selling has been largely indiscriminate, not all stocks are the same.

Defensibility

One of the big defences the incumbents have is switching costs. While consumers might change their shampoo in any given month, it’s a different story for business software.

Moving to a different setup involves retraining staff, hiring specialists to manage the migration, and disrupting ongoing work. So it’s not something they do often or easily.

They often will do it, though, if there’s a big enough benefit â such as a huge long-term cost saving. Importantly, though, the value equation can vary significantly from one industry to another.

One sector where inertia is higher than most is local government, where regulatory barriers are high and risks matter more than profits. Thatâs usually a bad thing, but it might not be in this case.

A stock to consider

Step forward Tyler Technologies (NYSE:TYL). The share price is down 50% in the last 12 months, making it one of the worst-performing S&P 500 stocks over the last year.

The firmâs latest earnings report came in below expectations and guidance was weaker than investors had hoped for. But the company is the leader in software for local governments.

That doesnât reduce the risk of AI disruption to zero. And even if the threat of losing customers to new entrants is relatively low, higher competition for new business is an ongoing threat.

Management expects revenue growth for 2026 to fall to between 8% and 10%. But a forward price-to-earnings (P/E) ratio of 22 is the lowest multiple the stock has traded at in a decade.

Government software

Iâve been avoiding shares in Tyler Technologies in recent years. The stock has typically traded at high multiples in an industry thatâs been slow to shift from analogue systems to digital ones.

In the last few months, though, the equation has changed completely. The share price has come down significantly and the inertia looks like it might provide much more of a defensive boost.

As a result, I think the stock is worth considering for anyone looking to add to an ISA before the April deadline. The AI threat is real, but itâs likely to be greater for some companies than others.

The post A once-in-a-decade chance to add some tech to a Stocks and Shares ISA? appeared first on The Motley Fool UK.

Should you invest £1,000 in Tyler Technologies, Inc. right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Tyler Technologies, Inc. made the list?

More reading

- A £13,607 annual second income for £500 per month? Hereâs how it can be done

- Why 26 February could be critical for Rolls-Royce shares

- An ISA with 500 Greggs shares could pay out £346 a year in passive income

- After making a fortune on Tesla and Amazon, Scottish Mortgage manager Baillie Gifford is piling into a little known growth stock

- 2 US stocks to consider buying as the market sell-off continues

Bank of America is an advertising partner of Motley Fool Money. Stephen Wright has no position in any of the shares mentioned. The Motley Fool UK has recommended Tyler Technologies. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.